Merchants winning the battle for mobile wallet supremacy – wallets focused on loyalty and rewards first, payments second

Issuers can replicate merchant success by targeting key segments and implementing consumers’ desired features

Since the launch of Apple Pay in 2014, payment providers, issuers, and merchants have been jockeying for top-of-wallet position. However, the Big Three mobile wallets — Apple Pay, Google Pay, and Samsung Pay — have failed to gain the widespread adoption that so many have been predicting for so long. In fact, merchant wallets have been the most widely adopted for consumers for payment at the point of sale. Javelin Strategy & Research’s new report, Mobile Wallet Wars: A Battle for Consumer Loyalty, calls into question the wallet as a payment method. It also explores the features that will compel consumers to readily use a mobile wallet in their daily lives and which consumers should be targeted next for adoption.

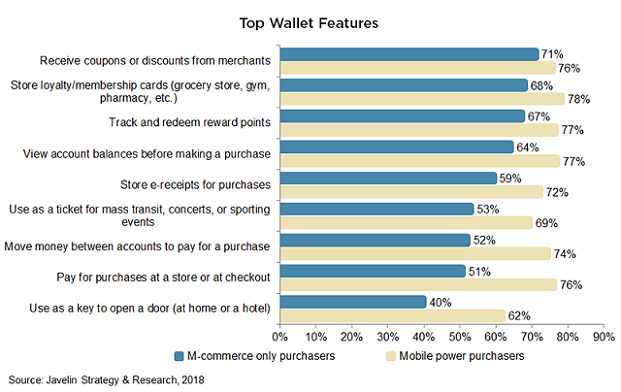

While overall mobile wallet adoption rates have been relatively stagnant, merchants have been leaders in delivering the type of wallets consumers want — namely, wallets focused on loyalty and rewards first, payments second. These features are particularly appealing to m-commerce-only purchasers — smartphone users who have made a mobile browser or app purchase but have not made an in-store mobile purchase. In fact, they respond much more positively to potential wallet features than the average consumer — typically at least 10 percentage points higher. Targeting this group with the right features — highlighted by real-life examples in the report — will be critical for issuers and third-party wallets to deliver an experience on par with that of the merchant.

“In the rush to market, the main wallet value proposition, paying at the POS, wasn’t particularly compelling. In reality, loyalty and rewards will drive adoption, something merchants are doing particularly well,” said Krista Tedder, Director of Payments at Javelin Strategy & Research. “Nevertheless, third-party wallets can and should compete. A large group of consumers are primed to make the jump to in-store payments, and a feature-rich mobile wallet stands to gain a larger share of their spend.”

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: