Canada had some of the highest interchange fees in the world – averaging 1.78%. The United States followed with a close second of 1.73%. Poland had one of the highest average IF rates in Europe, at 1.53%, followed by Croatia (1.48%) and Romania (1,34%). French and Hungarian vendors were likely to keep the most of their sales, despite accepting credit cards – common IFs in these countries were 0.21% and 0.30% respectively.

An article written by Joe Resendiz, a former investment banking analyst for Goldman Sachs

A seldom discussed consequence of the global shift to card payments is the cost to businesses. Interchange fees (IF) are a percentage based charge that a merchant must give up any time a customer pays by swiping a credit or debit card. Between North America and Europe, merchants typically surrender just under 1% of each sale to these IFs.

Through the use of data from the Kansas City Federal Reserve Bank, we were able to cross-compare these rates in the United States, Canada, and 32 of Europe’s largest economies. Results showed that the average merchant in North America paid 83% more in fees than their counterparts in Europe.

MasterCard branded credit cards were more expensive to accept over Visa, in both regions.

E-merchants paid the most to accept credit card payments, despite having fewer alternatives. In the United States online vendors paid on average 2.13% of each transaction towards IFs.

American merchants pay, on average, 1.76% in interchange fees – compared to a 0.96% average in most European nations. Interchange fee rates in both the United States and Canada trump even the most expensive European nations. Compared to Europe, very little interchange fee regulation exists within North America. This could serve as one possible explanation for the large discrepancies in charges between the two regions.

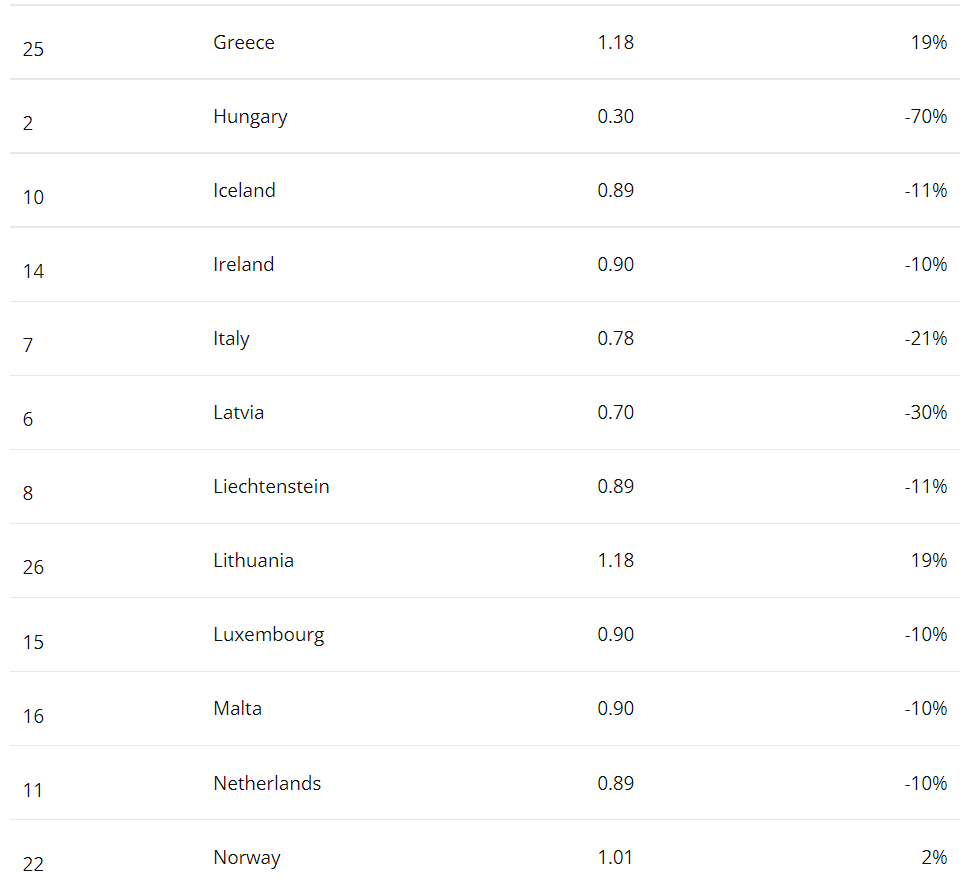

While the average global interchange fee is around 0.99%, there exists wide variation from this figure, country to country. Canada’s rates, for instance, are 79% above the mean. Below you can find all the countries included in our study, listed alphabetically. To the left hand side of each country is its global ranking – how it performs compared to all the other nations listed here. A rank of 1 represents the lowest interchange fees, while 34 is the highest. On the right side of each country is it’s actual credit card IF, and the increase or decrease of that value from the global average.

Poland has, by far, the highest average interchange fees in Europe – a typical rate paid by merchants there is 1.53%. That is nearly 60% more than the mean rate in Europe. Businesses in Croatia and Romania paid the next highest rates, with averages ranging from 1.48% to 1.34%.

France, through the efforts and regulation from the European Commission, has an average interchange fee of 0.22% – the lowest in the study.

Interchange fees vary between different credit card networks. In this study, we examined IFs from Mastercard and Visa – the two companies with the largest global market share. According to a 2013 Nilson Report, 48.3% of all credit card transactions are realized through Visa, while 31.7% occur on the Mastercard network.

Mastercard transactions are more expensive for merchants, both in Europe (1.19% vs 0.79%) and in North America (1.84% vs 1.67%). Mastercard transactions appeared to be most expensive in Canada, averaging 1.89%, whereas the in Europe Poland and Croatia were the highest (1.73% each). The highest Visa interchange fees are found in the United States and Canada (1.67%). On the Visa end, Poland once again leads the way in high interchange fees with 1.34%, followed by Cyprus with 1.28%. All these variations are a combination of multiple factors, and are difficult to attribute to one particular reason.

Read the article in full here

About the author

Joe Resendiz is a former investment banking analyst for Goldman Sachs, where he covered public sector and infrastructure financing. During his time on Wall Street, Joe worked closely with the debt capital markets team, which allowed him to gain unique insights into the credit market. Joe is currently a research analyst who covers credit cards and the payments industry. He earned a bachelor’s degree from the University of Texas at Austin, where he majored in finance.

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: