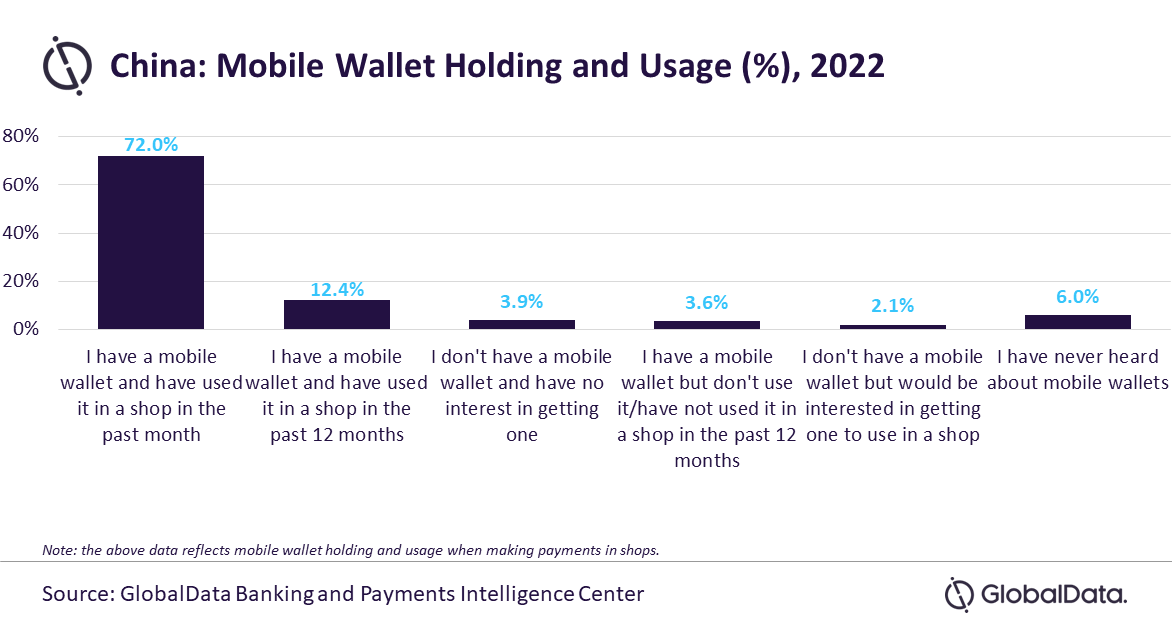

The use of mobile wallets as the primary payment method in China has become widespread, surpassing traditional forms of payment like cash and cards. Consequently, China is among the top countries in terms of mobile wallet adoption and usage globally with 84% survey respondents indicating that they have a mobile wallet and used it, according to a survey by GlobalData, a leading data and analytics company.

GlobalData’s 2022 Financial Services Consumer Survey* reveals that the COVID-19 pandemic has accelerated the growth of the mobile payments in China further. In fact, the adoption level is much higher compared to developed markets like the US and the UK, where consumers still predominantly use cards.

Shivani Gupta – Senior Analyst Banking and Payments at GlobalData, comments: “China is home to one of the most mature mobile wallet markets in the world. Mobile wallets are a mainstream payment instrument in China and widely used for day-to-day transactions at supermarkets, grocery stores, street vendors, and public transport, as well as for online transactions.”

High cost of POS terminals and generally insufficient payment infrastructure have pushed both merchants and consumers to leapfrog from cash to mobile-based payments, skipping payment cards.

Gupta adds: “Chinese consumers are far ahead of their Western counterparts in terms of mobile wallet usage. The availability of high-speed internet facility, coupled with a rise in smartphone penetration provided the foundation for mobile payments to thrive. This was also supported by its widespread QR code infrastructure, and rising consumer and merchant preference for electronic payments in the country.”

The extensive acceptance of mobile-based payments is primarily driven by the broad support from merchants, ranging from street vendors to large chains, who prefer mobile payments. This preference stems from the cost-effectiveness of mobile wallets, as they entail lower expenses for infrastructure (such as QR code stickers) and transaction fees compared to card payment systems.

GlobalData’s survey also revealed that in China mobile wallets are primarily used for purchase of food and drink, clothing & footwear and electrical goods, highlighting the high level of comfort among the Chinese consumers in buying everyday essentials using mobile wallets.

The mobile wallet market in China has been driven by domestic wallets such as Alipay and WeChat Pay. However, international solutions such as Apple Pay, and Samsung Pay are now making their presence felt in the country. Mobile wallet growth in China will also be supported by government’s push for e-CNY – the country’s central bank digital currency.

Gupta concludes: “China has a well-developed digital payments market. As consumers continue to embrace cashless payments, mobile wallet payments will continue to maintain their growth over the next five years.”

___________

*GlobalData’s 2022 Financial Services Consumer Survey was carried out in Q2 2022. Approximately 50,000 respondents aged 18+ were surveyed across 40 countries.

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: