Mobile-only bank N26 expects strong growth in its revenues to over 300 million euros in 2023, an over 30% increase. Monthly profitability is expected in the second half of 2024.

N26 Group („N26” or „Group”) shared an overview of its business and product strategy through to the year 2024. The company also announced key financial figures for the fiscal year ended December 31, 2022, as well as an outlook for the 2023 fiscal year and a profit expectation for 2024.

Following the successful introduction of N26 Crypto in 2022 and the recent launch of new Instant Savings Accounts, N26’s product offering will be expanded further to include an additional investment product next year. In partnership with German fintech Upvest, N26 customers will have the opportunity to trade stocks and ETFs directly in the N26 app within the first half of 2024.

Increased customer activity drives higher revenues and improved profit margins

Against the backdrop of the growth restriction in place since the end of 2021, the Mobile Bank has increased the number of revenue-relevant customers by 300,000 to 4 million in the 2022 financial year (+8% YoY). For 2023, N26 expects further revenue-relevant customer growth in a mid-single-digit percentage range. The company is forecasting disproportionate growth in its revenues to over 300 million euros in 2023 (> +30% YoY), due to significant increases in account usage and customer activity. In the 2022 financial year, N26 had already increased its revenues to 236.3 million euros (+24% YoY).

The volume of transactions made by N26 customers also grew significantly in 2022 compared to the previous year to more than 97 billion euros (+22% YoY). For 2023, N26 anticipates further growth in transaction volume of around 13% to more than 110 billion euros.

N26 increased its gross profit in the 2022 financial year to 153.8 million euros (FY-21: 111.6 million euros). For 2023, the company expects gross profit of more than 220 million euros. The company expects further improvements in its gross profit margin to over 70% in fiscal 2023 (FY-22: 65%).

Sustained deposit growth drives interest income

As it continues to build trust with consumers as a bank with a strong competitive offering against incumbents, N26 continues to see an increase in customer deposits even against the backdrop of macro economic challenges. By the end of 2023, the Mobile Bank expects to manage around 8 billion euros in customer deposits (+8% YoY). At the end of 2022, N26 managed 7.2 billion euros in customer deposits (+20% YoY).

By expanding its treasury activities on the basis of increasing customer deposits, N26 benefits from the rising interest environment as a fully licensed bank. As a result, N26 expects interest revenues to account for around 40% of the company’s total revenues in 2023. In fiscal year 2022, interest revenues contributed around 30% to the company’s revenues.

Investments in infrastructure and teams enable sustainable growth

In the last two years, N26 has built a strong, experienced leadership team of industry experts with years of industry expertise. Additionally, the Mobile Bank strengthened its corporate governance by transitioning to a German stock corporation, appointing a supervisory board, and establishing corresponding supervisory bodies and reporting activities.

Against the backdrop of ongoing growth restrictions, N26 reduced its marketing spend in 2022 to the lowest level since 2017. In addition, the company significantly increased its investments in compliance as well as the human and technical infrastructure to more effectively combat the growing threat of financial crime. To this end, N26 invested more than 80 million euros in FY-22 in state-of-the-art technology and its teams, as well as in external expertise.

The strategic investments driving this progress form the basis for N26’s sustainable growth. As a direct result, the Mobile Bank’s operating income decreased to -170,4 million euros in 2022. In 2023, N26 expects a significant improvement in its operating income to c. -80 million euros (c. +50% YoY) after a normalization of costs.

As a result of its investments into its infrastructure, N26’s net loss increased by 24% to 213.4 million euros in the 2022 financial year (FY-21: 172.4 million euros). With marked improvements in customer profitability, N26 expects its net loss to more than halve to 100 million euros in 2023.

On the basis of accelerated customer growth and improved customer profitability, the company expects to become profitable on a monthly basis in the second half of 2024.

______________

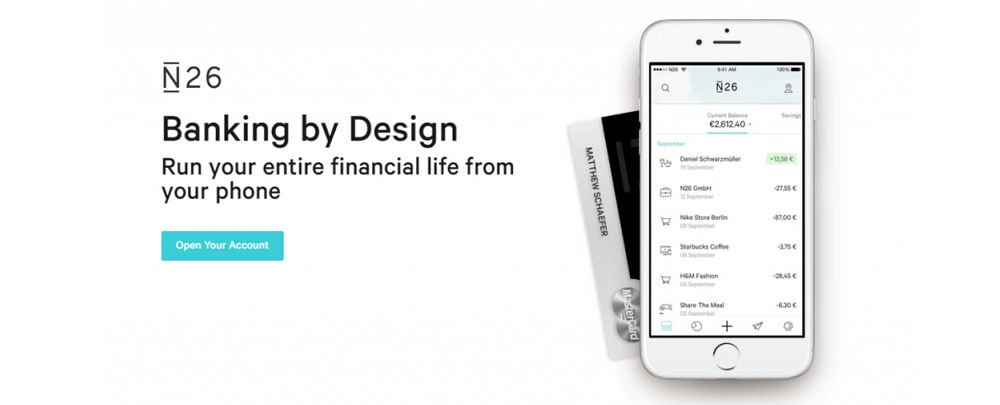

N26 AG is Europe’s leading digital bank with a full German banking licence. Built on the latest technology, N26’s mobile banking experience makes managing money easier, more secure and customer friendly. To date, it has welcomed more than 8 million customers in 24 markets, and processes over 100bn EUR in transactions a year. N26 is headquartered in Berlin with offices in multiple cities across Europe, including Vienna and Barcelona, and a 1,500-strong team of more than 80 nationalities. Founded by Valentin Stalf and Maximilian Tayenthal in 2013, N26 has raised close to US$ 1.8 billion from some of the world’s most renowned investors

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: