New MasterCard study on contactless payments shows almost 30% lift in total spend within first year of adoption

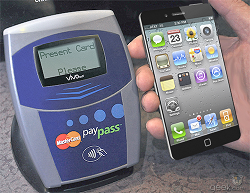

May 4, 2012 – MasterCard released the results of their first PayPass Adoption Study, a quantitative analysis of the changes in U.S. account transaction behavior after adopting a contactless payments solution. In one of the study’s key findings, the research showed that within the first 12 months of their first contactless transaction, PayPass-enabled accounts spent almost 30% more on average, using their PayPass-enabled card. The research also found a clear correlation between contactless adoption and preference for a particular card, illustrating that a contactless payments solution may help drive top-of-wallet behavior.

May 4, 2012 – MasterCard released the results of their first PayPass Adoption Study, a quantitative analysis of the changes in U.S. account transaction behavior after adopting a contactless payments solution. In one of the study’s key findings, the research showed that within the first 12 months of their first contactless transaction, PayPass-enabled accounts spent almost 30% more on average, using their PayPass-enabled card. The research also found a clear correlation between contactless adoption and preference for a particular card, illustrating that a contactless payments solution may help drive top-of-wallet behavior.

The study divided accounts into low, medium and high spend segments based on their monthly spend prior to adoption, and the 30% lift was consistent across the three segments, regardless of their spend levels prior to adoption. “In our highest spend segment, this lift translates into approximately $600 per month in incremental spend,” says Jonathan Orndorff, Principal at MasterCard Advisors and study lead. “Increases like this can have a significant impact on the issuer business case for contactless.”

The PayPass Adoption Study also noted significant lifts in top-of-wallet behaviors such as Recurring Payments, e-Commerce and Cross Border spend. Adds Orndorff, “Lifts in not just overall spend but the quality of spend also help the business case for contactless.” Most significant of these is the lift in Cross-Border spend, which exceeded 50% in all three spend segments in the 12 months after PayPass adoption. “Given the lift in Cross-Border spend associated with PayPass adoption, U.S. issuers might want to consider the role of PayPass in their EMV and EMV travel card strategies. U.S. issuers can look to Canada, where we saw ‘EMV+Contactless’ strategies successfully deployed by many Canadian issuers during their EMV migration,” says Orndorff.

The PayPass Adoption Study also noted significant lifts in top-of-wallet behaviors such as Recurring Payments, e-Commerce and Cross Border spend. Adds Orndorff, “Lifts in not just overall spend but the quality of spend also help the business case for contactless.” Most significant of these is the lift in Cross-Border spend, which exceeded 50% in all three spend segments in the 12 months after PayPass adoption. “Given the lift in Cross-Border spend associated with PayPass adoption, U.S. issuers might want to consider the role of PayPass in their EMV and EMV travel card strategies. U.S. issuers can look to Canada, where we saw ‘EMV+Contactless’ strategies successfully deployed by many Canadian issuers during their EMV migration,” says Orndorff.

Notes Mark Barnett, Group Executive, Consulting Services for MasterCard Advisors, “The research shows that even after cardholders use contactless only once, there is a clear halo effect. Contactless should be considered by any issuer seeking to capture share today while establishing a platform for the future migration to mobile commerce.”

In sum, contactless adoption was associated with several benefits to the issuer, including:

| 1. | Noticeable increase in preference for a particular card. | |

| 2. | Average of almost 30% sustained lift in overall spend, regardless of spend segment researched. | |

| 3. | Depending upon spend segment, 11.8 – 28.5% average lifts in Recurring Payment spend, 8.8 – 33.3% average lifts in eCommerce spend and 53.1 – 79.1% average lifts Cross-Border spend. |

Study Methodology

Using MasterCard transaction data, the MasterCard Advisors PayPass Adoption Study compared account behavior between two segments of U.S. accounts over a twelve month period beginning July 2009. The sample was comprised of U.S.-based accounts. Those in both the test and control segments were opened for at least four months and had non-PayPass-enabled purchase transactions in both the pre- and post- periods.

One segment had no PayPass activity, while the other initiated PayPass use in July 2009. The fixed “start date” meant that the researchers could track the lifecycle of PayPass use and its impact on overall behavior as accounts became familiar with its use. The methodology also allowed the research team to control for differences between the two segments by comparing pre-adoption behavior. The researchers divided the combined sample into three spend segments $0 – $400, $500-$1499 and $ 1500 or more per month based upon monthly spend in the three months prior to July 2009 to determine if account behavior differed by spending segment.

Update

Other studies released by MasterCard on May 3, 2012

Survey Examines Shift Towards Cashless Society – Americans Use Less Cash Today Than 10 Years Ago

MasterCard Certifies NFC Phones from HTC, Intel, LG Electronics, Nokia, RIM, Samsung Electronics and Sony

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: