The ability to access installments from credit and debit cards with Apple Pay will roll out starting in Australia with ANZ; in Spain with CaixaBank; in the U.K. with HSBC and Monzo; and in the U.S. with Citi, Synchrony, and issuers with Fiserv. With Tap to Cash, users are able to send and receive Apple Cash by holding two iPhone devices together — without having to share phone numbers.

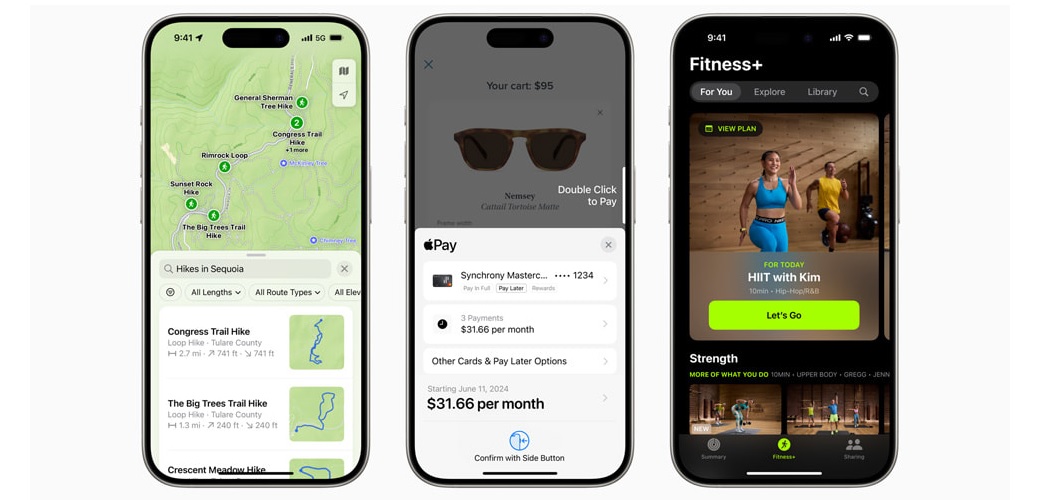

With the release of iOS 18, iPadOS 18, macOS Sequoia, watchOS 11, visionOS 2, and tvOS 18 this fall, Apple is enhancing the services users love with all-new features. Updates include U.S. national park hikes and custom walking routes in Apple Maps; the ability to pay with rewards and installments with Apple Pay; new accessibility features in Apple Music; and a redesigned Apple Fitness+ experience to help users make the most of its robust library of workouts and meditations.

“So many of our users rely on Apple services throughout their day, from navigating their commute with Apple Maps, to making easy and secure payments with Apple Pay, to curating playlists with Apple Music,” said Eddy Cue, Apple’s senior vice president of Services. “We’re excited to give them even more to love about our services, like the ability to explore national parks with hikes in Apple Maps, redeem rewards or access installments with Apple Pay, and enjoy music with loved ones through SharePlay in Apple Music.”

Greater Flexibility with Apple Pay

Apple Pay introduces even more flexibility and choice for users when they check out online and in-app. Users can view and redeem rewards, and access installment loan offerings from eligible credit or debit cards, when making a purchase online or in-app with iPhone and iPad.1 These features will be available for any Apple Pay-enabled bank or issuer to integrate in supported markets.

The ability to redeem rewards for a purchase with Apple Pay will be available beginning in the U.S. with Discover and Synchrony, and across Apple Pay issuers with Fiserv. The ability to access installments from credit and debit cards with Apple Pay will roll out starting in Australia with ANZ; in Spain with CaixaBank; in the U.K. with HSBC and Monzo; and in the U.S. with Citi, Synchrony, and issuers with Fiserv. Users in the U.S. will also be able to apply for loans directly through Affirm when they check out with Apple Pay.

Users can use Apple Pay on any third-party web browser2 and computer by simply scanning a code on their iPhone to securely complete the payment.3 Additionally, with Tap to Provision, users can add eligible credit or debit cards to Apple Wallet by simply tapping their card to the back of their iPhone.4

Tap to Cash with Apple Cash

With Tap to Cash, users are able to send and receive Apple Cash by holding two iPhone devices together — without having to share phone numbers.5 For example, Tap to Cash can be used to pay someone back at dinner or buy something at a garage sale.

„When it comes to FinTech, with Tap to Pay (which isn’t entirely new by the way) Apple basically solved P2P payments for 1.5 billion people. But here comes the crazy part… If you swap Apple Cash with Open Banking, or even better – an L2 protocol like The Lightning Network, you have the ultimate money experience of the 21st century. And that’s truly groundbreaking. I guess AI-driven finance might be just around the corner…” – said Linas Beliunas, Country Manager, Europe, and General Manager, Flutterwave Lithuania.

______________

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: