MasterCard study of social conversations reveals consumers are embracing the next generation of payments

Across the globe, cardholders are asking banks and retailers to provide real-life, ready-to-use mobile payments options, proven by social media comments more than doubling in just one year, according to the findings from the fourth annual MasterCard Mobile Payments Study, developed in partnership with PRIME Research. The study tracked 2 million global social media posts about mobile payments across Twitter, Facebook, Instagram, Forums, Google+ and YouTube, up from 85,000 posts in 2012.

Digital wallets including Apple Pay, Samsung Pay, Android Pay and MasterPass dominated – 97 percent – of total mobile payments conversations in 2015, centered on product launches, service improvements and how users are evaluating them. Outside of digital wallet discussions, contactless cards (47 percent) drove conversations, followed by biometrics (33 percent), personal payments (14 percent) and wearables (6 percent).

Conversations about contactless cards focused around opening up global acceptance at public transit systems including those in London and St. Petersburg as well as availability at major sporting events around the world.

Mentions of wearables in the last quarter of 2015 were more than 30 times higher than in the first quarter of the year.

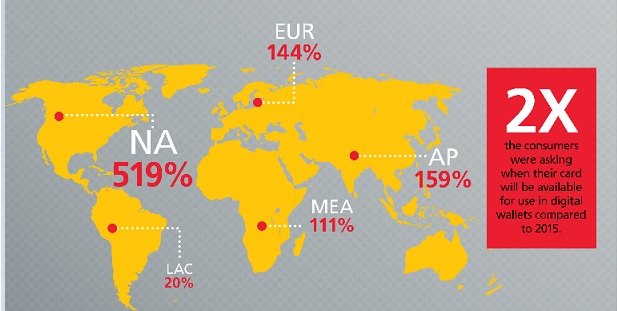

Digital wallets are gaining traction in social conversations worldwide. Within the last year there was an increase in every region including: Asia Pacific (+159%), Europe (+144%), Latin America and the Caribbean (+20%), Middle East and Africa (+111%) and North America (+519%) – photo.

„The safety and security of mobile payments continues to drive conversations, as more consumers continue to take a positive or neutral view of the services being offered to them (94 percent). This reflects a three percentage point increase over last year and 24 points above the initial 2012 study.”, according to the press release.

In 2015, the end of passwords and biometrics were among the most engaging topics in 2015, reflected in social conversations in 163 countries around the world. Fingerprint and electrocardiogram (ECG) payments-related technology became an engaging topic for users throughout the year, while facial recognition (“Selfie Pay”) remained a top driver (55%) of biometrics-focused conversation.

About the Study

MasterCard, in partnership with PRIME Research, conducted its fourth annual Mobile Payments Study, designed to identify expanding conversations on new ways to pay. Mining more than 2 million social media posts over the past year across Twitter, Facebook, Instagram, Forums, Google+ and YouTube, the study covers unique audience discussions from 61 markets across the globe. Reflecting growing interest in new ways to pay, this year’s study analyzed more than 1.6 million original posts, along with more than 433,000 reposts, which included both consumer commentary and news-driven conversations. Using PRIME’s proprietary human-based social media analytics methods and technology, the research firm identified key trends within new payments methods, including: biometrics, contactless cards, digital wallets, personal payments and wearable devices. The resulting report reflects insights into new mobile payments product and category trends across regions and countries.

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: