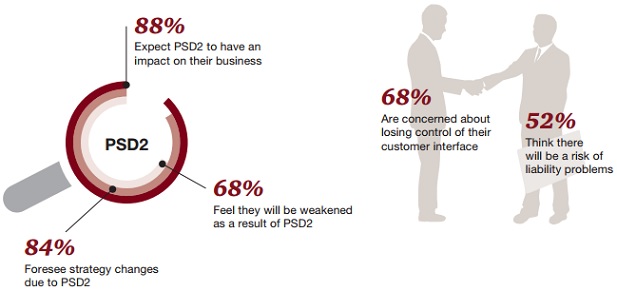

More than two thirds of bankers fear that PSD2 will (further) weaken the position of Europe’s banks

Europe’s bankers have reported being unsure related to more open banking due to PSD2 adoption in 2018, according to a new study by Strategy&, PwC’s strategy consulting business. 68% of bankers fear that PSD2 will cause them to lose control of the client interface and many remain unsure how to respond to the new directive. 88% of banks expect to see growing competition from third party digital services providers. 68% believe that PSD2 will (further) weaken the position of Europe’s banks.

The adoption of the revised Directive on Payment Services (PSD2) has set the stage for open banking in Europe. By providing standardized access to customer data and banking infrastructure, PSD2 will lower the barriers for entry to third-party providers and financial technology companies (FinTechs), and it will stimulate the development of new business models and a wide range of new banking services. „n this way, „PSD2 will be a catalyst for both disruption and strategic renewal in Europe’s banking markets”, according to the report entitled Catalyst or threat? The strategic implications of PSD2 for Europe’s banks.

The report says that the banks fears result from two new PSD2 requirements: third parties, such as fintechs, telecom providers, tech and data companies, will be officially recognised as participants in the payment services market and banks will have to provide these third parties with access to account and payment data, allowing them to leverage client data for services or to execute payments on behalf of customers once they have given their consent.

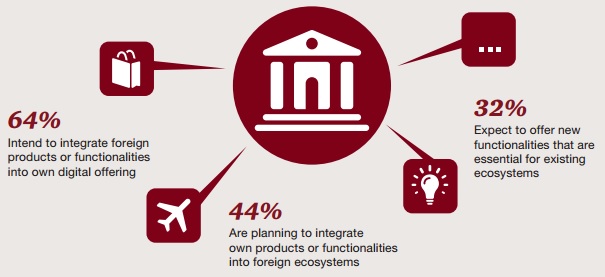

The firm quizzed senior execs at 30 major banks in eight European countries. Despite the perceived risks, 44% of those quizzed plan to provide an open bank offering in the next five years. 64% intend to integrate foreign products or functionalities in their own digital offering, 44% to embed their own products into other ecosystems, and a third to offer new functionalities that are essential for existing ecosystems.

Source: Strategy& interviews with executives of leading European banks, February–May 2016

Banks’ concerns about PSD2 is given weight by a survey of 1000 German consumers by PwC, which shows that 88% already use third-party digital payment services, such as PayPal and nearly three-quarters of them know that these services are not affiliated with their banks.

81% of consumers surveyed for the study use third party services, such as online payment systems to shop online. 85% rate the security of these alternative payment services as “high” or “very high” and 82% „agree” or „strongly agree” that companies such as PayPal and Amazon can handle cash transfers and payments just as securely and reliably as their own banks.

With these third parties clearly having established trust, PwC predicts that they can use PSD2 to expand beyond payments into other services, such as account monitoring and personal financial management, that banks have traditionally offered.

With PSD2’s mandates set to take effect in 2018, PwC concludes: „The only truly relevant question for European banks at this juncture is whether they will choose to lead and shape the future of open banking or be reduced to regulation-bound providers of commodity services to other, more visionary companies.”

„The catalyst school represents the only viable approach to PSD2. Because the directive mandates open banking, Europe’s banks should respond by formulating business models that embrace collaborative relationships with new partners and the exchange of data via APIs. Otherwise, banks will be vulnerable to service commoditization and competitive marginalization.”

Download the full report here

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: