New research conducted by Klarna across 2,000 UK consumers and over 250 retail decision makers, reveals that retailers are struggling to retain their customers as consumers today increasingly have zero tolerance for a poor retail experience.

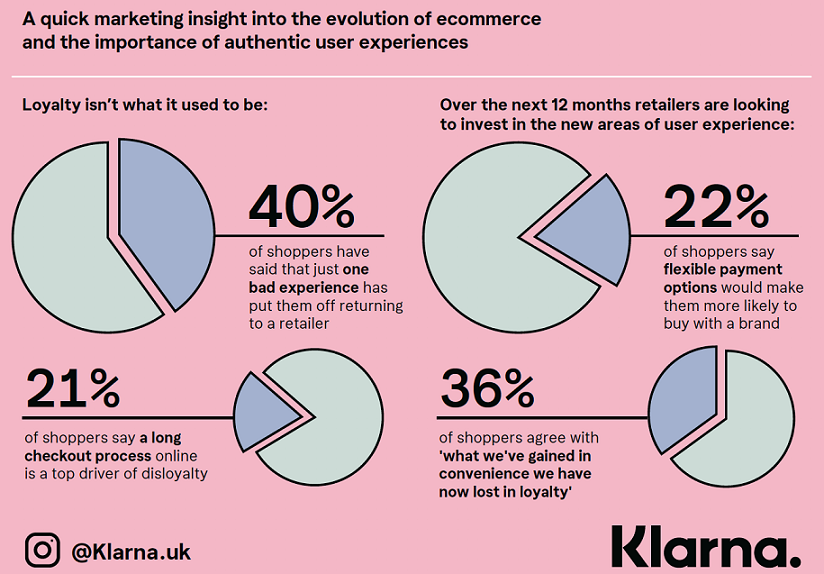

40% of shoppers say just one bad experience would stop them returning to a brand. A third (32%) say shopping isn’t as fun as it used to be, with 36% feeling that what shoppers today have gained in convenience, they’ve lost in experience.

Where brands used to think of loyalty in terms of reward schemes or points, the findings show that for today’s shopper, the drivers of loyalty run much deeper than a transaction or offer. And when it comes to what drives disloyalty, a bad returns process (30%) rank much higher for shoppers than retailers perceive them to be.

Retailers are recognising this shift and starting to evolve the way they think about loyalty. 41% of retailers agree that loyalty is no longer solely driven by rewards and 76% say they have to work harder than ever to retain customers. But, many (33%) are struggling to keep pace with changing consumer expectations around experience and are being held back by outdated tech (33%) and a short-term focus on sales (30%).

Shoppers demand more

This new research gives retailers some of the insights they need to help win the loyalty stakes and deliver the standout shopping experience demanded by consumers. It reveals that whilst the traditional drivers of loyalty remain important, it is no longer enough to only deliver value for money, quality products and a good online UX.

Shoppers today want more – craving things like brand values they can align with (40%), human engagement (35%) and flexible payment options (26%). This is especially true of millennial and Gen Z shoppers who care less about value for money, and more about brand image (20%, compared to 13% of over 45 year olds) and flexible payments (30%, compared to 25% of over 35 year olds).

Pay later pays off

In a competitive environment, retailers can’t afford to lose customers at the checkout. Shoppers are increasingly looking for more choice in how they pay — and having the option to pay later especially resonates.

A fifth (21%) of shoppers say a long checkout process online is one of the top drivers of disloyalty. And, 22% say flexible payment options would make them more likely to buy more with a brand, 26% said it would make them more likely to shop again and 20% said it would make them more likely to leave a positive review.

Can retailers keep pace?

These insights demonstrate how important it is for retailers to focus on these broader concepts of experience to win back loyalty. It’s encouraging to see forward-thinking retailers are already starting to invest in these ‘newer’ elements of experience. The top areas for investment over the next 12 months are a smooth online UX (39%), additional payment options (38%), a curated experience (37%) and brand content (34%).

Luke Griffiths, Managing Director at Klarna UK commented: “Loyalty is no longer a ‘points’ programme. It’s clear that consumers want to align themselves with brands who can offer them a deeper connection and understand how they want to shop. Retailers need to be investing in the right drivers of loyalty for their customers – whether that’s flexible payment options that fit with their lifestyle or curated experiences that put the fun back into shopping. As consumer expectations continue to grow and the role of experience becomes increasingly important, getting this right will be vital to success in a competitive retail market.”

Andy Mulcahy, Strategy & Insight Director at IMRG commented: “Shopper confidence appears to be in a suppressed state and many retailers are under pressure to enhance the customer experience they offer to keep ahead in a tough environment. The problem is that ‘customer experience’ is a term that can technically cover every aspect of a retailer’s proposition. Identifying where to focus resource is a challenge. This research shows that understanding the drivers of loyalty that will work for a specific retailer is important for keeping ahead today.”

Holly Stewart, Head of Brand, BEAUTY BAY: “We’re constantly evolving what we do to ensure we’re hitting the right drivers of loyalty for our customers. For example, being an online brand doesn’t mean only existing in the digital world and we know our customers want IRL experiences that allow them to feel truly connected to the brand. That’s why activations like beauty master classes with pop-up shopping help us create deeper loyalty and long-lasting brand advocates.

We’re also now seeing payments as crucial differentiator in the shopper experience, and we recently introduced Pay in 3 for customers to split payments into manageable chunks with no fees or interest. Our customers have loved this flexibility and it’s driving new customer acquisition, increasing loyalty amongst existing customers.”

For more insight on the research and advice on how you can create a standout experience, download Klarna’s full report – Experience is the new loyalty

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: