Although N26 brought on over 1 million new customers in 2021, the neobank’s losses widen after compliance spending push

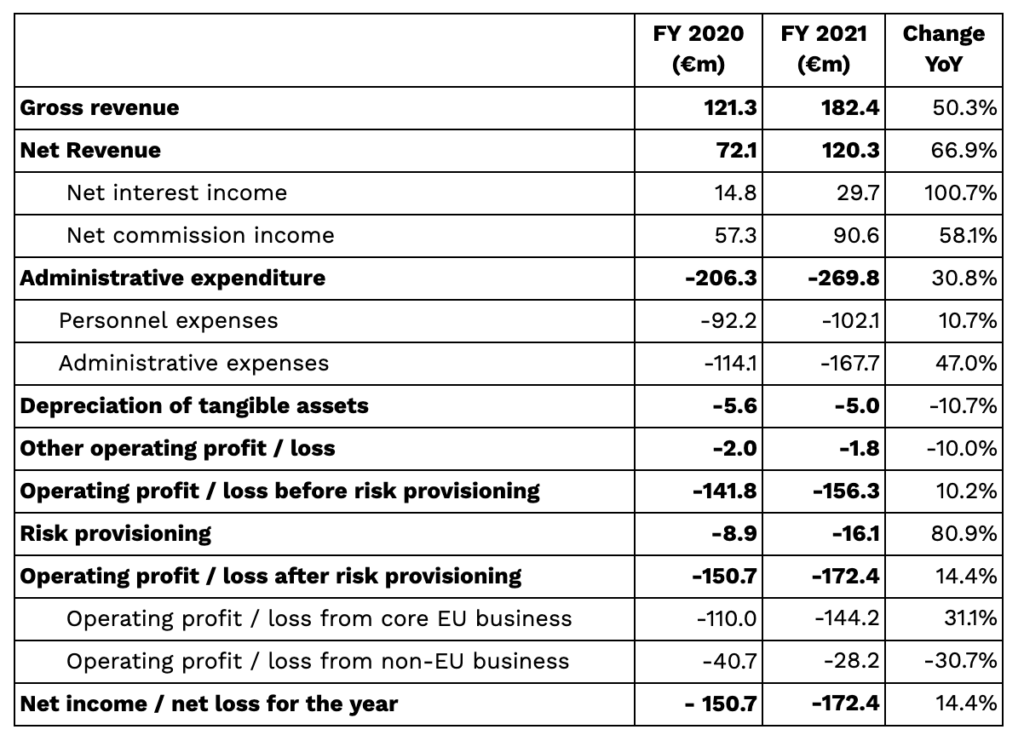

N26’s net losses rose 14,4% to €172.4 m last year, the German neobank reported as it focused on addresing its compliance headaches, according to a press release.

The fintech attributed its increased losses to a 31% increase in spending on governance, compliance and online fraud prevention frameworks, as well as continued hiring – at a time when many of its competitors have frozen hiring or are making layoffs.

The neobank also reported a 70% surge in net revenue to €120.3 m driven by stronger customer engagement, a growing user base and higher interest rates. N26’s user base grew by over 1m in the ywar to 8m customers – of which 3.7m were what it called „revenue-relevant” in a statement accompanying the results. Transaction volumes increased by 59% to over €80bn during the year.

Valentin Stalf, CEO and Co-founder of N26, said: “2021 saw us solidify our position as a leader in Europe’s digital banking market. We made further investments in our product, in our team, and in the scalability of our platform. On average, customers log in to their N26 app 3 times a week, making us the mobile bank with the most active customer base in Europe. This is reflected in a significant increase of transaction volume by around 60 % to more than EUR 80 billion.”

Jan Kemper, Managing Director and COO/CFO at N26: “In 2021, we focused on building a pathway to sustainable future growth. We increased revenues for the year and grew our premium subscriber base significantly. We also saw deposit volumes increase by 52% to EUR 6.1 billion in 2021, opening up additional revenue streams that will make us even more resilient as we look to the future.”

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: