Lunar, the Nordic challenger bank, is expanding its offering with Lunar Youth, a dedicated banking app for kids and teens aged 7-17. „Lunar Youth is a new banking app designed for kids and teens, linked to their parents’ accounts. It provides a fun, safe, and intuitive way to explore digital money management, helping young users build real-life financial habits while parents maintain oversight.” – according to the press release.

This launch reinforces Lunar’s position as an innovative digital bank in the Nordics. With over 2,5 million kids and teens in this age group across the region, Lunar Youth aims to fill a gap in the market, offering a practical and engaging way for kids to understand digital spending, while parents stay in control. Lunar Youth is offered to users on Lunar’s paid tiers Plus and Unlimited, and the phased rollout began silently in February to users with a strong response. 9% of users in the test phase upgraded to Plus or Unlimited shortly before activating Youth.

„Kids today grow up in a world where money is mostly digital—whether it’s tap-to-pay, in-app purchases, or subscriptions. Lunar Youth is a natural next step in our journey towards becoming the go-to digital bank for all life stages. It’s about giving kids and teens a safe, fun, and practical way to engage with money—together with their parents”, says Ken Villum Klausen, founder and CEO of Lunar.

At Lunar we firmly believe that part of learning about money should happen through hands-on experience, and banks are instrumental in making that experience safe, digital and easy.

„We believe that schools play a key role in helping kids understand money, but parents are equally important. Everyday habits, open conversations, and real-world experiences shape how kids develop healthy financial habits. As a bank, we have a role to play too. We’re building a digital bank for a digital generation—giving kids the tools to explore, learn, and build confidence in managing money, step by step, in a safe environment,” says Villum Klausen.

An important step in Lunar’s growth

While Lunar initially gained traction among younger digital-savvy users, reaching almost one million users across the Nordics, its growth in more mature segments has been part of a long-term strategy. The introduction of Lunar Youth strengthens Lunars’ position as a bank tailored to fit users’ lifestyles and everyday financial needs.

„We’ve been around for nearly a decade, and the customers who joined us in the early days have grown up with us—many of them now becoming parents themselves. Lunar Youth isn’t just about kids; it’s about continuing to be the go-to bank for our users as they move through different life stages—whether they’re opening their first account as teenagers or helping their own children take their first financial steps.” Villum Klausen explains.

Safety and parental controls Lunar Youth is built with safety in mind. It offers a range of parental controls, including spending limits, transaction monitoring, and category restrictions. These features ensure that kids can explore financial independence within a secure environment, giving parents peace of mind.

About Lunar Youth

For kids & teens aged 7-17, connected to parents’ accounts

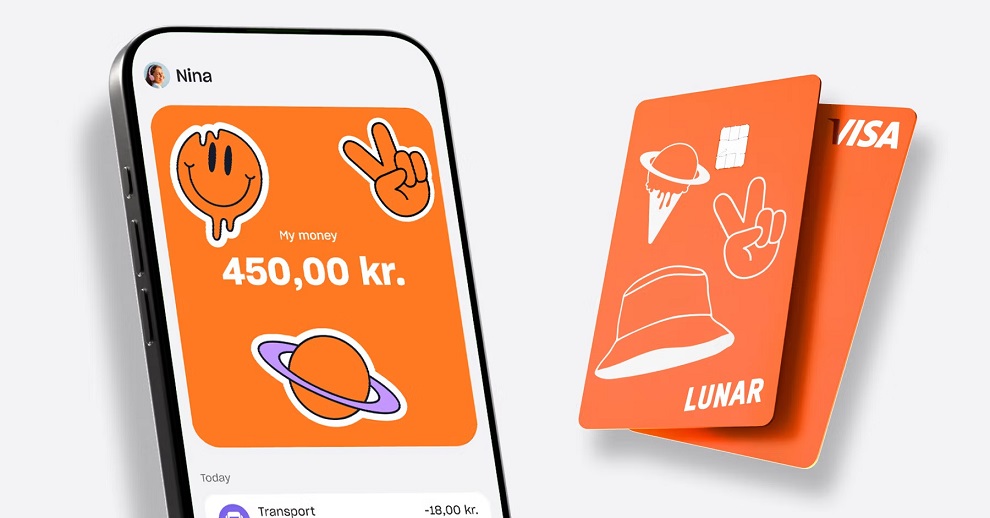

Customizable – kids and teens can design their own card and app theme

Apple/ Google Pay – for kids over 13

Smart digital tools – overview of spending, real-time insights, spend categorization (available now) and budgeting tool (end of March)

Safety – users choose their own pincode on their card and app login

Parental controls – Parents can set budget limits, monitor transactions, and access spending insights. Category restrictions block for example crypto, gambling, and adult content, and all online purchases require parental approval.

Availability – launches March 11 in Denmark, Sweden, and Norway

Pricing – Lunar Youth is included in the Lunar Plus plan (79 DKK/SEK/NOK) and the Unlimited plan (139 DKK / 169 SEK/NOK)

____________

Lunar is a digital challenger bank dedicated to simplifying and enriching people’s financial lives by creating the best everyday bank in the Nordics. Founded in Aarhus, Denmark, Lunar employs around 400 people across the Nordic region. In 2019, Lunar received its banking license and has since become one of the few banks with a Nordic banking platform. Today, over 950,000 private and business customers across the Nordics use Lunar.

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: