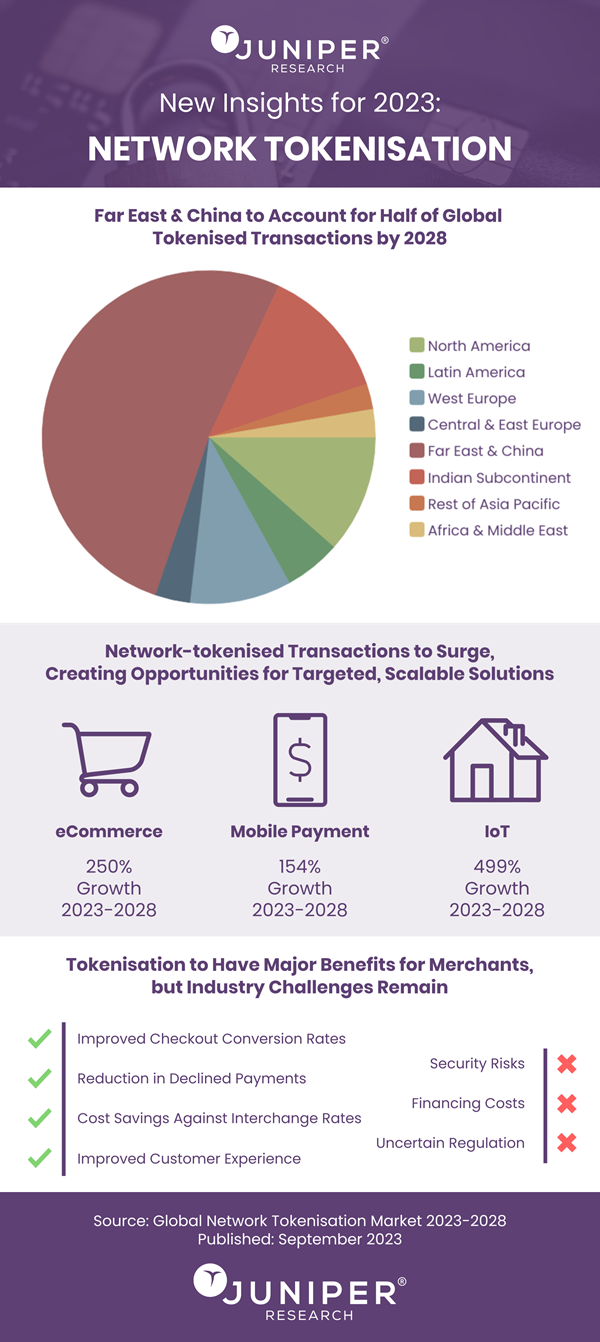

A new study by Juniper Research forecasts substantial growth of 190% in network-tokenised transactions; reaching 400 billion globally in 2028, up from 140.3 billion in 2023. These transactions include online and desktop eCommerce transactions, mobile payments and IoT transactions.

The study found that network tokenisation, the process of replacing card payment data with unique network-issued tokens, is able to balance security and friction more effectively than other solutions – a key concern within the eCommerce market. The repeated usability of network tokens reduces the instances a consumer is required to provide payment details; promoting limited friction.

The report anticipates a surge in network tokenisation mandates, following successful market implementations. A great example of this is the Reserve Bank of India, which requires tokenisation for all credit and debit cards used for online transactions from October 2022.

Research author Cara Malone commented: “As the number of transactions and payment methods within eCommerce continues to increase, it is important for governing bodies to take action throughimplementing regulations and mandates. These new mandates will represent an important opportunity for network tokenisation vendors to grow their revenue.”

The research found that surging eCommerce transaction volumes are placing great strain on payment providers to handle the growing workload, without compromising user experience or security. It is important for network tokenisation vendors to deliver scalable solutions which provide longevity, such as Click to Pay; a highly frictionless form of payment that eliminates the need for manually entering payment data whilst securing the checkout process.

About the Research Suite

The new market research suite offers the most comprehensive assessment of the network tokenisation market to date; providing analysis and forecasts of over 19,000 datapoints across 60 markets over five years. It includes a Competitor Leaderboard and examination of future market opportunities.

_____________

Find out more about the new report, Global Network Tokenisation Market 2023-2028, or download a free sample.

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: