Neobank numbers worldwide has exceeded 250, four times in just two years. Many more are in the process of being launched.

The neobanking industry may be more exposed to the Covid-19 pandemic than incumbents, but enthusiasm for the business model remains undimmed, with 256 players live and many more waiting in the wings.

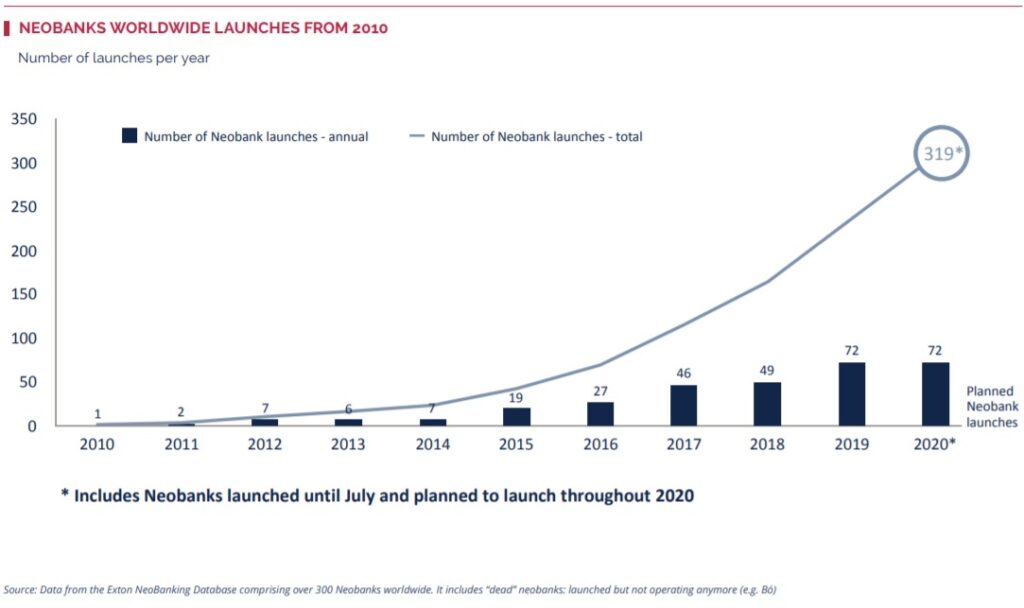

The data from Exton Consulting demonstrates the growing appeal to entrepreneurs of challenger bank opportunities, with a new business launching every five days over the past three years.

According to Exton’s Country Neobanking Index, Europe is still the engine for innovation with three of the five most advanced markets being located there: the UK as the neobanking powerhouse, followed by Sweden and France. In Europe alone, more than 50 million people have opened a neobanking account.

STATE OF THE NEOBANKING INDUSTRY

„When we published our last Neobanking newsletter back in 2018, we had identified 60 worldwide digital challenger banks that had launched until that date. Now, only two years later, that number has increased by more than 4 times to an astonishing 256 live Neobanks1, with many more in the process of being launched”, according to Exton Consulting.

For anyone following the evolution of digital startups in Financial Services, it has likely been a difficult task to keep count of all the Fintechs, Insurtechs and Regtechs popping up across markets. Regularly published FinTech “radars” may seem to be out-of-date the second they hit the web, and often show a myriad of players disrupting the Payments, Lending, or Banking as a Service landscape – just to name a few. A study conducted by Exton earlier this year on the French market, for example, counted more than 350 local Fintech startups in France alone.

Yet, for a long time, Fintechs rather focused on solving a specific financial pain point, while the setup of full Neobanks, launched to effectively compete with incumbent banks, remained the exception. As we show in the figure below, that began to change around 2015 when an increasing number of early-mover digital banks started to offer a blueprint for many others to follow suit. By 2019, more than 70 Neobanks launched within one year and 2020 numbers are expected to be in the same range. In other words, over the last two years there was a Neobank launched every five days somewhere in the world.

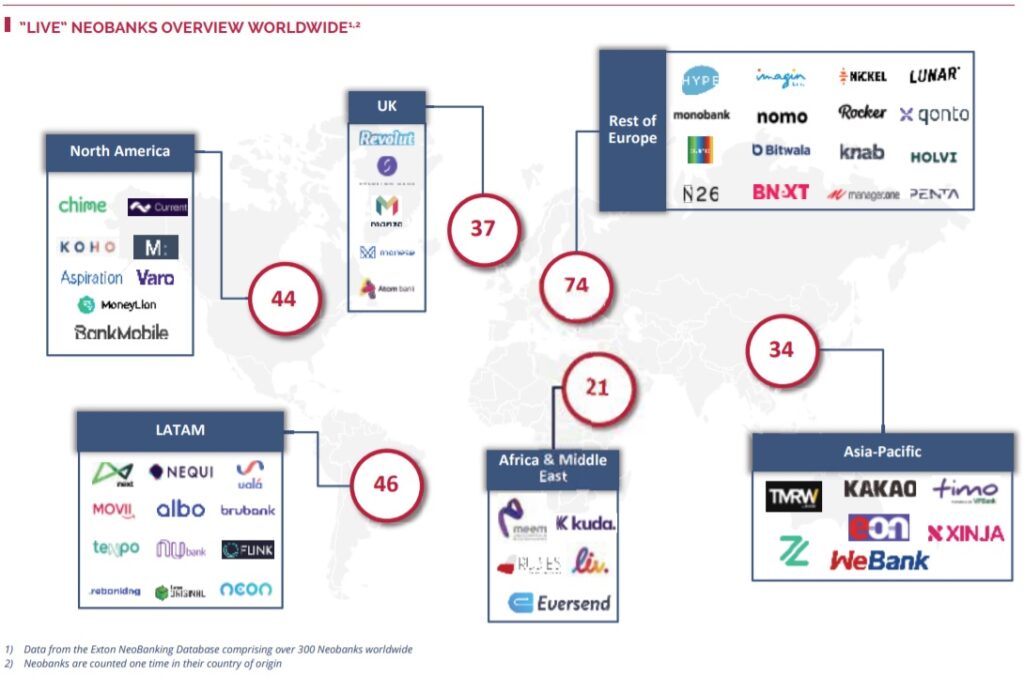

Five or six years ago, the Neobanking revolution was largely focused in Europe with some of the earliest mobile-centric and userexperience-focused examples seeing the light in the UK, France, Finland, Germany or Russia. Different from back then, Neobanking is now a truly global phenomenon and the universe of players is spread across the globe with an increasingly complete coverage of segments and banking models in major markets also in AsiaPacific and the Americas.

Latin America for example has seen an exceptionally dynamic evolution with now close to 50 live Neobanks following the footsteps of the Nubank success story in Brasil. China in turn has witnessed a unique development with the explosive growth of financial ecosystems like Ant Financial and WeBank which – apart from attracting hundreds of millions of clients and gaining a dominant position in payments – have successfully expanded into consumer lending and other products.

Country-by country differences are enormous and while on one hand this demonstrates different levels of entrepreneurship across countries, it is also a result of perceived market opportunity left open by the incumbent banks.

Two noteworthy examples in Europe are the UK and Poland. While the UK has produced 37 Neobanks already and thus shown the biggest individual innovation capacity in the sector, Poland is still waiting for its first home-grown pure digital bank (Note: mBank despite its digital reputation is not considered a Neobank in our analysis due to its history and existence of a branch network). It is likely not for the lack of opportunity in this country which is widely considered as one of the most digital banking countries overall but rather resembles a fear of not being able to differentiate and compete vs. the strong and highly digital incumbent banks in the country.

EXTON´S GLOBAL NEOBANKING COUNTRY INDEX

Following a “scale first” strategy, a growing number of Neobanks in Exton Consulting database have expanded their services to outside their home country and – unsurprisingly – EU based banks have been most active in that regard making use of EU passporting mechanisms. Currently 43 Neobanks (~17%) are operating multi-geography, with Revolut and Transferwise being the most global examples operating already in 36 markets and plans to expand further in the near future. Revolut´s stated ambition includes a launch in Brazil, Canada, Hong Kong, New Zealand and the UAE, whereas Transferwise recently expanded their global card issuing partnership with Mastercard.

However, despite the early-mover advantage these multigeography banks had in launching, recent numbers suggest that “local heroes” can still attract significant client interest. This is showcased by the strong growth of domestic players like Bnext in Spain or Hype in Italy.

But with local Neobanks growing quickly and new market entries happening frequently, the white spaces and opportunities are closing fast and first mover advantages are becoming ever more rare outside of niche and segment-specific offerings. For those that are considering the launch of a new Neobank or the expansion to other countries, it now becomes increasingly crucial to prioritize where and in what segment to launch. Many of our discussions with market participants have therefore circled around the following questions:

. What countries are the global champions in Neobanking? And what can be learned from the disruptors that excelled in those markets?

. In which countries and segments does White Space still exist, i.e. an opportunity to develop a clearly differentiated value proposition in a significantly digital and large market?

. And how can individual country opportunities possibly be compared and ranked?

To inform these discussions we have developed a Country Neobanking Index that covers 40 countries with noteworthy activity in that sector and measures the evolutionary stage of Neobanking across 3 major areas: 1) Level of Neobank activity 2) Client readiness for Digital Banking 3) Customer penetration of Neobanks.

The results of this analysis confirm that Europe is still the engine for innovation with three of the five most advanced Neobanking markets being located there: the UK as the Neobanking powerhouse, followed by Sweden and France. At the same time, other global markets are catching up quickly, most notably South Korea and Brazil but also the US. China, which given its unique development is difficult to compare to other markets, remains unrivalled with respect to client reach of their financial ecosystems.

Among the countries that finished surprisingly low in our assessment are Poland at No 25 and Japan at 30, but also Germany, the leading country in the era of direct banks2 , not making the Top 10 list of Neobanking countries. Those are the geographies where white space remains for innovative contenders and where we subsequently expect more activity in the years to come.

Download the full report here to find out more about 1) Trends and tendencies – where are Neobanks heading? 2) The rocky path to profitability – three options for Neobanks.

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: