More UK banks introducing blanket limits or bans on transfers from customer accounts to crypto exchanges. Trade Association CryptoUK calls on government to intervene over bank restrictions.

Trade Association CryptoUK has written to the government expressing „deep concern” about recent moves by banks to limit cryptocurrency purchases and suggested the creation of a „white list” of exchanges that should be exempt from such restrictions.

In recent months, NatWest, HSBC, Nationwide Building Society and Santander have all placed restrictions on customers buying cryptocurrency, citing regulatory concerns and the risk of scams.

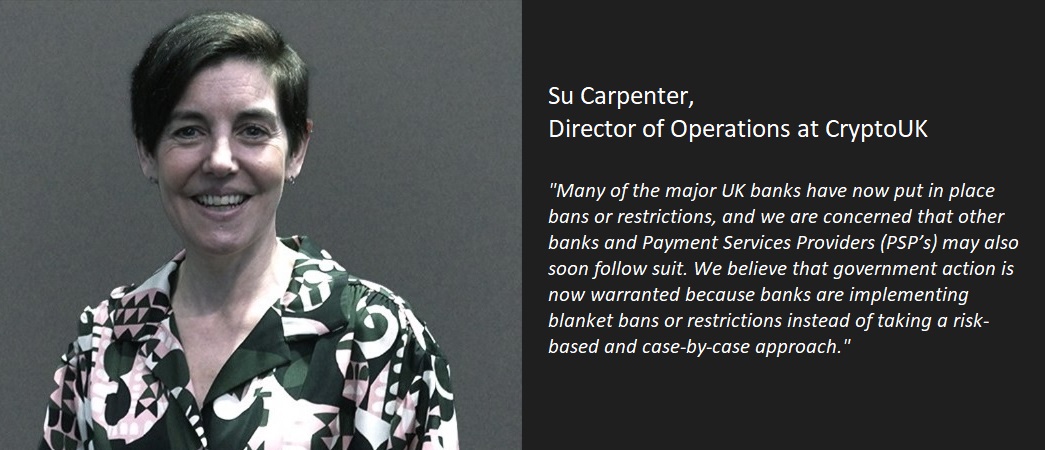

The letter written by Su Carpenter, Director of Operations at CryptoUK:

On behalf of CryptoUK’s members I am writing to express our deep concern about the introduction of blanket bans and restrictions of transfers from UK banks to crypto asset platforms. The introduction of these measures will have the effect of fundamentally undermining the Government’s ambition to become a crypto asset hub and its mission to maximise the potential of Web3 to spur UK growth and innovation.

CryptoUK and its members have attempted to engage constructively with the banks through UK Finance for several months during which time we have seen more banks announcing their decisions to block or limit transactions.

We have also been made aware that during the Crypto and Digital Assets APPG Inquiry, Dr Lisa Cameron invited several high street banks to participate in evidence sessions, all of which were declined or ignored. As an alternative, she requested written submissions and again, after several months, no responses have been received.

Many of the major UK banks have now put in place bans or restrictions, and we are concerned that other banks and Payment Services Providers (PSP’s) may also soon follow suit. We believe that government action is now warranted because banks are implementing blanket bans or restrictions instead of taking a risk-based and case-by-case approach.

We are calling upon the Government to find a path forward. This might require the Government bringing together UK CEOs of crypto asset exchanges and CEOs of banks to find a viable solution. Our members want to work constructively with the banking sector and believe there are a number of potential solutions that can be explored, including creating a “white list” of platforms that have engaged with the UK’s regulatory perimeter (either through AML registration or other EMI/MiFid licenses), to which transactions should be allowed to take place freely.

We urge the Government to take action as, left unaddressed, these measures will inhibit Web3 innovation and tech development in the UK, which we understand to be one of the core pillars of the Government’s plan for economic growth.

_____________

CryptoUK is an independent industry body that exists as a cohesive, credible voice for the

evolving UK crypto industry. It represents the UK’s crypto asset sector, working directly with

policymakers and market players to advocate for better education, mutual understanding,

and fair and balanced policy. Its 155+ members include crypto natives, services, custodians,

and institutional investors.

CryptoUK works with policymakers and agencies to improve protections where they are

needed and remove barriers where they are not. It works with industry market participants

to identify and promote use cases for digital and crypto assets which create value for UK PLC

as well as promoting the UK crypto industry on the world stage.

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: