N26 launches the first NFC enabled card with a metal core in Europe, three times heavier than a standard plastic card – an exclusive product for selected digital customers

N26 is launching its new premium Mastercard product, N26 Metal. Complementing the outstanding design of the card, N26 Metal customers have access to a personalized section within the N26 app which combines an exclusive partner program tailored to the needs of digital customers and dedicated customer service.

The exclusive card contains comprehensive worldwide travel Insurance and comes without any additional fees for withdrawing money when travelling abroad and best exchange rates for card purchases.

Selected N26 Black customers in Germany, France, Italy&Austria will be invited to signup for and get early access to the benefits of N26 Metal from the 14th of December prior to the official rollout in early 2018. Within the personalized section of theN26 app, customers have access to an exclusive partner program that caters to the needs of digital customers Who expect easy on-demand access to the products and services they enjoy.

N26 is proud to announce WeWork as its first flagship partner. This partnership gives N26 Metal customers the opportunity to become part of the global, diverse WeWork network. It includes credits to reserve workspaces or conference rooms in WeWork locations around the world. N26 is committed to continuously expanding its partner program by bringing together leading brands with international reach as well as distinguished local partners in individual markets.

„N26 Metal is more than just a premium banking product, it’s a card for today’s digital lifestyle,” explains Valentin Stalf, Founder and CEO of N26, „by partnering with the best brands, we go beyond providing purely financial products and give our customers access to the best products and services in a few taps within the N26 app.”

”The new premium product is the first NFC enabled card with a metal core in Europe, exemplifying the innovation for which N26 has become known. The core of the card is made from tungsten and gives the card three times as much weight as any standard plastic card, weighing in at 18g.”, according to the press release.

Around the core is N26’s stapel transparent varnish casing, which allows the customer to see the metal core and NFC antenna. The design also makes the card durable, its metal core won’t bend or break.

N26 Metal comes without any additional fees for withdrawing money in any currency at ATMs when travelling abroad. In addition it offers best exchange rates for card purchases and may be ”the best choice for international travelers”, the company says.

Selected N26 Black customers will be invited to sign up for N26 Metal in mid-December and have early access to the benefits of the new premium card before the official launch in early 2018. N26 Metal will be initially available in Germany, France, Italy and Austria. A rollout in additional markets is planned across 2018.

About N26

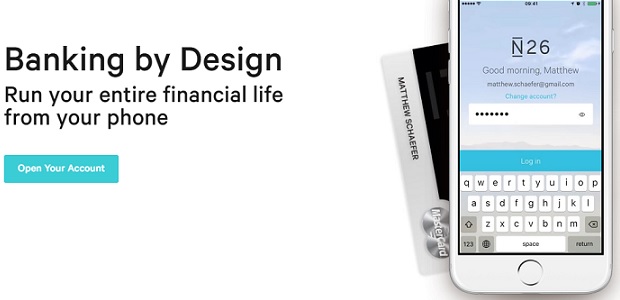

N26 is Europe’s first Mobile Bank with a full European banking license. N26 has redesigned banking for the smartphone, making it simple, fast and contemporary. Opening a new bank account takes only eight minutes and can be done directly from your smartphone. Users receive a Mastercard to pay cashless or withdraw cash all around the world. They can block or unblock their card with a simple click and send money instantly to friends and contacts.

Valentin Stalf and Maximilian Tayenthal founded N26 in 2013 and launched the initial product in early 2015. Since the launch N26 has grown to more than 500.000 customers across 17 European markets and has over 300 employees. N26 currently operates in: Austria, Belgium, Estonia, Finland, France, Germany, Greece, Ireland, Italy, Latvia, Lithuania, Luxembourg, Netherlands, Portugal, Slovakia, Slovenia, and Spain. N26 has also announced to enter the UK market in the first half of 2018 and the US market in Mid 2018 based in New York.

Since January 2015, N26 has been available for Android, iOS, and desktop. N26 has raised more than $55 million from investors.

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: