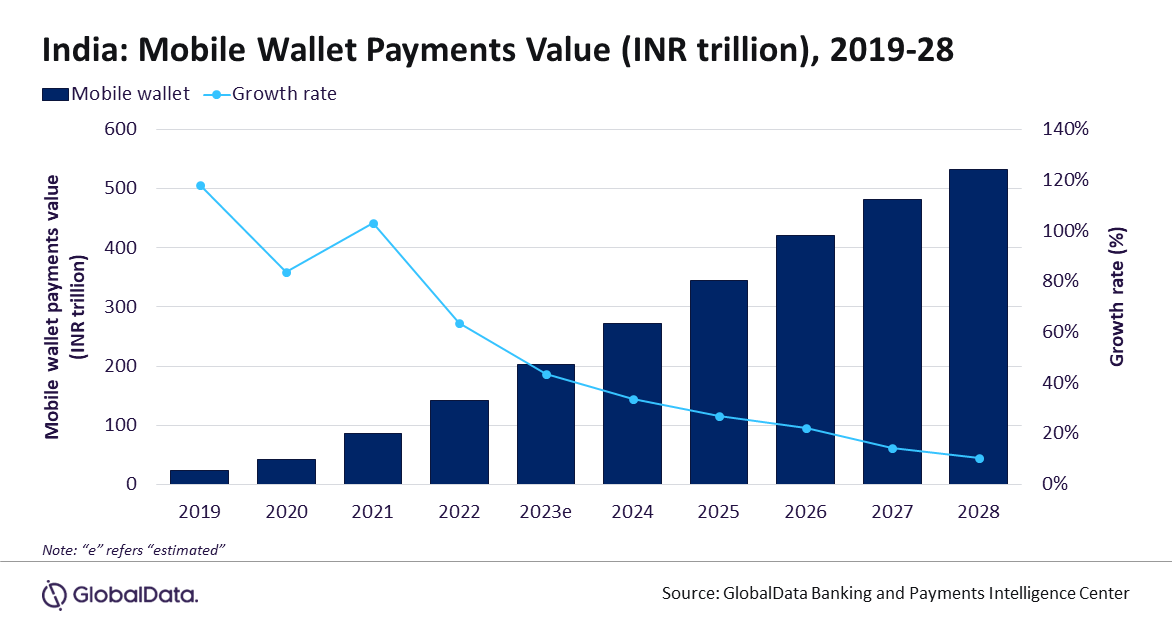

Mobile wallet adoption is surging in India, swiftly becoming a primary payment option, surpassing traditional methods like cash and cards. Payment through mobile wallet is anticipated to grow at a compound annual growth rate (CAGR) of 18.3% between 2024 and 2028 and reach INR531.8 trillion ($6.4 trillion) in 2028, forecasts GlobalData, a leading data and analytics company.

GlobalData reveals that the value of mobile wallet payments in India grew at a robust CAGR of 72.1% between 2019 and 2023 to reach INR202.8 trillion ($2.5 trillion) in 2023. This is mainly due to the government’s concerted efforts to promote digital payment methods, most prominent being the mobile wallet-based instant payment solution—unified payments interface (UPI).

Shivani Gupta – Senior Banking and Payments Analyst at GlobalData, comments: “India is one of the most developed mobile wallet markets in the world. Mobile wallets are now widely used for day-to-day transactions at supermarkets, grocery stores, and street vendors, as well as for online transactions. The rise in mobile wallet adoption is largely driven by UPI, which facilitates payments in real-time simply by scanning QR codes.”

Launched in April 2016, UPI had a user base of 300 million as of October 2023, with the figure growing continuously, courtesy of increasing merchant acceptance points. According to National Payments Corporation of India (NPCI) statistics, 12.1 billion transactions worth INR18.3 trillion ($221.5 billion) were made in February 2024 – up from 7.5 billion transactions worth INR12.4 trillion ($150.1 billion) made in February 2023.

The surge in UPI payments is attributed to the convenience of electronic payments, high smartphone penetration, rising banked population, and the proliferation of UPI-enabled mobile payment solutions in the country. Several mobile wallets, such as Paytm, PhonePe, Amazon Pay, and Google Pay, have incorporated UPI functionality, allowing users to conduct QR code transactions directly from their linked bank accounts.

Furthermore, to increase its presence beyond its national boundary and position itself as a global payment brand, UPI was launched in Sri Lanka, Mauritius, and the UAE in February 2024. Similar agreements are in place with other countries like Singapore, and France with more countries expected to follow the suit.

Gupta concludes: “The reach of mobile wallet payments is increasing at a rapid pace, supported by the government’s push towards digital payments, widespread use of UPI-based QR code payments, coupled with high merchant acceptance. The solution offers fast, secure, convenient, and low-cost fund transfers and payments and has the potential to further disrupt the overall payment space in India.”

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: