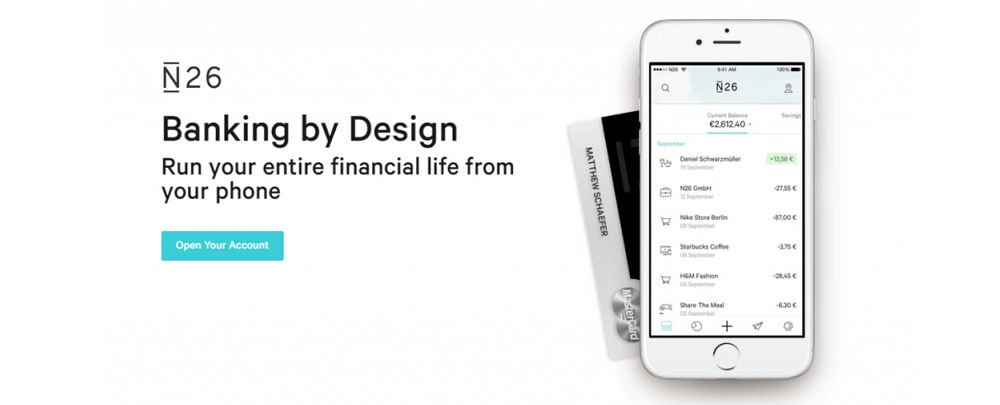

N26, the German mobile-only bank, is introducing virtual cards to the N26 Standard account. Banking without a card for a plastic- and paper-free experience, is a choice that is now available with N26.

The last months have been unprecedented to say the least, and it’s no surprise that customers have changed their habits to adjust to a new reality. For starters, cash use has declined like never before across Europe—we’ve seen ATM withdrawals fall by over a third during the pandemic, while mobile payments with Apple Pay and Google Pay have gone up 56% compared to last year.

„With more people managing money online, we’ve not only increased our efforts to share how you can stay safe while spending online, but also introduced new ways for you to manage your finances digitally—from IBAN scanners, QR-code enabled payments and added security toggles for different payment types, to automatic savings functionalities such as N26 Round-Ups,” according to a company’s blog.

„With this, we also thought it was time to consider whether physical payment cards are a necessity or an accessory. While many customers continue to choose to express their personality through their choice of card and card colour, we recognize that others would prefer to make a sustainable choice by moving away from plastic where possible. We believe that it’s time to offer customers a choice when they sign up to N26, allowing them to go cardless for a 100% digital experience and do away with paper and plastic, if they wish to do so,” N26 believes.

The new virtual card offered with a free N26 Standard account will begin rolling out in select European markets today. These virtual cards will be issued instantly as soon as an account is opened—a process that can be completed in minutes and requires no physical paperwork.

„Customers will be able to add their virtual N26 Mastercard to their mobile wallets immediately, accessing it in their N26 app to make online payments right away,” the company says.

This new virtual card functionality will first be available to every new customer signing up to a free bank account, giving them the ability to shop online, and pay via their smartphone with Apple Pay and Google Pay.

Additionally, customers will also be able to withdraw cash at contactless NFC-enabled ATMs—all without a physical card. Should customers still choose a physical card, they have the option to order one for a small, one-off delivery fee.

N26 Standard bank accounts are available at no monthly cost, and of course, both virtual and physical N26 cards can be easily managed within the N26 app as two separate payment cards, each with their own unique card number.

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: