Moody’s study – Electronic Payments Stimulate Economic Growth

From 2008 to 2012, global real GDP was only 1.8% per annum. Without increased card usage, that growth would have been just 1.6%, according to a Moody’s Report. Moody’s Analytics found that a 1% increase in card usage across the 56 countries in the study produces an annual increase of 0.056% in consumption. Increases in card consumption contributed to an average additional growth in GDP of 0.17 percentage point per year. This card penetration is equivalent to creating 1.9 million jobs globally during the period of study.

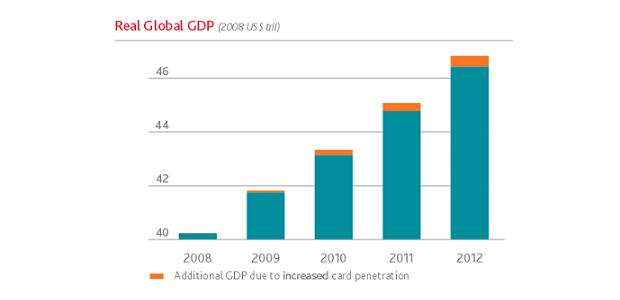

The growth in the use of electronic payment products, such as credit and debit cards, added $983 billion to the Gross Domestic Product (GDP) of the 56 countries examined between 2008 and 2012, according to a study conducted for Visa by Moody’s Analytics, a leading independent provider of economic forecasting.

The study of 56 countries that represent 93% of global GDP concluded that: „Card usage makes the economy more efficient, yielding a meaningful boost to economic growth, year after year, through a multitude of factors including transaction efficiencies, consumer access to credit and consumer confidence in the payment system overall.”

Increases in card consumption contributed to an average additional growth in GDP of 0.17 percentage point per year over the five-year period, the study found. Over the same time period, GDP in those countries grew by an average of 1.8 percentage points.

„Despite a challenging global economic landscape, the increased penetration of payment cards helped boost consumer consumption and, on average, added to GDP,” noted Mark Zandi, Chief Economist of Moody’s Analytics. „This was particularly true for emerging markets. The increase in consumption parallels the growing popularity and accessibility of electronic payments among global consumers, and the findings point to the need for governments to adopt policies that encourage the shift to efficient and secure electronic forms of payments.”

„Despite a challenging global economic landscape, the increased penetration of payment cards helped boost consumer consumption and, on average, added to GDP,” noted Mark Zandi, Chief Economist of Moody’s Analytics. „This was particularly true for emerging markets. The increase in consumption parallels the growing popularity and accessibility of electronic payments among global consumers, and the findings point to the need for governments to adopt policies that encourage the shift to efficient and secure electronic forms of payments.”

„The findings from the study confirm what Visa has long maintained – the migration to electronic payments increases economic efficiencies and supports global economic growth,” said Charlie W. Scharf, CEO of Visa Inc. „Notably, electronic payments helped to mitigate what would otherwise have been an even slower recovery from the global recession as card penetration and usage provided an important and measureable boost to economies.”

According to the report, from 2008 to 2012 global real GDP was only 1.8% per annum. Without increased card usage, that growth would have been just 1.6%.

Other highlights in the study include:

- U.S. Economic Growth: Card usage in the U.S. increased GDP by 0.3 percent, adding $127 billion to the U.S. economy.

- Global Economic Growth: In some countries, card usage increased consumption significantly – at the top of that list: China by 4.89%; Chile by 1.28%; and Brazil by 1.15%.

- Value of Electronic Payments: The study concluded that increased credit and debit card usage contributes to economic activity by reducing transaction costs and improving efficiency in the flow of goods and services. The advent of credit and debit cards has greatly aided consumers’ ability to optimize consumption decisions by giving them secure and immediate access to all of their funds on deposit or a line of credit. Merchants also benefit because there is less cash and check handling in the system, eliminating the burdens and risks associated with holding cash. In addition, the dramatic growth of ecommerce would not be possible without global electronic payment systems, which allow the safe and easy transfer of funds from consumers to merchants.

- Supporting Government: Electronic payments lead to a reduction in the gray economy by increasing transparency and generating additional tax revenue.

- Impact of Future Card Growth: Moody’s Analytics found that a 1% increase in card usage across the 56 countries in the study produces an annual increase of 0.056% in consumption. Given recent card penetration growth rates and the additive effects calculated on future GDP, Moody’s Analytics estimates a meaningful 0.25% addition to consumption and 0.16% additional GDP.

This survey is the second iteration, following a study conducted by Moody’s Analytics from 2003 to 2008.

The study and an accompanying white paper can be download here:

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: