Cash usage has increased for the first time in 13 years as many households respond to the cost-of-living crisis by budgeting with physical money. Data from Nationwide Building Society reveals more than 30.2 million cash withdrawals were made from Nationwide ATMs last year – a 19 per cent increase on 2021, according to a press release.

The average amount of cash withdrawn from Nationwide ATMs was £105 last year, down two per cent on the previous year but still up 25 per cent on 2019 (pre-pandemic).

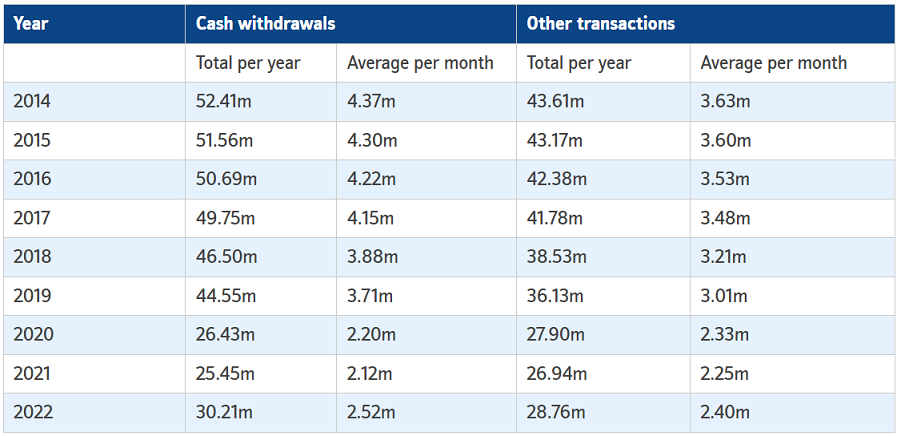

Over recent years the number of cash withdrawals had been steadily declining, most sharply at the start of the pandemic when the number of withdrawals at Nationwide ATMs dropped more than 40 per cent in a year (26.4m in 2020 v 44.5m in 2019).

Nationwide has more than 1,200 ATMs located across the UK either inside or outside its branches, all of which are free to use. Britain biggest building society continues to value the role of branches and the services they enable, such as access to cash. In June the Society extended its promise to not leave any town or city in which it is based without a branch until at least 2024.

ATM usage

The rise in multi-use ATMs mean that cash withdrawals are only part of the picture. Nearly half (49%) of all transactions are for other services – from printing mini-statements and paying bills to changing PINs and paying in cash and cheques.

When it comes to depositing cash, over the last five years (2017 to 2022) the Society has seen a 34 per cent increase in the number of times Nationwide’s ATMs are used to deposit cash into accounts with the average amount deposited rising to £277 – a 37 per cent increase on five years ago.

Locations

Nationwide’s ATM data reveals the busiest cash machines in the UK are mostly in London. The top five locations for cash withdrawals are: Southall, East Ham, Upton Park, Ilfracombe, Gillingham. The top five locations for other transactions are: Southall, Bedworth, Gillingham, Salford, East Ham

Otto Benz, Director of Payments at Nationwide Building Society, said: “For the first time in years we are seeing a natural rise in cash withdrawals as people return to using cash to help avoid getting into debt from the rising cost of living. ATMs play a vital role in society, enabling people to easily access cash. However, over the years, they have offered greater capability for people to manage their money, whether that’s checking their balance or paying a household bill. Our data shows people are clearly taking advantage of this enhanced technology as we are increasingly putting money away as well as taking it out. Far from the end for cash, it shows that the future of money management is constantly evolving. Taking advantage of the additional services that ATMs provide can be a speedy and convenient experience.”

_________

Nationwide is the world’s largest building society as well as one of the largest savings providers and a top-three provider of mortgages in the UK.

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: