N26 will offer fractional investing, giving account holders the opportunity to invest in partial shares of some of the most popular European and US assets on the global equity markets with as little as 1 EUR. The new investment product will gradually roll out from 17 January to eligible customers in Austria* in the form of an early version offering ETF trading. The offer will then be progressively expanded to the German market in the coming months to include stocks and free savings plans.

N26 announced the launch of a new Stock and ETF trading product that will allow all account holders to buy and sell stocks and ETFs for 0.90 EUR per trade, directly in the N26 app. The launch of this new and comprehensive trading product will see N26 continue to expand its offer beyond its digital bank accounts, bringing customers more solutions in savings and investments.

With financial independence increasingly front-of-mind for all customers, a growing number of Europeans aspire to proactively build their wealth. N26 Stocks and ETFs aims to make managing and building one’s investment portfolio simple and accessible to all. The new product will allow customers to buy and sell partial shares of some of the most popular European and US assets on the global equity markets at a market-leading execution price, thanks to N26’s partnership with Upvest.

The new product will be gradually made available starting today in the form of an early version to eligible customers in Austria, offering fractional investing in more than 100 ETFs, with orders starting from 1 EUR. The product’s simple and transparent pricing structure of a fixed 0.90 EUR per trade offers customers access to the equity markets at one of the most competitive prices in the market. N26 will also shortly roll out free trades with its premium memberships.

N26 plans to expand the range of assets offered to trade to the full suite of over a thousand stocks and ETFs in the coming months to customers in both Germany and Austria, with further availability in additional markets to be announced in due course. In the coming months, customers will also be able to invest on a recurring basis with fee-free Savings Plans.

Valentin Stalf – CEO at N26, said: “Following the launch of N26 Instant Savings and N26 Crypto, N26 Stocks and ETFs will give our customers the ability to manage all their finances within the N26 app. Our customers can spend, save and invest within one app at extremely competitive rates, with no hidden fees and an exceptional user experience.”

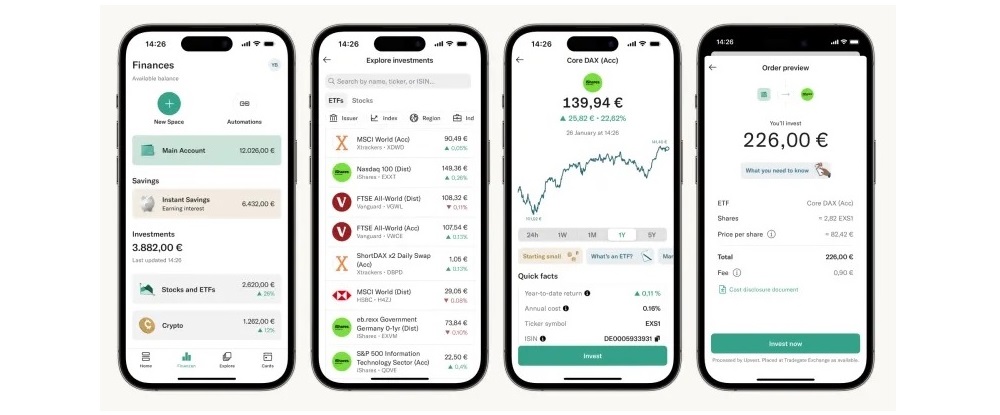

Customers will easily be able to view a summary of their Stocks and ETFs portfolio and purchased assets alongside their Instant Savings and N26 Crypto accounts to get a full view of their finances with N26.

N26 account holders who have successfully completed N26’s identity verification and eligibility checks will be able to sign up to open their trading account in a matter of seconds to begin investing. Funds for purchasing stocks and ETFs can then be easily moved from the main account to the trading account and invested with just a few taps.

To purchase their chosen stock or ETF, a customer simply needs to select the desired asset and the amount they would like to trade. Associated fees will be displayed transparently and will need to be reviewed and confirmed before each transaction is made, and the cash equivalent of the trade will be deducted from the account holder’s bank balance. Customers will also benefit from clear visualizations of their Stocks and ETFs portfolio, making it easy to track their purchase history and portfolio development over time.

*: While Stocks & ETFs is available to personal banking customers, not all customers may be eligible to access the product due to factors that may include nationality, tax residency and security criteria.

N26 AG is Europe’s leading digital bank with a full German banking licence. To date, it has welcomed more than 8 million customers in 24 markets, and processes over 100bn EUR in transactions a year. N26 is headquartered in Berlin with offices in multiple cities across Europe, including Vienna and Barcelona, and a 1,500 team of more than 80 nationalities. Founded by Valentin Stalf and Maximilian Tayenthal in 2013, N26 has raised close to US$ 1.8 billion from some of the world’s most renowned investors.

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: