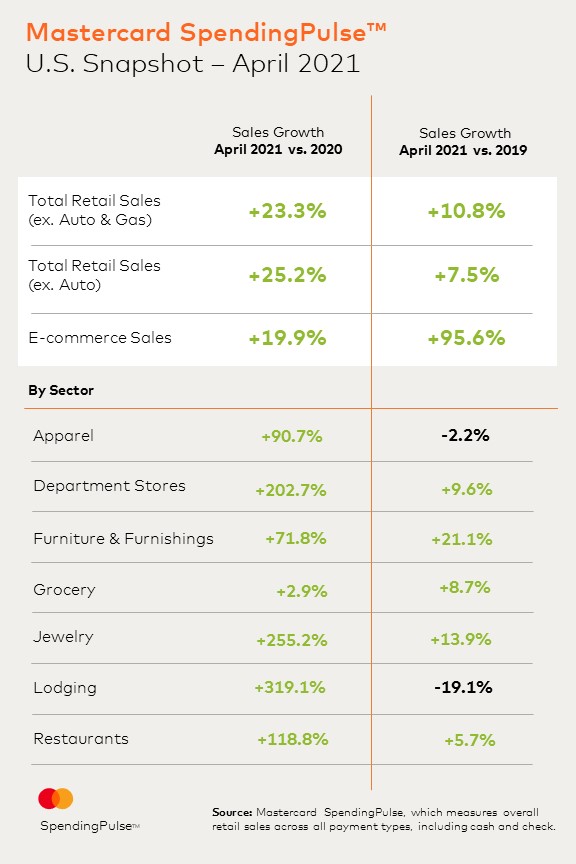

Total U.S. retail sales sprung into another month of double-digit growth in April, according to Mastercard SpendingPulseTM, which measures in-store and online retail sales across all forms of payment. U.S. retail sales excluding automotive and gasoline increased 23.3% year-over-year in April, and 10.8% compared to April 2019. Online sales in April grew 19.9% and 95.6%, respectively, compared to the same periods.

Retail sales continue to benefit from stimulus payments, coupled with warmer weather and broader reopening across the country. While the recovery has not been universal or consistent – due to geographical, economic, and household differences – there are a number of key overarching trends.

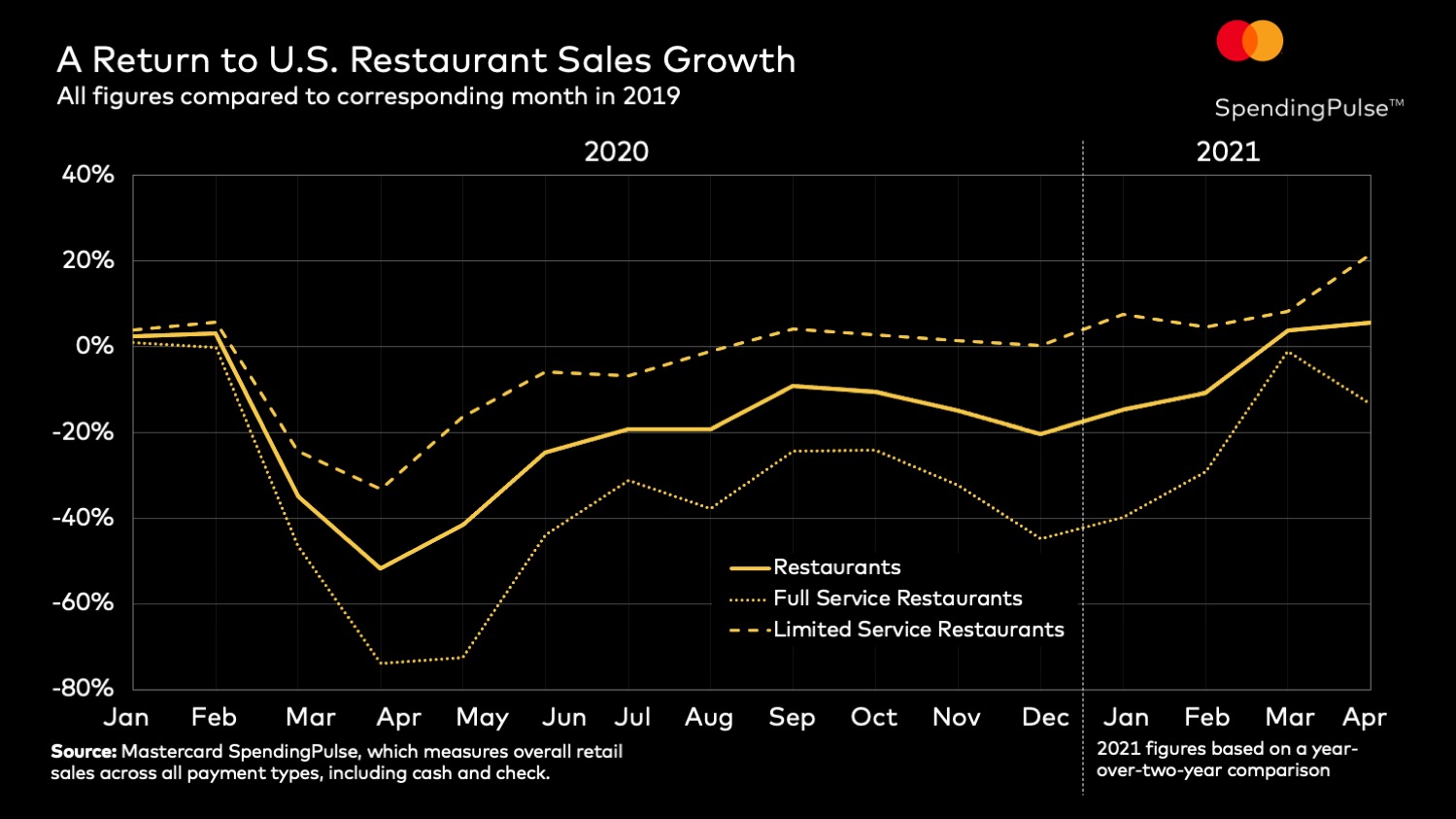

Restaurant Resurgence: April marks the second consecutive month of positive growth for the Restaurant category, underscoring that consumers have an appetite to eat out again. Spending at restaurants grew 118.8% vs. 2020, when widespread shut-downs crippled the industry, and were up 5.7% compared 2019.

Limited-service Restaurants, such as fast-food, were up 21.7% compared to 2019, outpacing their Full-service counterparts (-13.5% YO2Y).

Online Convenience: Despite the record shattering e-commerce growth in April 2020, online sales remained up year-over-year. E-commerce share continues to make up a bigger portion of total retail spend overall (21.6%), as well as in categories such as Apparel (61.7%), Department Stores (21.0%) and Jewelry (15.7%).

Department Stores See a Boost: Many of the depressed sectors in 2020, including Department Stores (+202.7%), Jewelry (+255%) and Lodging (+319.1%), are showing some of the largest year-over-year gains as retailers gear up for the return of gatherings and events. Department Stores grew 9.6% compared to 2019.

“April’s retail sales growth reinforces that the American consumer is healthy and eager to spend, especially on categories such as restaurants, which have faced restrictions over the past year,” said Steve Sadove, Mastercard senior advisor and former CEO of Saks, Inc. “There are a lot of factors at play including stimulus funds, pent-up demand, and the desire to reconnect with friends and family. The fact is that people are excited to gather again and they’re refreshing their look for the occasion.”

*Overall retail sales excluding gasoline and automotive compared to April 2020

_____________

Mastercard SpendingPulse™ reports on national retail sales across all payment types in select markets around the world. The findings are based on aggregate sales activity in the Mastercard payments network, coupled with survey-based estimates for certain other payment forms, such as cash and check. As such, SpendingPulse™ insights do not in any way contain, reflect or relate to actual Mastercard operational or financial performance, or specific payment-card-issuer data.

Mastercard SpendingPulse defines:

U.S. retail sales: As sales at retailers and food services merchants of all sizes. Sales activity within the services sector (for example, travel services such as airlines and lodging) are not included.

Restaurants: All full-service restaurants and limited-service eating places

Full-Service: Fine Dining (high-end steakhouses, seafood, and other restaurants), Casual Dining (mid-priced casual dining establishments), Family Dining (budget-priced family oriented establishments)

Limited-Service: Quick service (traditional quick-service low priced restaurants) Fast Casual (limited service restaurants that offer upscale menus)

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: