Major meeting of central banks produces same old ‘evaluating’ CBDCs refrain

As China tests a digital version of its national currency with citizens, the U.S. central bank and others are still mulling over the idea.

During a panel discussion hosted by the International Monetary Fund on Monday, officials said they continue to evaluate the merits and drawbacks of central bank digital currencies (CBDCs), with the familiar caveat that digital innovation has its benefits but policy considerations abound.

The panel, featuring Federal Reserve Chairman Jerome Powell; Bank Negara Malaysia Governor Nor Shamsiah; Bank for International Settlements General Manager Agustin Carstens; and Saudi Arabian Monetary Authority Governor Ahmed Abdulkarim Alkholifey, appeared to conclude that while CBDCs may be useful for some countries, it’s too soon for them to be issued, according to coindesk.com.

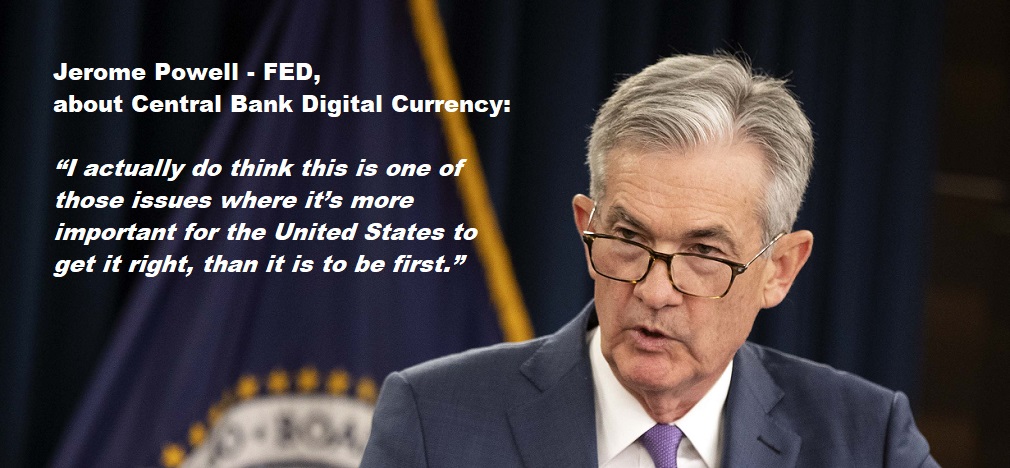

Nothing particularly new was said during the hour-long segment, in which Powell reiterated the U.S. is evaluating a digital dollar.

“I actually do think this is one of those issues where it’s more important for the United States to get it right, than it is to be first,” he said. “Given the dollar’s important role globally, it’s essential that we remain on the frontier of research and policy development. The dollar is the world’s principal reserve currency and there continues to be large global demand for Federal Reserve notes. There is about two trillion dollars with Federal Reserve notes in circulation and we estimated somewhere close to half of that value in notes is held outside the United States.”

The Federal Reserve Bank of Boston is collaborating with MIT’s Digital Currency Initiative to research CBDCs, he noted.

“These types of experiments advance our understanding of the risks and benefits of CBDCs, measuring trade-offs between different designs and system arrangements and assessing security risks on the policy side,” Powell said. “We’re also actively engaging with a wide variety of stakeholders from government, academia and the private sector to gather different perspectives and expertise about potential CBDC issues, the range of design options and other considerations.”

Powell said much the same a year ago, when he told U.S. lawmakers that while central bank researchers were evaluating a potential digital dollar, it was unclear what specific benefits the U.S. would enjoy.

“We are committed to carefully and thoughtfully evaluating the potential costs and benefits of a central bank digital currency for the U.S. economy and payments system. We have not made a decision to issue a CBDC,” Powell said according to Bloomberg.

The IMF published a report on CBDCs and their policy considerations in the lead-up to the event, which said digital currencies can be a useful tool for central banks but they need to evaluate the potential effects on their country’s monetary policy goals.

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: