Mt. Gox Files for bankruptcy, claims $63.6m bebt

Mt. Gox, the largest bitcoin-fiat currency exchange from 2010 until last year, is officially filing for bankruptcy protection with an outstanding debt of ¥6.5bn ($63.6m), finally admitting openly that 750,000 of its customers’ bitcoins and 100,000 of the company’s own have been lost, according to coindesk.com.

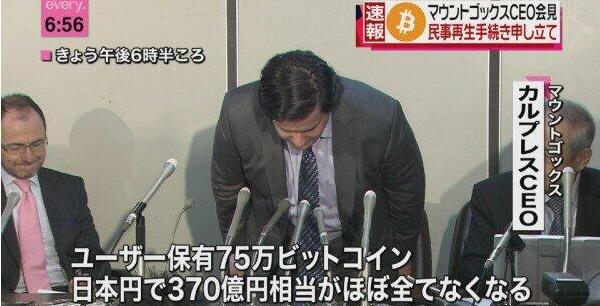

The exchange’s lawyer announced the news during a conference at the Tokyo District Court late on Friday afternoon, Japan time. CEO Mark Karpeles, wearing a suit and tie, bowed deeply in the tradition of disgraced Japanese business leaders fronting the media.

At a news conference in Japan on February 28th, Mt Gox CEO Mark Karpeles told reporters (photo) that it may have lost nearly half a billion dollars worth of the virtual coins, adding 100,000 of its own bitcoin stash to the 750,000 already reported as missing. The firm is also investigating a $27.4 million discrepancy in its own bank account.

The 850,000 BTC loss figure is higher than the 744,400 figure mentioned in the so-called “Crisis Strategy Draft” document leaked and released by Ryan Galt, aka The Two-Bit Idiot, earlier in the week.

That same document also described fiat assets of $32.43m and liabilities of $55m. The assets include $5m “held by CoinLab” and another $5.5m “held by the DHS”. The Department of Homeland Security seized that amount from Mt. Gox’s US accounts in mid 2013, claiming it had not registered properly as a money transmission business.

It’s been a nightmare week for Mt. Gox and its customers, with much of the situation’s true nature still mired in online speculation, rumor and conspiracy theories. The exact fate of all Mt. Gox customers’ bitcoins is still unclear: how such an amount came to be lost or stolen without anyone knowing or taking action, whether ‘transaction malleability’ was indeed behind it, or whether they were transferred to other addresses or lost to the bitcoin network altogether.

CEO Karpeles resigned his position on the Bitcoin Foundation Board at the beginning of last week, beginning a chain of events that culminated in today’s press event. Shortly after that, Mt. Gox’s entire Twitter history disappeared, the ‘crisis’ documents were leaked, and then the website went completely offline, taking with it most customer hopes of ever seeing their money again.

The domain mtgox.com now features only a blank page with the Mt. Gox logo and two short statements, one of which reads “In light of recent news reports and the potential repercussions on MtGox’s operations and the market, a decision was taken to close all transactions for the time being in order to protect the site and our users. We will be closely monitoring the situation and will react accordingly.”

The most recent, from 26th February, reassures everyone that Karpeles is still in Japan and “working very hard with the support of different parties to find a solution to our recent issues.”

While no regulatory action is guaranteed in Japan, federal prosecutors in New York City have subpoenaed Mt. Gox and requested that it preserve documents that may be relevant.

Speaking about the Mt. Gox closure, Japan’s vice finance minister Jiro Aichi says that the government will respond „if necessary” but that that bitcoin regulation needs to by international.

Meanwhile, US Fed chair Janet Yellen has responded to a letter from West Virginia Senator Joe Manchin about bitcoin in which he calls it „disruptive to our economy”.

Says Yellen, quoted by finextra.com: „To the best of my knowledge there’s no intersection at all, in any way, between bitcoin and banks that the Federal Reserve has the ability to supervise and regulate. So the fed doesn’t have authority to supervise or regulate bitcoin in anyway.”

However, she adds: „But certainly it would be appropriate for Congress to ask questions about what the right legal structure would be for digital currencies…It’s not so easy to regulate bitcoin because there’s no central issuer or network operator.”

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: