New Zealand’s buy now pay later market to reach nearly $2 billion in 2026, estimates GlobalData

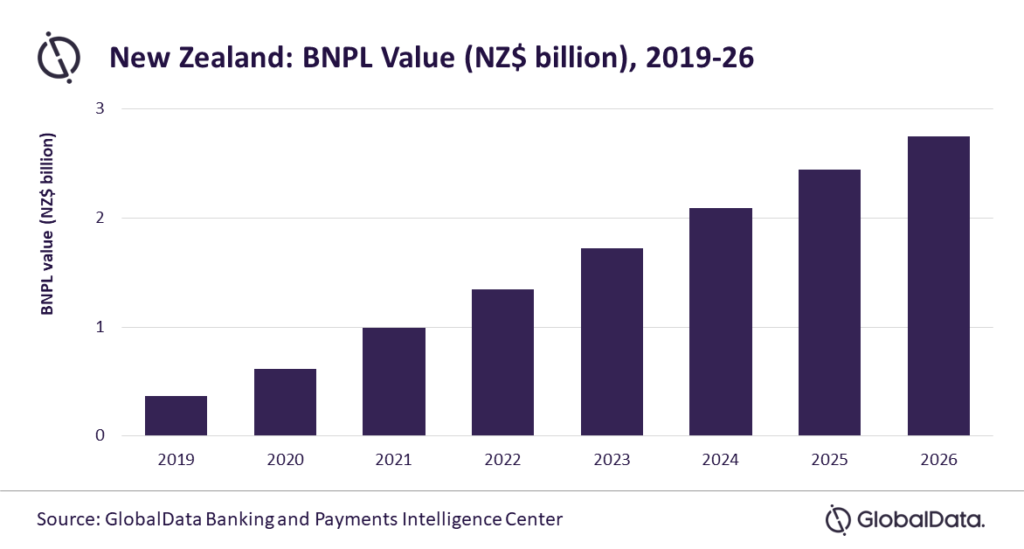

Buy now pay later (BNPL) has become a popular payment tool in New Zealand, due to increasing demand for short-term credit coupled with growing consumer preference for online shopping. Given its popularity, the BNPL market in the country is estimated to grow by 28.3% to reach NZ$1.7 billion ($1.2 billion) in 2023, forecasts GlobalData, a leading data and analytics company.

GlobalData’s E-Commerce Analytics reveals that the BNPL transaction value in New Zealand is expected to grow at a compound annual growth rate (CAGR) of 16.7% between 2023 to 2026 to reach NZ$2.7 billion ($1.9 billion) in 2026. GlobalData’ s BNPL data reflects e-commerce transactions made using BNPL solutions.

Shivani Gupta, Senior Banking and Payments Analyst at GlobalData, comments: “BNPL is widely popular in New Zealand supported by high consumer awareness, rising demand for short-term finance especially among millennials, and proliferation of BNPL payment providers. Further, with the pandemic adversely affecting consumers’ disposable income, the demand for short-term consumer financing solutions has increased in the past couple of years.”

The BNPL space in New Zealand is occupied by a number of providers, with some of the popular brands being Afterpay, Laybuy, Zip, and Klarna. According to GlobalData’s 2022 Financial Services Consumer Survey, Afterpay leads the market, with almost half of the respondents preferring it, followed by Laybuy and Zip.

Global BNPL brands are also making a foray into New Zealand. For instance, in May 2021, Klarna entered the market through its ‘Pay in 4’ buy now pay later service in New Zealand.

Considering the growing demand for BNPL, the country’s Minister of Commerce and Consumer Affairs proposed a regulation in November 2022 to protect consumers from falling into debt trap. As part of this, BNPL will be brought under the purview of ‘Credit Contracts and Consumer Finance Act 2003’, which governs all regular credit services like credit cards and personal loans.

According to the proposed regulation, like other credit providers, BNPL lenders are also required to assist borrowers in making informed decisions and help them with repayment during unforeseen circumstances. BNPL providers would need to evaluate consumers’ repayment capacity before offering them credit above a threshold of NZ$600 ($410.7). The regulation is currently under discussion and is expected to be passed later this year. Initiatives like this will help boost consumer confidence on BNPL products and help drive its growth.

Shivani concludes: “BNPL will continue to gain traction in New Zealand, driven by rising demand for short-term credit coupled with positive regulatory changes.”

___________

*GlobalData’s 2022 Financial Services Consumer Survey was carried out in Q2 2022. Approximately 50,000 respondents aged 18+ were surveyed across 40 countries.

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: