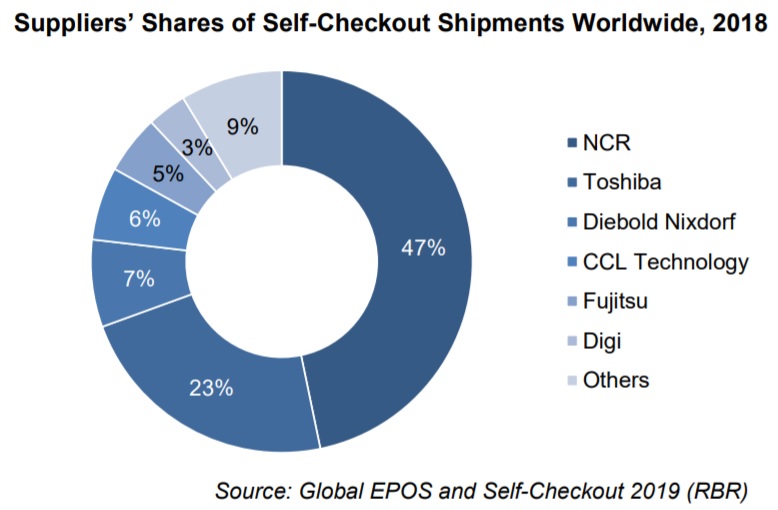

New research reveals there were more than 80,000 self-checkout shipments in 2018, with NCR holding the largest market share, according to RBR London.

Wide variety of suppliers compete in dynamic self-checkout market…

Global EPOS and Self-Checkout 2019, the latest study by strategic research and consulting firm RBR, shows another record-breaking year for self-checkout shipments. The report, which covers 53 country countries worldwide, highlights a dynamic and competitive environment of more than 20 suppliers, with global, regional and local vendors all active.

…but NCR and Toshiba still delivered seven out of 10 terminals

NCR is the largest self-checkout vendor, accounting for nearly half of units delivered worldwide. The company leads in five out of the six regions in RBR’s study, with its terminals installed at major international retailers including Walmart, Tesco and REWE group.

Toshiba, the second largest supplier, grew its share by two percentage points in 2018. The Japanese vendor’s customers are mainly leading US and Japanese grocery chains such as Albertsons and Life supermarkets. NCR and Toshiba together make up 70% of global shipments.

Diebold Nixdorf is the third largest supplier and accounts for nearly a third of all European shipments. CCL Technology has quickly established itself as the largest self-checkout supplier in its Chinese home market and delivered 5,000 units in 2018. Japan’s Fujitsu also has a strong presence domestically, as well as the largest share in Canada.

Other vendors shipping more than 1,000 terminals globally include Japan’s Digi, Sweden’s ITAB and China’s Wintec. Digi’s terminals are installed at local supermarket chains, ITAB mainly works with European retailers, and Wintec has installations in its home country as well as Israel.

Local vendors add to the competitive landscape

The competitive landscape of the self-checkout market is evolving, with new suppliers emerging year-on-year. Momentum in Brazil has been fuelled by multiple domestic vendors, while there are also regional suppliers present in CEE. Alan Burt, who led the RBR research, commented: “The range of self-checkout suppliers is expanding every year as retailers across the globe look for solutions to provide their customers with a frictionless checkout experience in store.”

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: