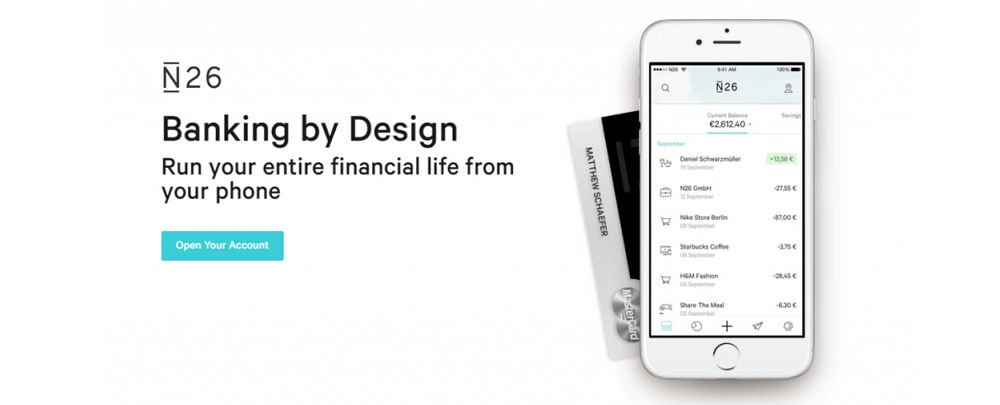

N26 – the German mobile only bank – now operates in 26 markets. After U.S. the company continue its global expansion and launches in Switzerland.

N26, The Mobile Bank, is launching its service in Switzerland today, bringing their free euro bank accounts to the market for the first time. Swiss customers using iOS will also be able to use N26 with Apple Pay.

The N26 account will offer all Swiss customers five free withdrawals in euros per month within the Eurozone, with no foreign exchange fees on card payments worldwide, irrespective of currency.

„This offer is designed for people who travel frequently within the European Union, those who live near the Swiss border, and those who are tired of paying high fees for a euro account. With a bank account denominated in euros, N26 will offer Swiss customers truly borderless banking within the Eurozone.”, according to a press release.

“We’re really happy to present a mobile banking offering in Switzerland that works not just here, but also well beyond the borders of the Eurozone and in Switzerland,” says Georg Hauer, General Manager for DACH at N26.

“Our mission is to become the most popular euro currency account in Switzerland. Additionally, with Apple Pay, N26 customers have access to an easy, secure and private way to pay in stores, apps and on the Internet via Apple devices.”

To date, more than 20,000 people have signed up to the waiting list, ahead of N26’s public launch in Switzerland. A recent N26 study showed that participants living close to the border, or in larger cities such as Zurich, Basel and Geneva, showed high interest to a euro-denominated bank account that would help with seamless payment within the Eurozone. Today’s launch means that N26 is now present in 26 markets globally.

Founded in 2013, N26 launched the initial product in early 2015. Today N26 has more than 3.5 million customers in 26 markets who generate over €2 billion in monthly transaction volume with no branch network .

With a full European banking license, the company employs more than 1.300 employees across 5 office locations: Berlin, New York Barcelona, Vienna and São Paulo.

N26 has raised more than $670 million from the world’s most established investors, including Insight Venture Partners, GIC, Tencent, Allianz X, Peter Thiel’s Valar Ventures, Li Ka-Shing’s Horizons Ventures, Earlybird Venture Capital, Greyhound Capital, Battery Ventures, in addition to members of the Zalando management board, and Redalpine Ventures.

N26 currently operates in: Austria, Belgium, Denmark, Estonia, Finland, France, Germany, Greece, Iceland, Ireland, Italy, Latvia, Liechtenstein, Lithuania, Luxembourg, Netherlands, Norway, Poland, Portugal, Slovakia, Slovenia, Spain, Sweden, the UK and the US, where it operates via its wholly-owned subsidiary, N26 Inc., based in New York. Banking services in the US are offered by N26 Inc. in partnership with Axos® Bank, Member FDIC

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: