Mobile payments subject on social media: consumer sentiment evolves from “why mobile?” to “what’s next?” in 24 months

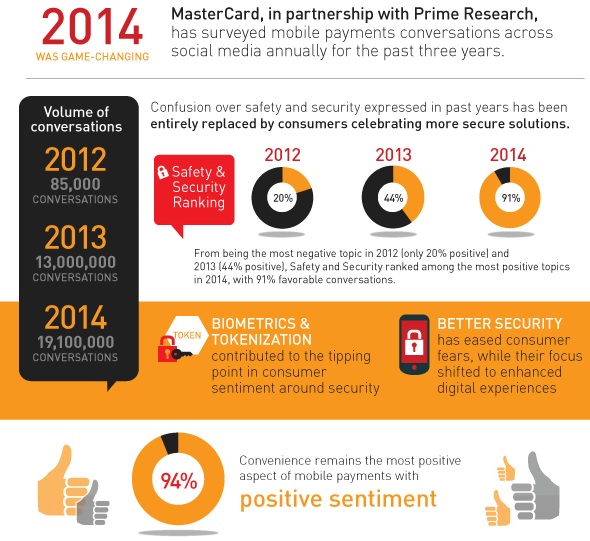

MasterCard today announced the findings from its third annual Mobile Payments Study, developed in partnership with PRIME Research. The study tracked 19.1 million global social media posts across Twitter, Facebook, Instagram, Forums, Weibo (CN), Google+ and YouTube throughout 2014, up from 85,000 posts in 2012. The study results not only show a remarkable growth in volume of conversations, but a change in both the tone and focus of the social discussion.

According to the latest MasterCard research, consumers have shifted their focus from questioning the security of mobile payments to now discussing the possibilities of enhanced digital experiences on devices. Overall sentiment around mobile payments continues to improve. In 2014, 94% of global conversations were favorable, compared to 77% last year and 70% in 2012. The most positive conversations centered around innovation, rewards and loyalty and convenience (91% average positive tone).

Safety and security ranked among the most positive topics discussed

Overall, 91% of the safety and security conversations in 2014 were favorable, up from 20% in 2012 when it was the most negative topic appearing in the research. Confusion and concern over safety and security, cited in both the 2012and 2013 studies, have now been replaced by consumers celebrating more secure solutions. Tokenization and biometrics, both key conversations in 2014, contributed significantly to this tipping point.

Focus shifts to the benefits of mobile payments through innovation

Although security conversations were among the most positive in the study, the volume of these conversations was low.

. Conversations on digital innovation and the enriched experiences delivered by mobile and connected devices drove the majority (71%) of social discussions among stakeholders in 2014.

.Convenience was the most positive aspect of mobile payments (94% positive sentiment). Consumers were most excited to share specific purchases made with mobile devices, particularly how they could utilize them for everyday purchases.

. Along with convenience, additional reward incentives – like coupon redemption and loyalty programs and points – were discussed frequently within innovation (24% of stakeholder conversations). The additional potential benefits to be integrated into mobile payment offerings reinforce consumers’ loyalty to using mobile devices (58% of conversations were driven by consumers), and point to opportunities for MasterPass and other digital payment services.

About the Study

PRIME Research conducted the third annual Mobile Payments Study, designed to identify evolving consumer attitudes toward digital payments and mobile solutions. Mining more than 19.1 million social media posts over the past year across an increased number of social media channels -Twitter, Facebook, Instagram, Forums, Weibo (CN), Google+ and YouTube -the study covers unique consumer opinion from 56 markets in North and South America, Europe, Africa, Asia and the Pacific Rim.

Reflecting a spike on interest about digital payments and mobile solutions, this year the study uncovered over 8M conversations about these topics, including consumer commentary and news-driven conversations. Using PRIME’s proprietary human-based social media analytics methods and technology, the research firm identified trends on innovation, safety & security, and other aspects related to digital payments.

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: