N26 further strengthens offer in 12 new markets with launch of Stocks and ETFs trading

N26, Europe’s leading digital bank, today announced the launch of Stocks and ETFs trading in 12 new markets. With the introduction of N26 Stocks and ETFs, customers in Belgium, Denmark, Estonia, Finland, Greece, Latvia, Lithuania, Norway, Poland, Portugal, Slovakia, and Slovenia will be able to manage their investment portfolio directly within the N26 app.

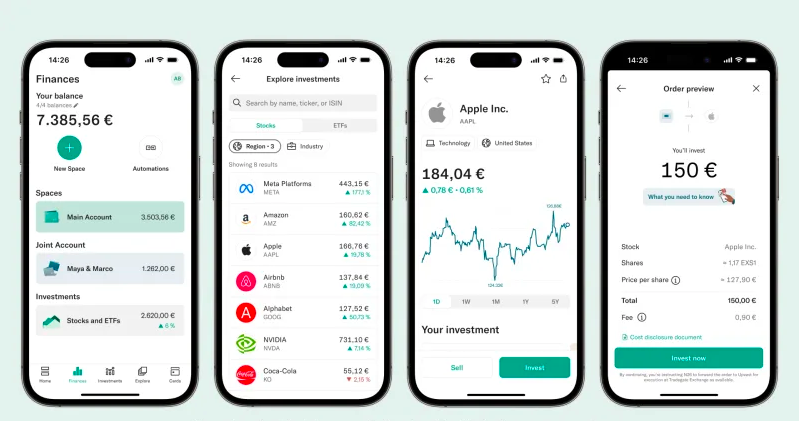

With its new Stocks and ETFs trading product, N26 allows its customers to invest in fractional shares of hundreds of the most popular European and US assets on global equity markets with as little as 1 EUR. The new product further strengthens N26’s premium offering, with N26 Metal customers benefiting from 15 free trades per month, and N26 You customers receiving 5 free trades per month. All other trades are priced at 0.90 EUR per trade.

Together with N26 Accounts, N26 Stocks and ETFs will give customers the ability to go beyond managing their day-to-day finances, empowering them to build future wealth and financial well-being with simple and intuitive tools directly within the N26 app. The new trading product aims to empower millions of customers who have yet to explore the equity markets with simple and accessible tools that can help them easily take their first steps in their investing journey.

Rolling out progressively to eligible N26 account holders over the coming weeks, N26’s trading product will allow customers to buy and sell shares of more than 500 popular European and US stocks, and invest in global ETFs*. The range of assets available to trade is set to continue to expand to over a thousand stocks and ETFs in the coming months.

With a simple pricing structure of a fixed 0.90 EUR per trade, customers in 12 Markets will be able to invest at one of the most competitive prices in the market, without being charged commissions or custody fees. N26 customers with N26 You and N26 Metal memberships will also be able to benefit from free trades as part of their subscription.

N26 You customers will have 5 free transactions per month included as part of their membership, while N26 Metal customers will get 15 free transactions per month. In addition, the digital bank is also offering free Investment Plans to give all customers the means to automate their investments on a recurring basis and cultivate healthy financial habits as they progress on their investment journey.

Valentin Stalf – Founder and CEO at N26, said: “With this new feature, we are further expanding our product portfolio, and building on the launches of N26 Instant Savings and Joint Accounts to offer our customers one of the most attractive investment and saving products to accompany their N26 bank account.”

N26 Stocks and ETFs will be made available progressively to eligible customers in these markets over the coming weeks.

##OO##

* At launch, trading of over 500 stocks will be available to customers in Slovenia, while ETF trading will be made available to trade for customers in the market in due course. Customers in all other markets will be able to trade stocks and ETFs at launch.

N26 is Europe’s leading digital bank with a full German banking license. It offers simple, secure and customer-friendly mobile banking to millions of customers in 24 markets across Europe. N26 processes over 100bn EUR in transactions a year and currently has a 1,500-strong team of more than 80 nationalities. The company is headquartered in Berlin, with offices in multiple cities across Europe, including Vienna, Paris, Milan and Barcelona. Founded by Valentin Stalf and Maximilian Tayenthal in 2013, N26 has raised close to US$ 1.8 billion from some of the world’s most renowned investors.

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: