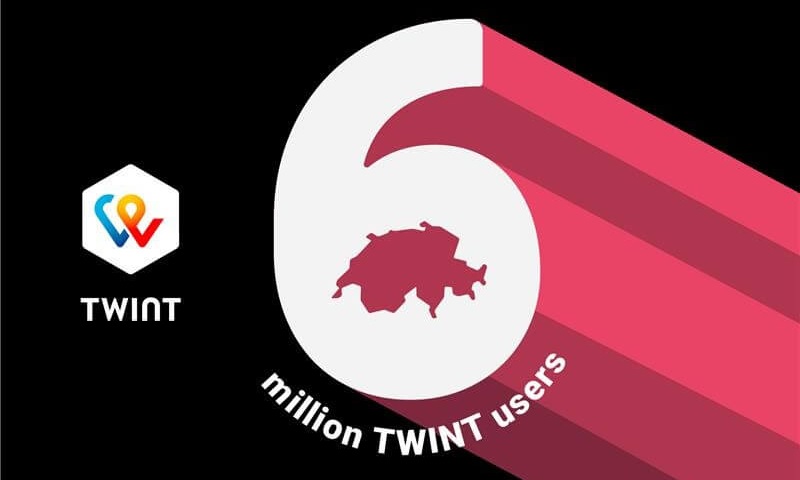

Over 6 million people in Switzerland now use TWINT to make simple, quick and secure payments with their smartphones and send money to friends, family and acquaintances, according to a press release. As a Swiss solution for digital payments, TWINT also offers users and merchants a degree of independence from global tech companies.

Whether paying at a cash register, in an online shop, at market stalls or when visiting a restaurant with friends, TWINT has become an integral part of everyday life in Switzerland. While the app is most frequently used at cash registers, it is also very popular for purchasing public transport tickets, paying for parking and in small local shops, specialist shops and market stalls. Not only is the number of users constantly growing, but existing TWINT customers are also using the app more frequently and in an increasing number of everyday situations.

TWINT in figures

. Over 6 million active users;

. 99% awareness among people aged over 16 years;

. 75% commercial transactions, 25% between private individuals;

. TWINT is offered as a payment method by around 81% of physical stores and 84% of online shops in Switzerland;

. Approximately 65% of commercial transactions in presence business, Around 35% in distance business.

“We are delighted that more than 6 million users now benefit every day from the flexibility and digital sovereignty that TWINT offers them. Our goal remains to make life easier for people in Switzerland through digital payment innovations,” says TWINT CEO Markus Kilb.

How TWINT is simplifying everyday life with its digital solution:

. Simple, quick and secure payments with your smartphone – at cash registers, in online shops and at many other acceptance points.

. Loyalty cards such as Migros Cumulus or Coop Supercard can be stored directly in the app and points are easily collected when making payments.

. Digital payment of parking fees in Switzerland thanks to TWINT’s collaboration with Digitalparking.

. Refuelling and charging cars is now also quicker and easier thanks to TWINT QR codes at fuel pumps or at charging stations.

. Super Deals, digital vouchers, subscription comparison, insurance, Spin & Win and other offers and features are available in the app.

. Donations can be made to numerous charitable organisations using the donation feature directly in the TWINT app.

. Cash can be withdrawn at over 2,300 locations using TWINT (including k kiosk and Volg branches).

. TWINT is developing a new generation of the classic direct debit (LSV+), which will be discontinued in 2028.

The fact that TWINT is simplifying all areas of life through its digital solution is making a significant contribution to its perception by the Swiss population as more than just a means of payment. “To twint” has established itself as a verb in everyday speech, and TWINT has become a true love brand for many people in Switzerland. This is confirmed by numerous independent studies on brand popularity – most recently, the BrandAsset Valuator, one of the world’s most comprehensive brand studies. In the latest issue, published in March 2025, TWINT was named Switzerland’s strongest brand.

Annual TWINT transactions

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: