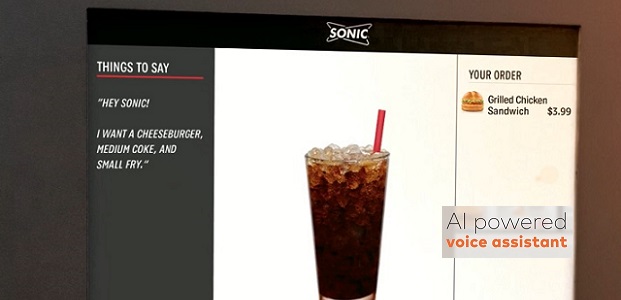

Mastercard announced a partnership with ZIVELO, a leader in self-service kiosk technology, to enhance the drive-in and drive-through ordering experience for quick service restaurants (QSRs) with a first-of-its-kind AI-powered voice assistant and personalized dynamic menu. Sonic Drive-In will be the first partner to pilot the new experience at selected Sonic locations in the U.S. this year.

Upon arrival at the QSR’s drive-in or drive-through, consumers will be prompted to order from an AI-powered voice ordering assistant, which will integrate with a dynamic menu display. The menu will automatically update using a proprietary AI solution developed by Mastercard, which will allow the display to be customized either for a specific customer or for external factors such as weather, time of day, seasonality and location.

“Voice AI promises to provide carefree conversational ordering that complements the overall experience. We anticipate AI integration will also provide opportunities to streamline repeat orders, personalize suggestions based on data, and offer rewards that are truly relevant.”, said Jon Dorch, vice president of integrated customer engagement.

The artificial intelligence engine that powers the voice ordering experience to provide a dynamic menu was developed through Mastercard Labs and can be adapted for the needs of each specific merchant partner. The solution is built on OakOS, ZIVELO’s software operating system for public computing experiences, and relies on ZIVELO’s expertise within the self-service display industry, having successfully deployed tens of thousands of kiosks in restaurants to date.

Mastercard also provides innovation support through an off-the-shelf voice AI solution for merchants that can be designed, developed and launched without significant effort, allowing them to quickly deploy the experience in-market.

“Drive-thru accounts for 70% of QSR transactions, yet the experience has remained more or less untouched by innovation,” said Healey Cypher, CEO of ZIVELO. “As customer expectation continues to move towards faster, personalized, and contextual experiences, we are excited to partner with Mastercard to bring this transformative solution to market and hopefully exceed those expectations.”

The voice ordering experience and dynamic menu solution was designed by Mastercard and ZIVELO to be flexible for each unique quick service restaurant environment. Additional partners will pilot the technology as it continues to roll out in 2019.

SONIC, founded in 1953, is the largest drive-in restaurant brand in the United States with more than 3,600 restaurants.

Founded in 2008, ZIVELO has rapidly grown to become the leading self-service technology brand, offering a sleek and sophisticated product design, intuitive user experience, and cutting-edge modular hardware solutions. In 2018, ZIVELO acquired Oak Labs, the creators of OakOS – the world’s first operating system for public computing experiences. Through the acquisition, ZIVELO now provides brands with an end-to-end solution for the roll-out of kiosks and digital signage and is one of the only full-service kiosk providers to offer world-class hardware, software, services, and financing under one roof.

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: