„We expect cash usage to continue to fall and by 2031 cash will account for six per cent of all payments made in the UK. Rather than the UK becoming a cash-free society over the next decade, the UK will transition to an economy where cash is less important than it once was but remains valued and preferred by many,” according to UK Finance – Payments Markets Report.

Key findings:

. 40.4 billion payments were made in 2021, a return to pre-pandemic levels.

. Debit cards were the most used payment method, accounting for 48 per cent of all payments.

. The number of cash payments fell by 1.7 per cent in 2021, although it remained the second most commonly used payment method, used for 15 per cent of all payments in the UK.

. Faster Payments overtook Bacs Direct Credit as the payment method most frequently used by businesses.

. 57 per cent of UK adults used mobile banking in 2021.

Almost a third of all payments in the UK were made using contactless methods in 2021.

Overall

A total of 40.4 billion payments were made by consumers and businesses in the UK during 2021, which represented a return to pre-pandemic payment volumes after a significant fall in 2020 due to the Covid-19 lockdowns.

As the economy reopened, payment trends reverted towards their long-run patterns. Card payments increased and cash payments continued to fall.

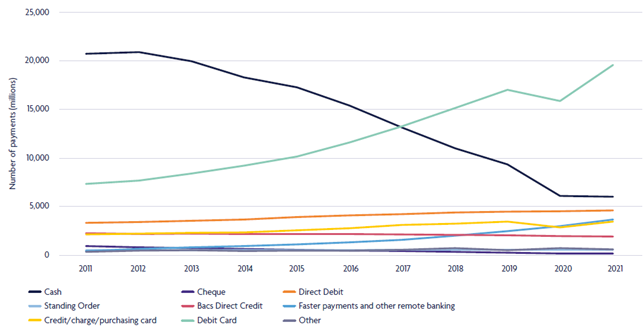

The chart below shows the overall trends in the number of payments made using different methods over the past ten years.

Card payments

The number of debit card and credit card payments, which declined in 2020, rose again in 2021 (to 22.9 billion payments), such that 57 per cent of all payments in the UK were made using cards.

Debit cards remained the most common payment method, growing by over 23 per cent to reach a total of 19.5 billion payments. The growing popularity of debit card payments has been a key feature of the last decade, and this appears set to continue in future.

Contactless

Contactless payments – including payments initiated using contactless cards, mobile phones and watches – continue to grow in popularity. Almost a third of all payments in the UK were made via contactless methods in 2021, up 36 per cent compared with 2020.

When you consider just consumer card payments, 58 per cent were made via contactless.

Contactless appears to be popular with consumers, due to the speed and security of transactions. The increase in the contactless payment limit (to £45 in April 2020 and then to £100 in October 2021) expanded the range of purchases that could be made this way. Retailers also encouraged the use of contactless during the pandemic as a way of helping to facilitate social distancing in shops. Card acceptance devices have also become more widespread in recent years, especially among smaller businesses.

Cash

The number of cash payments decreased by 1.7 per cent to 6 billion, although it remained the second most commonly used payment method, accounting for 15 per cent of all payments made in the UK last year.

During 2021 there were 23.1 million consumers who used cash only once a month or not at all, a significant increase from 13.7 million consumers the previous year. At the same time, there were 1.1 million consumers who mainly used cash when doing their day-to-day shopping.

Different people prefer different methods of managing their finances. Some find mobile banking to be a convenient way of staying informed about their current balance. Others find having physical cash useful for budgeting purposes. Given the rising cost of living this may impact people’s use of cash over the coming months.

Buy Now Pay Later

For the first time the report includes data on Buy Now Pay Later (BNPL) services, based on market research data. This found that 12 per cent of people had used BNPL services last year, with broadly equal numbers of male and female consumers. Younger consumers were more likely to use BNPL than older consumers, although the age group that used it the most was 35 – 44-year-olds.

Business payments

Businesses made just over 5.5 billion payments in 2021, a 14 per cent increase compared with 2020. This reflects the reopening of the economy as the pandemic-related lockdowns came to an end.

In recent years businesses have increasingly used Faster Payments to make payments, largely due to the adoption of online banking as a method of managing business finances and making payments, particularly among smaller businesses. As a result, Faster Payments overtook Bacs Direct Credit as the payment method most frequently used by businesses to make payments in 2021.

Adrian Buckle, Head of Research at UK Finance, said:

„Payment trends generally tend to change slowly, as we all form habits about the way we pay for things and these don’t change easily. However, the pandemic accelerated the pace of change in 2020, in particular the reduction in the number of cash payments.

“In 2021 we saw the total number of payments return to pre-pandemic levels and a return towards the long-run trends in payment method usage. Contactless continued to be popular, accounting for almost a third of all payments. Cash usage fell slightly, although remained the second most commonly used payment method. These are trends we expect to continue over the next decade, alongside a continued decline in cheque use, and an increase in the number of people using remote banking.„

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: