Mastercard announced its commitment to enabling the increase in contactless payment limits across Europe. The move comes as 29 countries implement new limits, which will ultimately improve shopping experiences for people across the region.

„75% of all Mastercard transactions across Europe are now contactless. This increase in contactless limits will mean cardholders and shopkeepers will soon be able to make and receive more of their payments both quickly and securely, and without the need to enter a PIN or use cash.”, according to the press release.

“Mastercard was the first to grasp the potential and ensure all payment terminals became contactless ready from 1st January 2020. We have all now seen how quickly people have embraced Contactless payments as their preferred way to pay every day. Today’s announcement is designed to reflect the pace of changing behaviours of the people we all serve giving them ease, speed and peace of mind in a fast changing world.” said Milan Gauder, Executive Vice President of Product and Innovation, Europe at Mastercard.

Among the 29 countries, UK, Ireland, Estonia and Poland are leading the way with permanent changes to limits while the likes of Netherlands and Greece are implementing temporary limit raises to help their people shop easily during this difficult time.

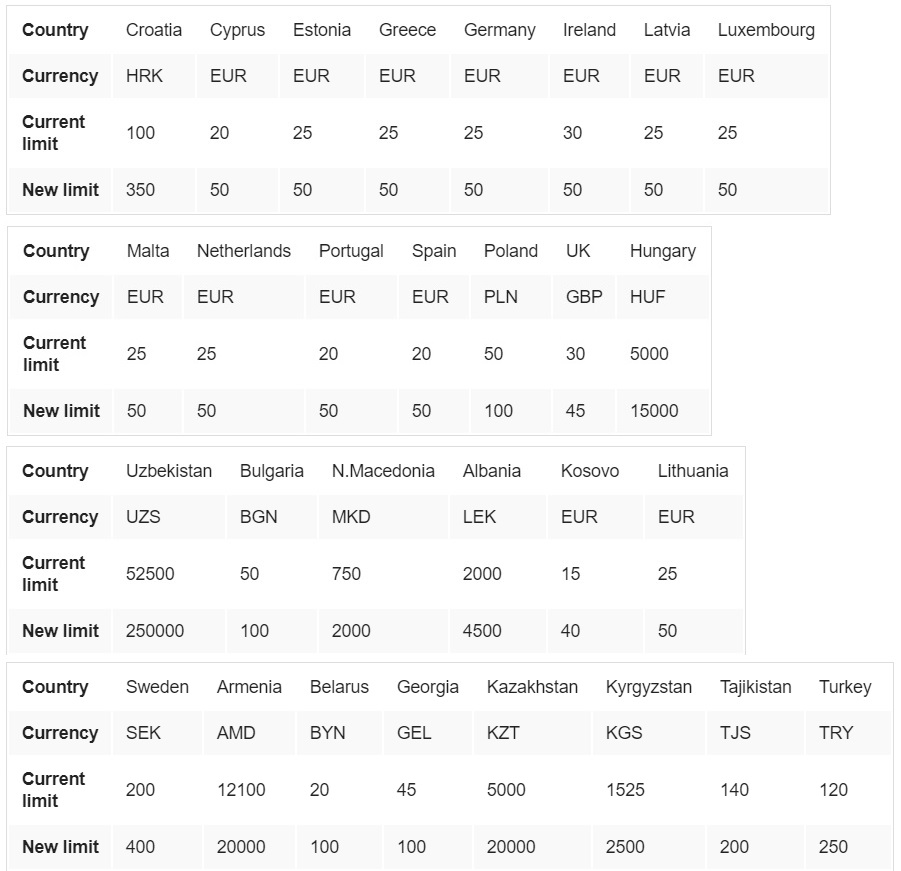

Please find below all 29 countries with their old and new limits:

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: