Cantaloupe, Inc., a digital payments and software services company that provides end-to-end technology solutions for the unattended retail market, partnered with the Broad College of Business at Michigan State University for a joint study on payment trends in unattended retail.

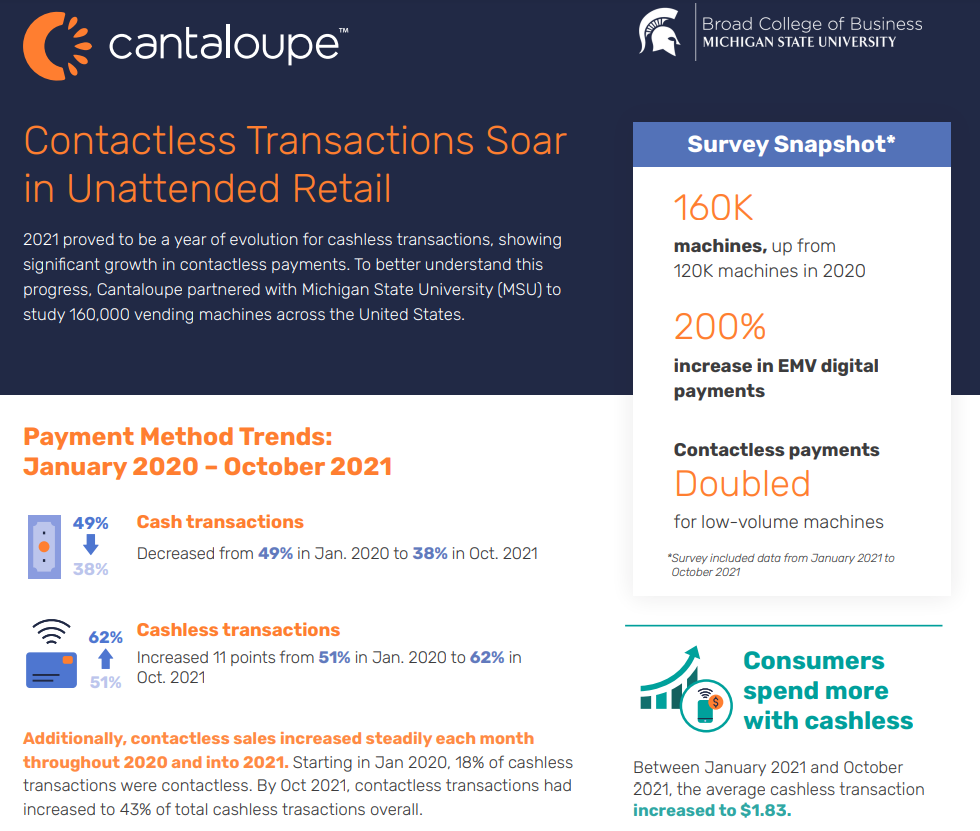

The “Payments in Unattended Retail” study saw the overall share of cashless transactions increase dramatically from 51 percent in January 2020 to 62 percent in October 2021 compared to cash transactions, which decreased from 49 percent to 38 percent in the same time period.

The rise in cashless payments overall is being driven by consumer adoption of contactless payments, or any payment method that uses either near-field communication (NFC) or radio frequency identification (RFID) technology to “tap to pay” — such as a credit or debit card with a chip, or a mobile wallet.

The study found that from January 2020 to October 2021, contactless transactions had grown steadily month to month from 18 percent of total transactions to 43 percent of total cashless transactions overall. The percentage of contactless transactions reached 48% after the first six months of this year.

“When we analyze our entire network of devices throughout the first half of 2022, we’re seeing contactless payment methods make up nearly half of all cashless transactions,” noted Sean Feeney, CEO of Cantaloupe, Inc. “And these trends aren’t slowing down. The data indicates that by the end of 2022, more than two-thirds of all transactions will be cashless, driven by consumers preferring to tap. For vending operators, this underlines the importance of offering contactless payment options if they want to increase revenue and remain competitive.”

Cantaloupe’s purchase data from January to November 2021 also showed an increase of EMV (Europay, Mastercard, and Visa) digital payments growing from 1 million transactions to 3 million. Cantaloupe predicts the number of EMV transactions to grow by an additional 2 million in 2022, reflecting the impact of EMV security changes by payment processors and card brand issuers. Vending operators should be aware of the revenue risks if their card readers are not EMV compliant.

This research reflects observed consumer payment trends toward cashless payments when customers pay in person, driven by increased adoption of contactless payment methods such as chip cards or mobile wallets. Based on the data, the study predicts that contactless payments will grow another 31 percent during 2022.

__________

The results of the study, which analyzed a sample set of 160,000 Cantaloupe ePort cashless devices across various location segments, show that contactless transactions at vending machines soared during the height of the COVID pandemic from January 2020 to October 2021, the time of the study.

Cantaloupe was founded in 1992 with the goal of providing cashless acceptance to the traditionally cash-driven vending market, and the company continues to be a leader in the unattended retail industry.

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: