Major Japanese banks have published the first results of a blockchain interbank payments trial

Several major Japanese banks, in partnership with bitcoin exchange bitFlyer and Deloitte Japan, have published the first results of a blockchain interbank payments trial: „possibility in benefitting from cost reduction effect in system development by leveraging blockchain technology was confirmed”, according to the report.

The Blockchain Study Group, which includes Mizuho Financial Group, Inc., Sumitomo Mitsui Banking Corporation and Mitsubishi UFJ Financial Group, Inc., have spent the last year collaboratively testing the technology for uses in bank-to-bank payments. The results of the specific trial disclosed today relate to the issuance of payments. According to the institutions involved, future testing will be widened to include the clearing and settlement of those transactions.

The contents of the report, a full copy of which can be found below, represent perhaps some of the more granular details of blockchain experimentation in Japan to date. Since the start of 2016, a range of proofs-of-concept have been developed and tested by financial institutions in Japan, primarily in the areas of payments, document management and digital currency.

The authors note: “Through practical experiment of domestic interbank payment operation, possibility in benefitting from cost reduction effect in system development by leveraging blockchain technology was confirmed. However, various issues exist in the application of blockchain technology to the domestic interbank payment operation, such as in methods to interface to existing bank systems and to areas outside payment, and in methods to fulfill non-functional requirements of high levels.”

In other words, while the proposed system can make it potentially cheaper to transact from one bank to another, the existing infrastructure isn’t quite ready to integrate with the technology. Further study, the report goes on to explain, will focus on how to alleviate some of these problems.

The report itself contains intriguing details about how bank-driven blockchain systems might look in production.

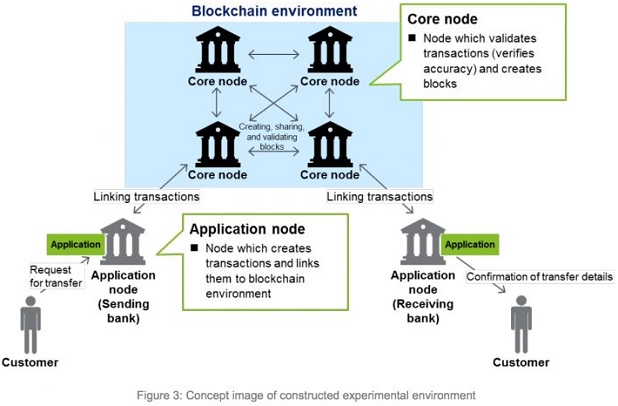

Included in the report is a diagram detailing the structure of how participants interact with the proposed network. Transaction validation, for example, would be a process reserved for select banks – known as “core nodes” in this instance. “Application nodes”, on the other hand, would constitute the banks that are sending or receiving transactions that are including in the blocks created by the core nodes.

According to the report, the prototype system was capable of processing over a thousand transactions per second.

“In the assessment to the experiment environment constructed this time, it was proven that the performance throughput in particular achieved 1,500 transactions per second and that the level sufficient for actual operation is expected,” the authors wrote.

As for the specifics behind those cost-cutting measures, the report highlights that reduced expenditures for software licenses, hardware, and maintenance would all be lower when compared to technologies utilized today. Costs related to middleware and applications were noted to be lower as well.

A full copy of the report can be found below:

Source: coindesk.com

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: