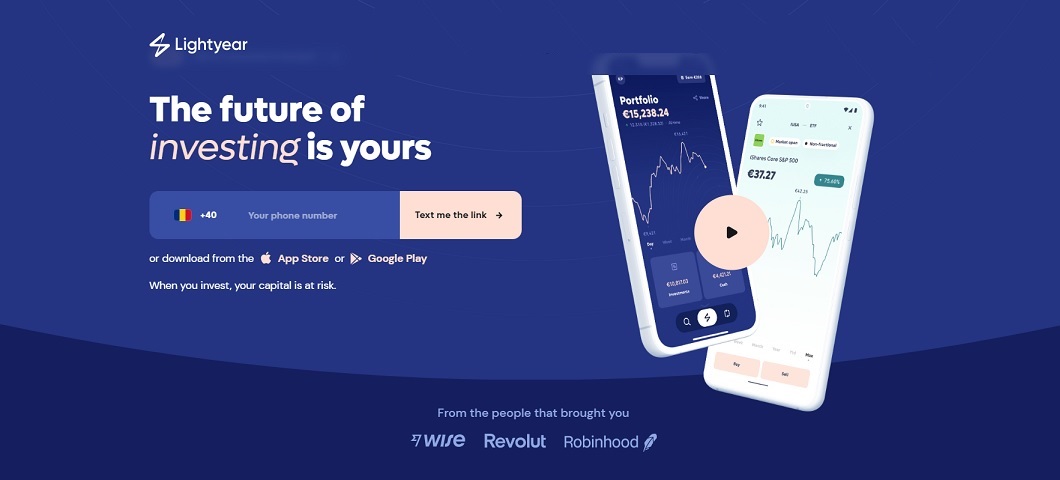

Lightyear, a commission-free investment platform founded by two early Wise employees, has raised $25 million as it launches into 19 European countries.

„People in 19 countries across the continent now have truly commission-free access to over 3,000+ global stocks & funds. Today, investing in Europe gets fairer and easier. But it’s just the beginning for us.” the company says.

Lightyear received a European license from the Estonian Financial Supervision Authority in Q1, giving it the right to provide services in all EU and EEA countries, following its UK launch in October last year.

„To make global investing truly seamless, we’ve built a multi-currency account, allowing you to hold and invest money in EUR, GBP & USD. That means you can say goodbye to hidden fees. The only fee you’ll find on Lightyear is 0.35% as a one time flat fee when you convert between currencies.” says Martin Sokk, CEO and Co-Founder Lightyear.

Countries part of this first European rollout include Ireland, the Baltics and most of Western Europe such as Spain, Germany, Italy, Portugal, Netherlands and France.

Sokk added that the company also has its sights set on non-Euro countries next including the likes of Sweden, Norway, Romania, Poland and Hungary.

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: