Revolut has started issuing credit cards in Poland and granting consumer loans. The new services can be used by selected customers who were invited to the pilot project and who previously converted their payment accounts to accounts at Revolut Bank, according to cashless.pl.

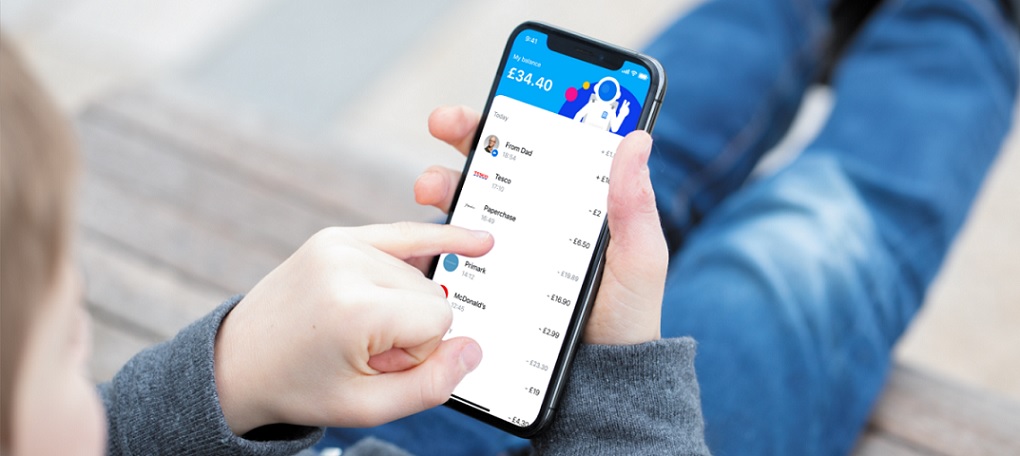

In the press release, the company said that you can apply for a card and a loan via the Revolut application. For both products, the debt limit may not exceed PLN 20,000. PLN. In the case of a loan, fintech proposes a maximum repayment period of 60 months.

The credit card, however, has a 62-day interest-free period. The loan interest rate is not the same for all customers. It is to be calculated for each client individually, so for now it is difficult to say more about the attractiveness of the Revolut offer.

It is worth recalling that in order to start using loan products, Revolut Bank customers must download the latest version of the application. If included in the pilot program, they will be able to apply for a card or credit through the app. If not, they can register their interest in the service by clicking on the banner. They will receive a notification when new products are available to them.

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: