The Mobile Bank, N26 announced an extension to its partnership with global technology leader in international payments TransferWise, to offer a wider range of options for foreign currency transfers. Now available in over 30 currencies, the digital bank has also enhanced the in-app design for a more transparent customer experience.

International money transfers are becoming increasingly popular in an evermore connected world, and N26’s own European customer research revealed that their most popular usage is to pay bills in another country (43%) such as student loans and mortgages. This was followed by helping family members living abroad (35%), foreign purchases (23.7%), foreign currency investments or savings (18.3%) and paying friends and family (17.5%).

When asked to rank the most important factors when choosing a foreign transaction provider, cost came out top. This was followed by speed and trust that data and money would be safe, and then by providing clear and transparent fees.

Available for new and existing N26 account holders across Europe*, the expanded TransferWise functionality will enable customers to make international money transfers through a quick, intuitive, all-in-the-app experience. One that also comes with no hidden fees as customers pay at the real exchange rate without any markup.

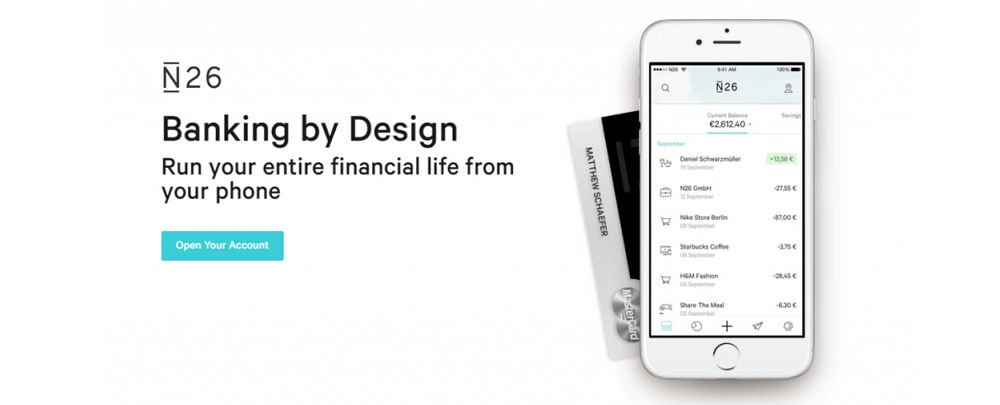

Enhancements have also been made to the app design to offer a more intuitive user experience. Customers can easily get a real-time quote with N26’s international money transfer function in the Explore tab of their app. N26 provides full transparency on both the fees customers pay and the effective rate offered, as well as the estimated time of arrival of the transfer.

The extended TransferWise functionality complements smart N26 banking features such as MoneyBeam to split bills or payments with friends and family, Spaces to easily set up sub-accounts to put money aside for an emergency or towards a savings goal, or CASH26 to withdraw and deposit cash for free from more than 14,500 retail outlets across Europe that help N26 customers bank seamlessly in an intuitive, quick and enjoyable way.

* Currently not available for N26 Business, N26 Business You and N26 Business Metal customers

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: