N26 hits 250,000 U.S. customers in first five months

Globally, the company recently reached 5 million customers to coincide with its fifth anniversary following a year of record growth.

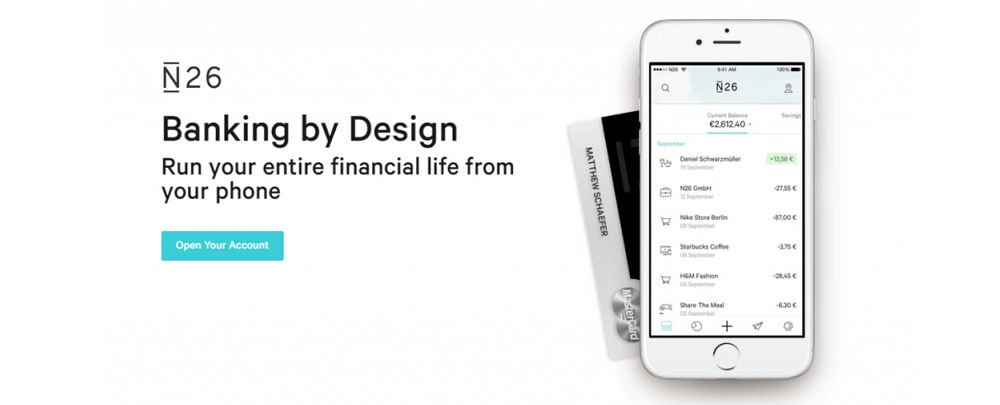

N26 Inc., the U.S. subsidiary of one of Europe’s fastest-growing mobile banks, N26 GmbH, today announced it has reached 250,000 U.S. customers. Having only launched in the U.S. last August in partnership with Axos Bank, N26 has grown rapidly to become a leading force in changing how American consumers bank.

Without ever setting foot in a branch, through N26 customers can open an account in less than five minutes, instantly transfer money to their friends with MoneyBeam, and easily open sub-accounts for their savings goals using Spaces. Accounts opened through N26 also have no hidden fees and offer access to a network of over 55,000 Allpoint surcharge-free ATMs. Also, users can get their pay up to 2 days earlier with direct deposit*.

The app also gives customers access to a range of security features, including setting spending limits, locking their card if its lost, and enabling or disabling international charges. With several launches planned for 2020, N26 aims to stay at the forefront of innovation by delivering products that address customer needs, with the ultimate goal of empowering users to make their money work for them.

Globally, N26 GmbH surpassed 5 million customers as it reached its fifth anniversary on January 26. Boasting a strong workforce of almost 1,500 employees, it combines 80 nationalities across offices in Berlin, New York, Barcelona, Vienna, and São Paulo.

N26 has put a heavy focus on its investments in product, service quality, and people. In 2019, N26 had a year of unprecedented growth, more than doubling its global customer base — which accounts for more than every single year previously combined.

Additionally, the company raised $470 million in funding, which bolstered its launch in both the U.S. and Switzerland, as well as fund the opening of a new Tech Hub in Vienna.

“5 million customers is a great achievement, but it’s not just growth that we are after. We are today, one of the biggest players in digital banking. But we have not forgotten our original mission – to challenge an industry that is ripe for change. N26 has proved that banking can be simple and intuitive through the use of technology,” added Valentin Stalf, co-founder and CEO of N26.

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: