M-Pesa – Africa’s first mobile payments service – has been a major driver of financial inclusion, and now has 51 million customers and 465,000 businesses across seven countries.

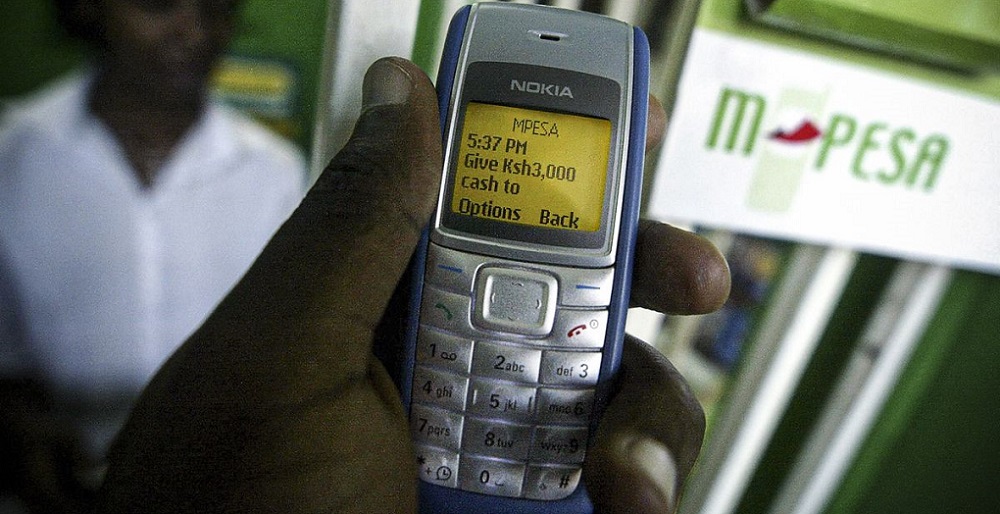

M-Pesa today marked its 15th anniversary since the service was first launched in March 2007 to enable money transfers between people using 2G feature phones. Vodacom Group jointly acquired the M-Pesa brand, product development and support services from Vodafone in 2020 through a newly-created venture with Safaricom.

From its beginning in Kenya, M-Pesa has grown to serve more than 51 million customers and 465,000 businesses. The service is provided by 600,000 agents across Kenya, Tanzania, Mozambique, the Democratic Republic of Congo, Lesotho, Ghana and Egypt. M-Pesa processes more than 61 million transactions a day, making it Africa’s largest fintech provider, and it has attracted 42,000 external developers to create additional services for the platform.

With more people across the African continent shifting to smartphones, and using 3G and 4G broadband, M-Pesa is evolving to become a digital financial services provider. In 2021, M-Pesa Africa launched the M-Pesa Super App and M-Pesa Business Super App which enables any business on the service to run a virtual storefront providing their services through M-Pesa Mini Apps.

Shameel Joosub, Vodacom Group CEO says „Vodacom is proud to have been a part of M-Pesa’s extraordinary growth journey during its rapid evolution to become Africa’s largest payments platform today. Millions of people and small businesses on the continent, many of whom are unbanked, now have access to financial services thanks to M-Pesa. We will continue to look for opportunities to scale the platform as we connect the next 100 million people in Africa.”

The M-Pesa Super App is designed to be a customer’s lifestyle companion connecting them to services they need in a typical day including shopping, restaurants and food delivery, transport services, government services and much more. More than 9 million customers and 320,000 businesses have downloaded the M-Pesa Super App since its launch.

In addition to the Super App, M-Pesa Africa is revamping the M-Pesa platform to support additional digital services, faster development of new products, and to achieve increased stability and reliability. The platform revamp includes expansion of the M-Pesa APIs to provide developers with even deeper access to the service enabling them to deploy more innovations on the service.

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: