KPMG: „Revolut is the CX champion of the financial services sector in Romania”

The Financial Services Sector ranks 5th in the KPMG Customer Experience Excellence 2019 Report with a score of 7.70. The Champion of the sector is Revolut with a score of 8.48, significantly above the industry average.

Besides being an instant hit after their entry to the Romanian market in 2018, the UK based fintech company is the CX champion of the Financial Services sector, scoring highly on all 6 Pillars (resolution, empathy, personalization, time & effort, expectations and integrity).

„In fact, it scores the highest across the whole market in terms of the Expectations pillar (8.57), proving that clear, simple and transparent value propositions are what customers increasingly appreciate.”, according to a KPMG report about customer experience.

With an impressive adoption rate, Revolut also registers the highest score in terms of promoters in this KPMG year’s survey.

Sector Performance Overview

Other key findings

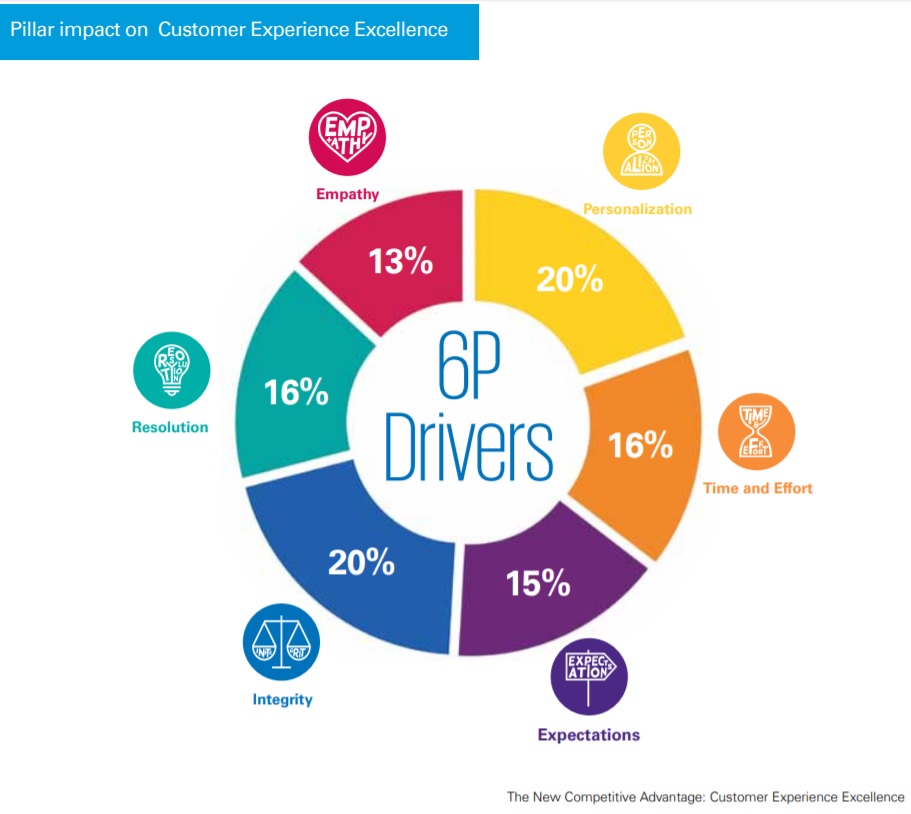

In Romania Integrity matters most in Customer Experience, closely followed by Personalization. KPMG survey suggests that Romanian consumers are most focused on the level of Integrity and Personalization which a brand offers.

Considering that integrity is a fundamental basis of the customer experience, the above result is not entirely surprising. Without integrity, a truly critical factor, there is no sustainable framework for building valuable, long term customer relationships. This appears to match a global trend, with corporate ethical behavior being seriously taken into consideration by customers. This means that brands that have incorporated strong values into their business and act on them consistently are more likely to build a loyal customer base.

Personalization, on the other hand, is valued by customers because it creates a unique emotional connection, one that is remembered and revisited by clients when they re-engage with their brands. Developments in technology and data analytics are now helping organizations uncover and predict consumer trends, wants and needs. This allows the creation of personalized journeys and the design of tailored products and services to please individual tastes.

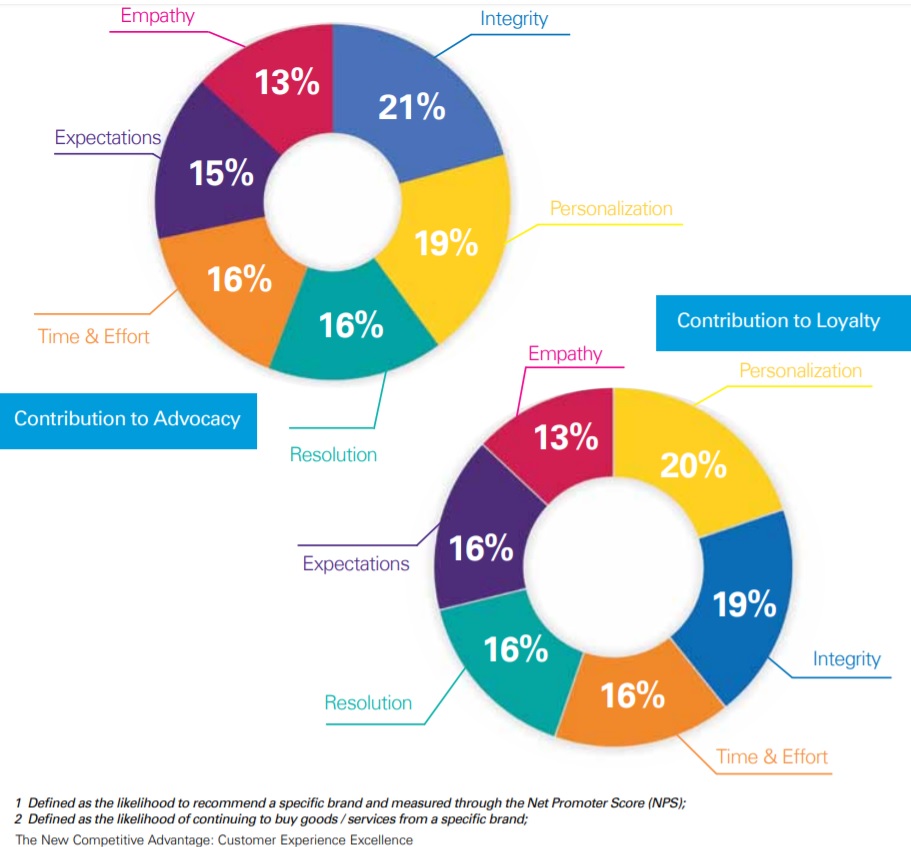

The influence of the Six Pillars of Customer Experience Excellence on Advocacy (1) and Loyalty (2)

The Six Pillars don’t just define Customer Experience Excellence, they also predict commercial success, with strong performance across The Six Pillars leading to improved brand Loyalty and Advocacy.

With regard to Advocacy, the likelihood to recommend a product or service, Integrity also seems to be the number one influencing factor, in close correlation with the impact it has on the overall Customer Experience. This tells us that trusting a brand is important for Romanian consumers.

Personalization comes very close as the second most important factor, indicating the emergence of a mature and demanding customer who increasingly values individualized interactions and meaningful connections with his/her brands. The same Personalization and Integrity Pillars play the most important role in customer Loyalty.

Surprisingly, Empathy seems to have the lowest influence on both customer loyalty and advocacy in Romania. That said, since companies and relationships move further into the digital world, one can expect that empathy will become an increasingly important differentiator for many organizations, regardless of whether they are interacting with customers online or offline. As such, Empathy seems to be the number one opportunity for brands willing to raise their Customer Experience game.

(1) Defined as the likelihood to recommend a specific brand and measured through the Net Promoter Score (NPS);

(2) Defined as the likelihood of continuing to buy goods / services from a specific brand.

Financial services sector

The financial services sector appears to be a two-speed market, with only two brands represented in the top 10 and only 4 brands in the aggregate Top 30, taking 2nd, 3rd, 11th and 17th place. This does not come as a surprise however for at least two reasons.

Firstly, the companies that have managed to position themselves so well in our survey are at the forefront of adopting customer centric initiatives. For instance, Revolut (2nd) is known for having designed its business model and the whole app ecosystem around solving particular customer painpoints. As such, it manages to deliver customer excellence consistently across the 6 Pillars.

The only banks in the top 30, ING Bank (3rd) and Banca Transilvania (11th), are known for adopting an intensive customer centric approach, embedding CX tools and methodologies at the core of their agile banking models and strategies.

Secondly, most organizations in this sector, particularly banks, are still challenged by the legacy of complex organizational structures and cumbersome (sometimes obsolete) internal systems and processes. This has a significant impact on agility, which further translates into poor performance in the Time & Effort pillar. This is of course enhanced by regulatory burdens that are significantly more stringent for financial institutions compared to other industries.

The image of a polarized sector takes further shape when we notice that only 6 out of 18 brands in the financial services sector made it into the top half of the 2019 Customer Experience Excellence Top 100.

On the trends side, the digitalization of the B2C financial industry is now a global phenomenon and it includes a wide spectrum of measures from putting in place advanced cyber security systems, to developing and/or improving IT platforms, online tools and apps for customer interaction. Players on the Romanian market are no strangers to these developments and are taking steps towards building digital bridges with their customers, either by taking radical approaches, for example by building end to end digital banking platforms, or by going more specific, for instance by launching specific mobile interaction apps that allow in-app dialogues and enhance conversational marketing opportunities. The main rationale behind these endeavors is technology advancement which has led customers’ expectations to change dramatically, as people increasingly value simple and timely interactions, doubled by high-quality and personalized service.

What we often notice with regard to digitalization, but also other corporate transformation efforts in the financial services industry, is a disconnect between the specific solutions created/implemented and the actual customer reality on the ground (e.g. process improvements, organizational redesigns, CRM implementation/reshuffle). The main danger in such projects is that companies become too attached or captive to inside views and put little or no emphasis on the outside-in perspective, i.e. the customers’ view.

Based on the results of KPMG study most organizations in the sector have great opportunities to start making greater sense of the data they currently gather, to improve customer related data collection (both qualitatively and quantitatively), and design human centered solutions that “speak” to the customer and actually solve specific issues.

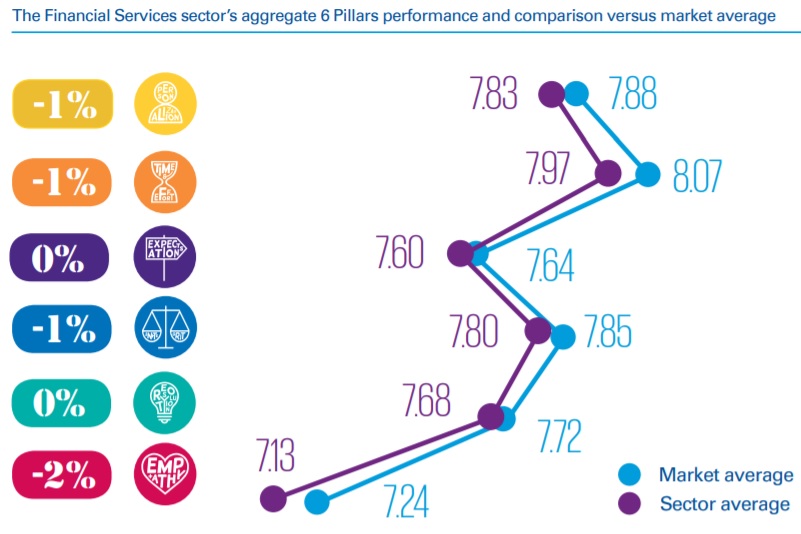

With regard to the 6 Pillars performance, the financial services sector is positioned just below the market average. The biggest gaps versus the average appear under the Time & Effort and Empathy pillars. This may bring several opportunities for financial services players to better attend to their clients’ needs and wants in terms of speed and efficiency of interaction (directly linked to a company’s processes and systems) as well as in terms of designing human centered experiences, which is will be provided by a company’s workforce.

Methodology

What is the Customer Experience Excellence (CEE) analysis?

For ten years, the Excellence Centre of KPMG has been comprehensively researching customer experience best practice across the globe through the Customer Experience Excellence programme. In that time, over 275,000 consumers have been interviewed and 2,700 brands have been measured – providing over 3 million individual evaluations across 24 countries to support our expertise in customer experience best practice.

For the 2019 Romanian analysis, KPMG interviewed 2,499 consumers. A nationally representative consumer sample was targeted via our online panel partner (Targeted to be representative in terms of age and gender in Romania). Respondents must have interacted with a company in the last six months to answer questions about it. 103 brands are included in the final Romania 2019 results. In order to be included in the final results, each brand must have achieved over 100 responses.

The data collection was conducted between 14 May and 10 June 2019.

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: