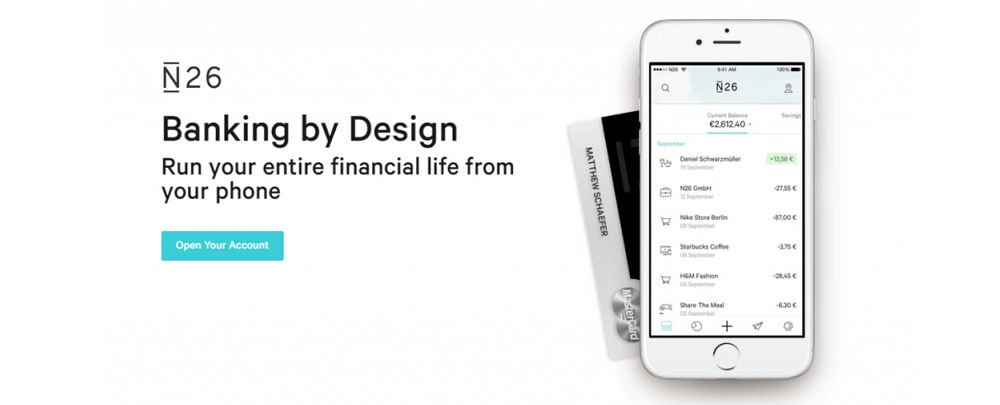

Mobile-only bank N26 integrates insurance into its app

Looks like N26 is the latest digital challenger bank to build a one-stop-shop app for all its customers’ needs. The German challenger bank has officially launched its first insurance product, aptly named N26 Insurance.

As the Challenger-Bank N26 has just announced, it has entered into a cooperation with Simplesurance from Berlin. Customers in Germany can now get smartphone insurance directly in the N26 app (from 6 euros per month), further offers are to follow.

According to its own information, N26 has seven million customers in 25 countries – some of them now have access to the digital insurance services of the new partner. As a result, private liability, household, life, travel, pet, bicycle and electronics insurance policies that can be taken out directly in the app are also planned. In general, this fits in with N26’s strategy of acting as a platform for additional services. For example, there is also a cooperation with Wise (Ex-TransferWise) for cheap international transfers.

Big market

There is potential for the new business area. According to N26, every European spends on average over 2,000 euros per year on insurance. Overall, the insurance market comes to an annual volume of 1.3 trillion euros, so a very promising field of activity for N26 and simplesurance.

As is currently the case with many other scale-ups in Europe, the signs at N26 are now pointing to an IPO. Co-founder and CEO Maximilian Tayenthal told the FAZ that they were preparing to go public in 2022.

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: