A total of 205 billion card payments were made worldwide in 2013, a rise of 13% on 2012, according “Global Payment Cards Data and Forecasts 2013-2019”, a new report from RBR. This growth was slightly higher than the 11% increase in card numbers to 10.8 billion, which reflects an expanding global physical and virtual merchant acceptance network, as well as a gradual migration from cash (and in some countries, cheques) to cards for everyday payments. The research also reveals that the continued rapid growth in card numbers in China has caused the share of the Chinese scheme UnionPay to increase further.

North America and western Europe account for 63% of card payments versus only 25% of cards

There is a striking difference between regions in terms of card usage. Cards in North America and western Europe are used twice as frequently for purchases as in any other region, and these two regions account for 63% of the global card payment volume, compared to just 25% of cards.

Distribution of Card Payments Worldwide, by Region, 2013 – Source: Global Payment Cards Data and Forecasts 2013-2019 (RBR)

In contrast, despite accounting for more than half of cards, Asia-Pacific represents only 21% of card payments and has the lowest average volume of any region at eight payments per card per year. This masks a huge variation in average in the region, from just one payment per card per year in Vietnam to 126 in New Zealand.

Low card usage in some regions points to enormous future potential

2013 saw the volume of card payments worldwide surpass 200 billion for the first time, an achievement all the more remarkable given the low usage of cards for purchases in some of the most populous countries, including China and India. Although the introduction of regulations and alternative means of payment may impact the use of cards in certain markets, rising acceptance in both the physical and virtual environments, coupled with a greater use of cards for low-value payments will drive up volumes further.

If average usage per card worldwide were to reach the levels currently seen in North America and western Europe, half a trillion payments in a year would be attained, even with no increase in card numbers. This may well be seen sooner rather than later.

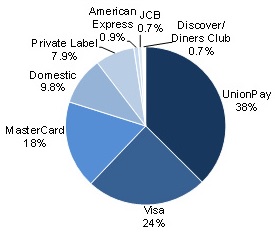

China Union Pay has a market share of 38% in terms of cards number – Visa and MasterCard together covers 42%

China’s card base once again saw staggering growth in 2013, this time of 19%. As a result, UnionPay’s share of the global cards base rose by a further three percentage points to 38%. This reflects 4.1 billion cards, more than 99% of which are in China. Visa and MasterCard brands represent 24% and 18% of cards worldwide respectively.

Share of Payment Cards Worldwide by Scheme 2013 – Source: Global Payment Cards Data and Forecasts 2013-2019 (RBR)

UnionPay’s share will move above 40% in the coming years, barring a marked slowdown in the expansion of its home market or an overhaul of current regulations which require the UnionPay brand to appear on all Chinese cards. UnionPay’s entry into other markets, including Russia in 2013, will cement its position as the leading scheme in terms of card numbers.

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: