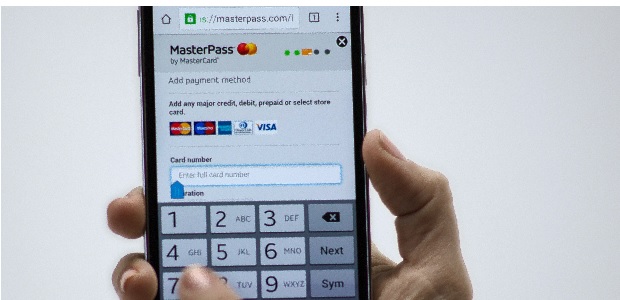

MasterCard is promising to boost security for online and in-app shoppers by tokenising its MasterPass digital wallet. The move means that, at the request of issuing banks, MasterCard will replace the personal account numbers for consumer credit, debit, commercial and prepaid cards stored in MasterPass with a secure ‘token’ – a new 16-digit number that represents the existing PAN on the front of a payment card.

Tokenisation will come to US MasterPass wallets next year before making its way to all markets where the MasterCard Digital Enablement Service is enabled, according to the press release.

Ed McLaughlin, chief emerging payments officer, MasterCard, says: „In tokenising MasterPass, we’re creating for consumers a secure ‘digital stream’ directly from their bank which can be connected through the online and mobile banking tools they already know. Together with our banks, we are creating the easiest and most secure way to pay today.”

MasterPass enables issuers to deliver digital payments across channels and devices around the world, seamlessly extending the trusted relationships consumers have with their banks. It securely stores shoppers’ preferred payment and shipping information, which makes checkout just a few clicks away, with no long strings of numbers or details to enter. The “Buy with MasterPass” button is currently found within the website and apps of more than 250,000 merchants globally across travel, entertainment, quick service restaurants, retail and more.

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: