Many investors going into debt to buy bitcoin using credit cards – they’re counting on another year like the 1,400 percent gain registered in 2017

LendEDU polled 672 active Bitcoin investors and discovered that many of them are purchasing the crypto currency in an incredibly risk manner: incurring credit card debt. „Much of the data that came from this poll was quite concerning.”, LenEDU says.

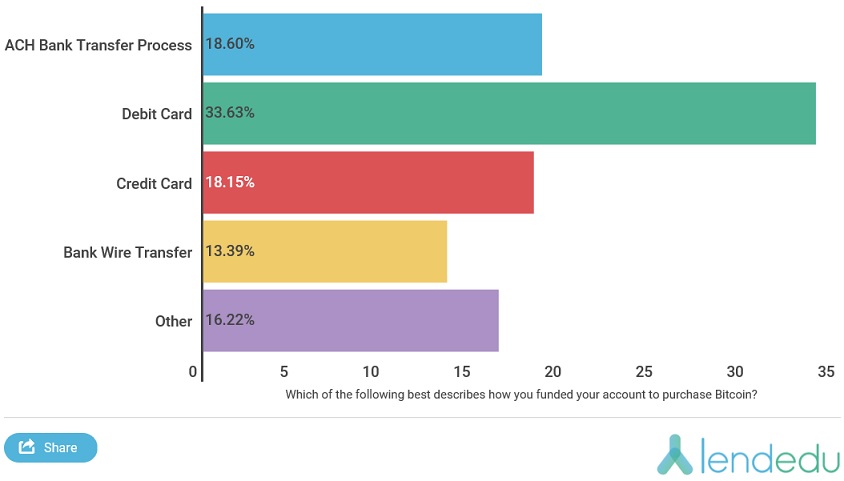

First, more than half (51.78%) of respondents stated that they either used a credit or debit card to fund their account to purchase Bitcoin. Specifically, 33.63 percent of investors were using debit cards, while 18.15 percent were using credit cards.

Why is this concerning? The virtual currency exchanges where Bitcoin is bought and sold will charge conversion fees when either a credit or debit card is used to find an investor’s account. Coinbase, the largest of the cryptocurrency exchanges, charges a conversion fee of 3.99 percent when a user uses his or her credit or debit card to bankroll their account.

Obviously, this is not the most financially-savvy move on the part of of a sizable percentage of Bitcoin investors; no one ever wants to pay extra than what is necessary, especially when dealing with something as volatile as Bitcoin. The wisest and most frugal way to fund a virtual currency exchange account would be through an ACH transfer, which is completely free of charge. Only 18.60 percent of our 672 Bitcoin-invested respondents were paying for the cryptocurrency in this fashion.

However, this was not even the most pressing concern coming from the LendEDU poll. That recognition belongs to this data-point: 22.13 percent of Bitcoin investors did not pay off their credit card balance after purchasing Bitcoin.

Going into debt to buy Bitcoin is not a wise decision no matter which way it is spun. There is no guarantee that Bitcoin investment returns will be profitable in the long run, but one can guarantee that the credit card company will need to be paid back. Considering the average annual percentage rate (APR) on a credit card is 15.07 percent, a Bitcoin investor that finances their investment at the wrong time will find themselves in serious debt.

This is especially worrisome when the volatility of Bitcoin is taken into thought. Some of the world’s foremost financial minds predict the virtual currency could crash at some point. Heavily investing in Bitcoin via credit card only to have it crash overnight could lead to a nightmare financial scenario.

Judging from the results our poll, most Bitcoin investors are not worried about a crash and believe that the returns from their Bitcoin investment will be sufficient enough to pay back their credit card bills. For example, 70.37 percent of respondents that carried over their credit card balance stated that owning Bitcoin is worth the interest expense. Additionally, 88.89 percent of that same pool of investors plan on paying off their credit card bill from the money generated after selling their Bitcoin.

Is it possible that the price of Bitcoin continues to skyrocket and the gamble these respondents are taking pays off? Definitely, but that is not to say they are not still playing with fire. Using a large line of credit and carrying over one’s balance to gain financial leverage on Bitcoin and possibly take advantage of the virtual currency’s huge price swings might pay huge dividends but may also leave him or her in insurmountable debt, made worse by interest.

Evidently, none of these fears are scaring off many of the Bitcoin investors that are using a credit card to purchase the cryptocurrency. In fact, they are doubling down. 76.23 percent of this cohort said they have intentions to purchase more Bitcoin using a credit card.

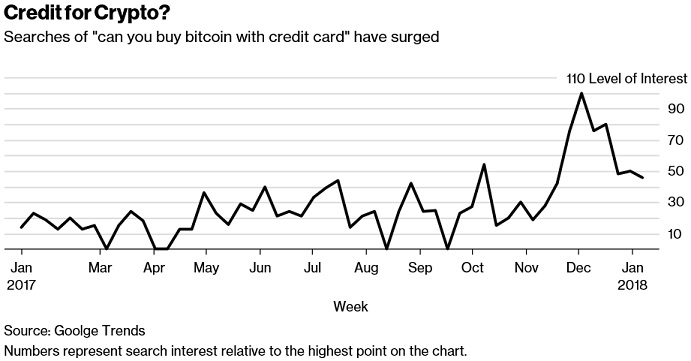

Even beyond those surveyed, interest in buying bitcoin with a credit card has surged, according to Google Trends, quoted by Bloomberg. But going into debt for exposure to such a volatile asset, prone to price swings of plus or minus as much as 30 percent a day, comes with risk.

Nearly 90 percent of those surveyed by LendEDU who said they hadn’t paid off their credit card bill said that they plan on doing so using money generated from selling their bitcoin.

Guess they’re counting on another year like the 1,400 percent gain registered in 2017.

Source for image: Cointelegraph

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: