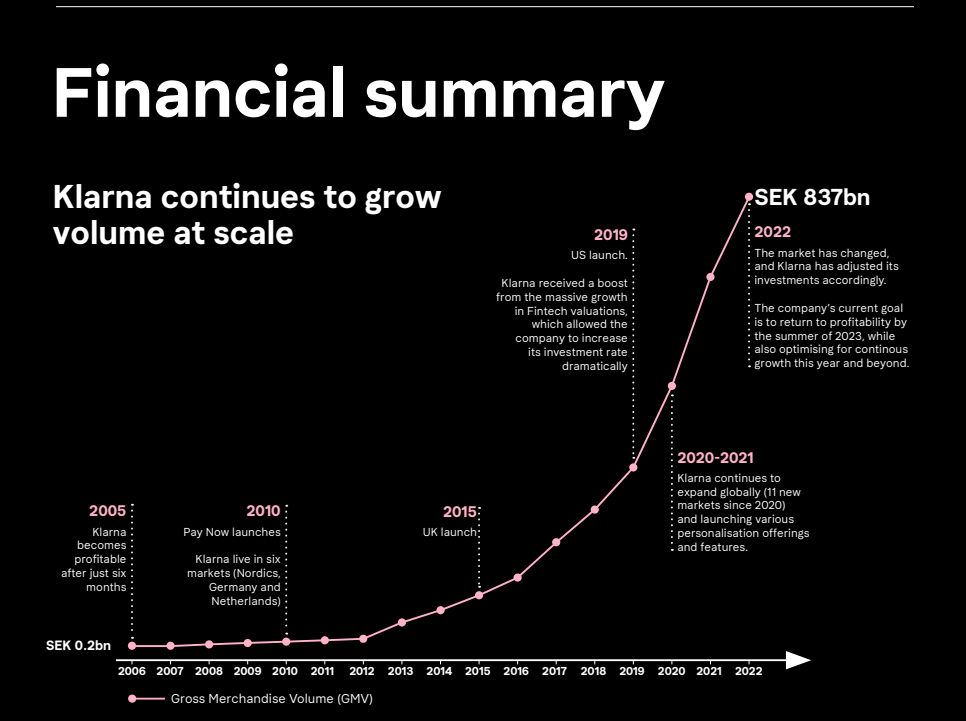

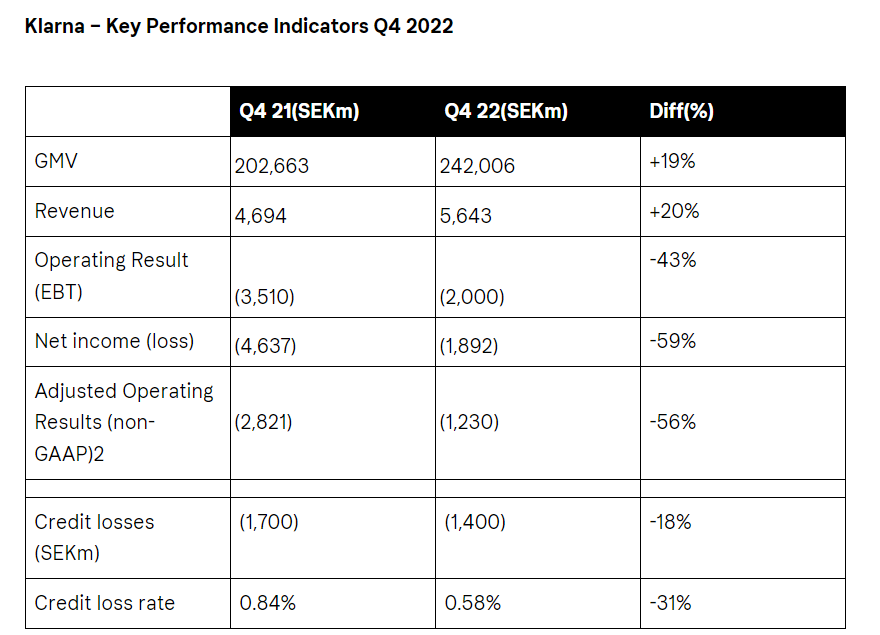

Klarna posted a full-year operating loss of 10.5 billion crowns ($1 billion) against 6.6 billion crowns in 2021. In 2022, gross merchandise volume (GMV) – the value of goods purchased through Klarna – was up 22% and revenue growth was 19%.

Klarna has plunged to the biggest annual loss in its history, but the Swedish buy now, pay later company maintained it was on track to return to profitability and raised its chief executive’s pay by more than a third, according to the Financial Times.

The privately held Swedish fintech, whose valuation was slashed from $46bn to $6.7bn last year, reported its annual net loss had grown to SKr10.4bn ($1bn), a 47 per increase from 2021. Net losses narrowed in the fourth quarter to SKr1.9bn from SKr4.6bn a year earlier. Credit losses were SKr1.4bn in the three months, an improvement of 18 per cent on the same period in 2021.

“We are making concrete progress towards profitability, simultaneously driving growth well ahead of ecommerce and reducing credit losses and costs,” said chief executive Sebastian Siemiatkowski, in his message to shareholders within the 2022 Annual Report.

“The U.S. and the UK is growing at a very high pace, pushing up the average growth number for the whole company,” Chief Executive Sebastian Siemiatkowski told Reuters.

Siemiatkowski said group growth could accelerate further on the back of the high growth rates in those two countries.

Q4 2022 results

„While ecommerce remained flat1, the value of goods purchased through Klarna (Gross Merchandise Volume (GMV)) grew by 19% in Q4 2022 compared to the same quarter in 2021, driving an increase of 20% in revenue over the same period. Klarna made further progress in diversifying revenue, with marketing revenue up +131% in 2022, accounting for 10% of total global revenue in Q4 2022.” – according to the press release.

In Q4, Klarna has reduced credit losses by 18% or SEK 300m compared to the same quarter in 2021. Compared to Q4 2021 Klarna improved its credit loss rate (credit losses / GMV) by 30% to an industry-leading 0.58% in Q4 2022.

The wider buy now, pay later sector is facing regulatory scrutiny in important markets including the US, UK and Australia amid concerns that lenders are failing to ensure users can afford to take out loans or are encouraging users to overspend.

„I am super excited about 2023 and our strong product pipeline that will help consumers save even more time and money, and worry less.” – concludes Sebastian Siemiatkowski, CEO and Co-Founder of Klarna

____________

Klarna, which was founded in 2005 by a trio of business school friends in Stockholm, was regularly profitable until 2019 when it started an aggressive expansion in the US. It last made an annual profit in 2018, a quarterly profit in the second quarter of 2019 and a monthly profit in August 2020.

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: