UK telco joint venture Weve, which covers 80% of UK mobile phone users, has teamed up with MasterCard, promising to clean up the „mess” of mobile commerce and bring NFC-based m-payments to the masses.

“…after significant investment by banks and retailers, contactless payments using cards have finally reach the tapping point, with over 36m of us armed with a card and around 300,000 tills around the country enabled for secure and convent payments.”, says David Sear (photo), Weve CEO, in a blog article.

With a 220% growth in the number of contactless transactions in Europe, there is massive scope for innovation in mobile payments – from location-based initiatives to point-of-sale engagement. The partnership between Weve and MasterCard will create “the most ubiquitous platform for contactless mobile payments in the UK”, according to the press release.

Why Uk? Because contactless payments have already been embraced by UK consumers and retailers. “In fact, with around 300,000 retail outlets now accepting contactless payments, the UK is the most advanced and ideal market to further adoption of contactless payments through mobile phones.”, says Sear.

Marion King (photo), President UK & Ireland at MasterCard said “MasterCard is delighted to be working with Weve who is an innovator in the mobile space. We look forward to implementing this contactless mobile payments technology in the UK and providing the technology and service to banks to ensure their customers can benefit from safe and simple mobile payments. The partnership with Weve will play an important part in providing ways to pay as we continue to work towards a world beyond cash.”

Marion King (photo), President UK & Ireland at MasterCard said “MasterCard is delighted to be working with Weve who is an innovator in the mobile space. We look forward to implementing this contactless mobile payments technology in the UK and providing the technology and service to banks to ensure their customers can benefit from safe and simple mobile payments. The partnership with Weve will play an important part in providing ways to pay as we continue to work towards a world beyond cash.”

Tapping into the relationships that MasterCard has with banks, Weve plans to let customers link their MasterCard accounts to their handsets through their bank apps.

Once this is done, users will be able to wave their phone against the UK’s 300,000 contactless readers to make payments of under £20. Because the system is SIM-based, it will work even if the handset is turned off.

“…we’re building a payments system that takes existing industry contactless standards and builds mobile around them, rather than implementing new technologies and protocols that require everyone in the chain to learn something new. That way, consumers can carry on doing something they already understand – just tapping their device onto a point-of-sale terminal to pay for something, in the same way that they’re already doing with 36 million contactless cards today at 263,000 spots around the UK. Nothing new to learn, no fancy hardware to acquire; just the handsets consumers are already using that support the global NFC standard for electronic payments, and the terminals that retailers have already installed.”, added Sear.

Sear believes that none of this works, though, unless the banks have an easy way to get on board too. “That’s why today, we’re announcing a new partnership with MasterCard that will provide exactly that – a way for the UK’s banks to take part in the UK’s largest mobile payments initiative, without having to build something from scratch all over again.”

MasterCard’s partnership with Weve’s platform provides financial institutions with minimal complexity while facilitating ease of access– two of the biggest barriers to mobile payments to date. “By removing those barriers, MasterCard and Weve are enabling banks to focus on engaging with their mobile customers at the point of sale” said Sear.

Weve says that it hopes to go live sometime in the first half of next year and is talking to banks but it has yet to go public with any names, according to finextra.com.

“…the mobile landscape has long been littered with the corpses of failed payments projects. Part of the problem is that nearly all of them have tried to reinvent or subvert payments standards or change consumer behaviour in an attempt to wrestle some kind of competitive advantage. Weve believes that unless the mobile payments industry takes a reality check and partners fully with the banks and retailers, we’ll be waiting for another ten years for adoption of mobile payments at scale.”

While security concerns persist among many customers when it comes to contactless payments, the telcos are hoping that these will subside as the technology becomes more familiar.

Both EE and VodaFone are introducing their own pre-paid contactless m-payments services. Weve product development director Sean O’Connell says that this could act as stepping stone – acclimatising users to the technology with little financial risk so that they are eventually more willing to link their main debit or credit accounts to their phones.

About Weve (www.Weve.com)

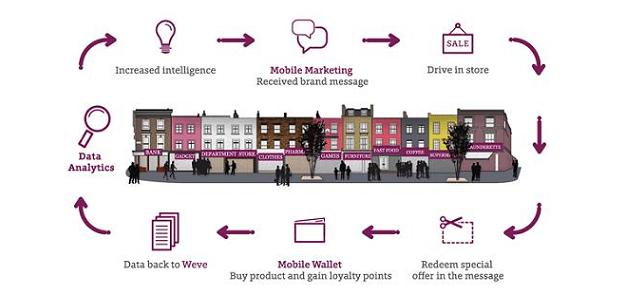

Weve is a new focal point for a whole new set of ideas and services in mobile marketing and display, payments and loyalty. The company has taken these services and the combined base of its shareholders’ customers to develop a unified marketing service combined with a payments and true loyalty service which will be available to businesses in the UK with a single point of contact and a single point of technical integration. This is all underpinned with some of the most intelligent data analytics available in the UK. The company is a JV between the three largest MNOs of Vodafone, O2 and EE.

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: