More than two million programmable EPOS units were shipped worldwide in 2022, according to a brand-new study from strategic research and consulting firm RBR Data Services, a division of Datos Insights. Global EPOS and Self-Checkout 2023 shows that this marks an increase of 3% on the previous year as the market continued its post-pandemic recovery.

Major replacement projects helped to drive shipment growth in 2022. The USA saw its highest number of EPOS deliveries since 2017, with hardware upgrades at leading grocery and hospitality chains including Chipotle. The US market alone accounted for two-thirds of global growth.

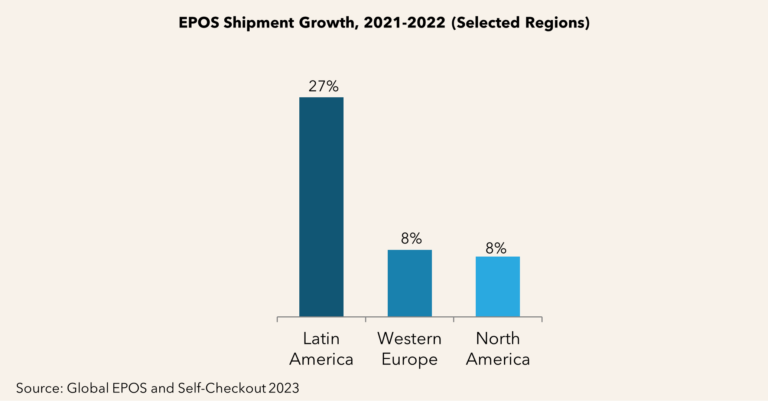

Meanwhile, shipments to western Europe rose for the second consecutive year. Activity leapt by a third in the UK, where several leading supermarket chains refreshed their hardware, while major retailers in other countries, including Italy, Netherlands and Spain, continued to undertake replacement projects.

Investment in EPOS technology crucial in developing countries

2022 marked a strong year for activity in Latin America. An improving post-pandemic economic climate encouraged greater investment in store technology, with the Brazilian market returning to growth for the first time since 2017. Elsewhere, the market in Mexico was buoyant, with local convenience chain OXXO opening more than 1,000 new stores during the year.

The study shows that demand also ramped up in developing markets in Asia-Pacific. In Indonesia, the expanding retail sector buoyed growth, while the Philippines saw EPOS deliveries bounce back to pre-pandemic levels following ongoing COVID-related restrictions in 2021.

China remains the world’s second largest EPOS market, but lockdowns and store closures dented investment, with shipments falling overall. Excluding China, global shipment growth stood at 7% in 2022.

Market expected to surpass pre-pandemic levels in 2023

Activity in the global EPOS market is expected to surpass pre-pandemic levels in 2023, with investment in China predicted to recover. There remains strong potential for long-term growth in developing markets in southeast Asia and Latin America, with nearly 16 million EPOS units forecast to be installed worldwide by 2028.

Jeni Bloomfield, who led RBR’s Global EPOS and Self-Checkout 2023 research, remarked: “The global EPOS market remains in robust health, with advanced hardware continuing to be a key component in retail and hospitality operators’ store technology plans”.

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: