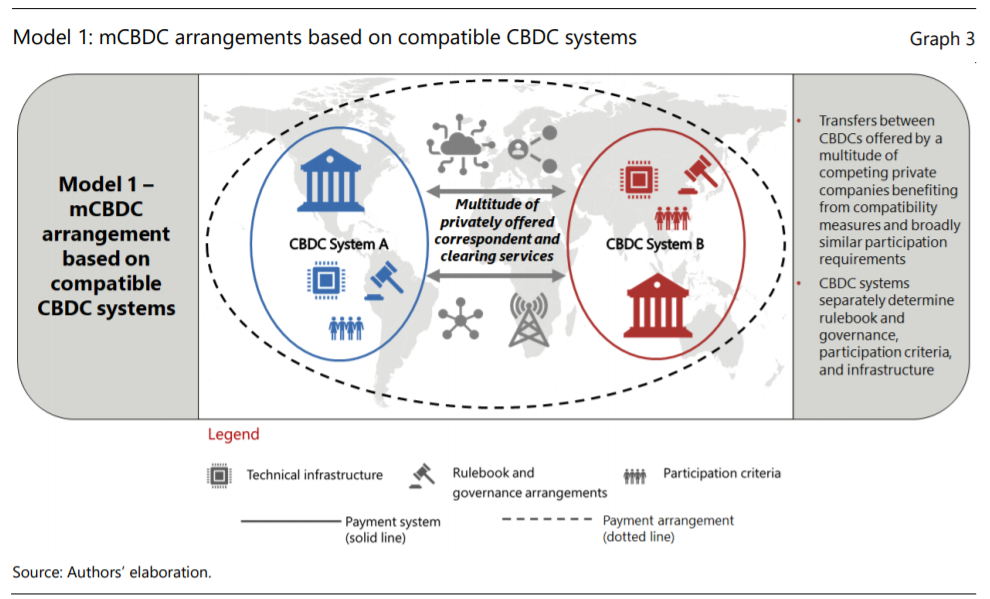

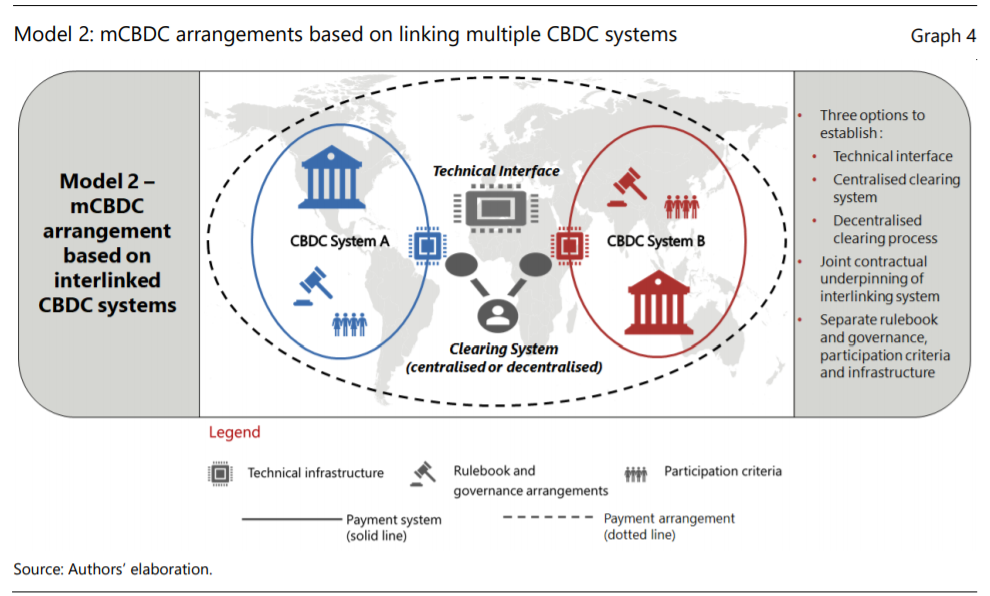

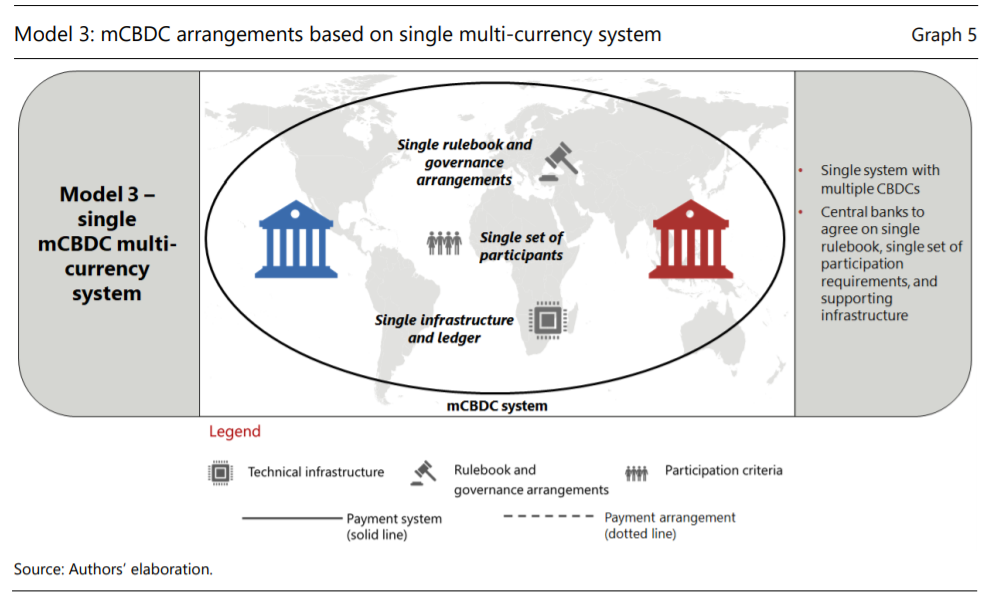

Cross-border payments are inefficient, and technology could play a role in making them better, according to an analysis published by BIS. One means could be through interoperating central bank digital currencies (CBDCs), forming multi-CBDC (mCBDC) arrangements.

This paper explores dimensions of payment system interoperability, how they could feature in mCBDC arrangements and where potential benefits lie. These benefits are especially relevant for emerging market economies poorly served by the existing correspondent banking arrangements.

Yet competing priorities and history show that these benefits will be difficult to achieve unless central banks incorporate cross-border considerations in their CBDC development from the start and coordinate internationally to avoid the mistakes of the past.

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: