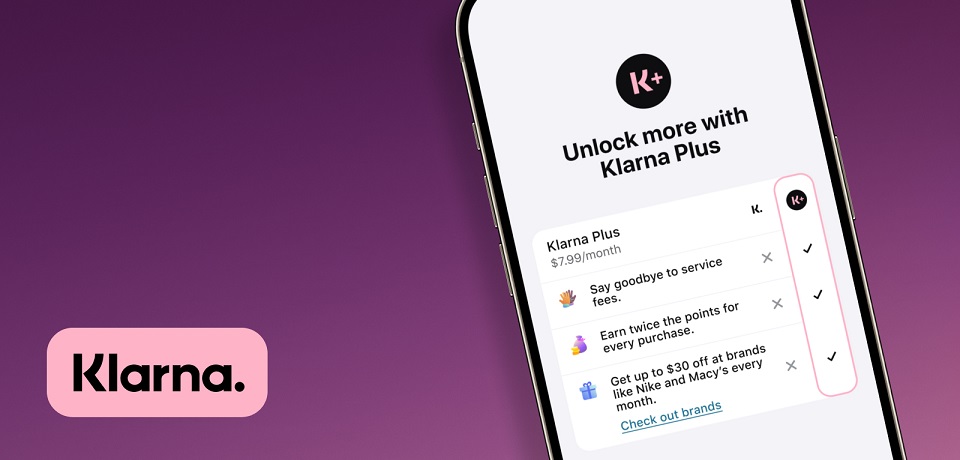

Loyal Klarna shoppers can now unlock exclusive shopping and financing features and deals with a monthly Klarna Plus membership

Klarna, the AI powered global payments network and shopping assistant, has announced its entry into the subscription service model with the launch of Klarna Plus, issued by WebBank, now available to eligible US consumers through the Klarna app for a monthly fee of $7.99*.

„Klarna Plus allows members to maximize their Klarna experience through access to a variety of features and offers, including waived service fees on Klarna’s One Time Card product, double rewards points, and access to special deals with popular brands.” the company explains.

“Today marks an exciting milestone for Klarna with the introduction of our first-ever premium subscription service, Klarna Plus,” said David Sandstrom – Chief Marketing Officer, Klarna. “Our research indicates that dedicated Klarna users are looking for an enhanced shopping experience through a subscription model. Klarna Plus addresses this demand, allowing us to deepen our engagement with 37 million loyal US consumers, while also further diversifying a portfolio of payment and shopping solutions.”

The global subscription e-commerce market is thriving, projected to reach a valuation of US$2419.69 billion by 2028, fueled by evolving consumer shopping preferences including the continued proliferation of online retail and mobile shopping.

„Klarna Plus delivers a suite of premium benefits for a nominal fee. Available within the Klarna app, this new service builds on the innovative suite of best-in-class payments and shopping services, offering a subscription model that brings even more value to loyal Klarna shoppers by giving members access to a variety of exclusive offers and deals.” according to the press release.

Klarna Plus offers the following features at launch, with more coming soon:

Double rewards points – Collect double points (2 points for every $1 spent) on purchases with Klarna rewards club.

No service fees – Shop at any retailer outside Klarna’s network to split payments into four interest-free installments using Klarna’s One Time Card, with no added service fees. This exclusive benefit can save loyal Klarna consumers ~$12 each month**.

Exclusive deals*** – Access special discounts at Nike, COACH, Macy’s, Instacart, and GOAT, totaling up to $30/month.

In addition, consumers who sign up for Klarna Plus can take advantage of a welcome offer, saving $8 on their first Klarna Plus purchase****.

Klarna Plus’s debut comes during a period of substantial and continued growth for Klarna in the US market, as the company continues to evolve beyond Buy Now, Pay Later into a 360-degree shopping and payments ecosystem. Over the past year, Klarna’s US customer base has expanded by an impressive 32%, now reaching 37 million consumers. This growth is attributed to Klarna’s ongoing market innovation, with Klarna Plus being the latest addition to an expanding suite of US payments and shopping services, which today includes flexible payment options allowing consumers to pay now, pay later or over time; as well as a comprehensive suite of shopping solutions including the AI-powered Klarna App, which now boasts over 7 million monthly users in the US.

____________

With over 150 million global active users and 2 million transactions per day, Klarna’s, sustainable and AI-powered payment and shopping solutions are revolutionizing the way people shop and pay online and in-store, empowering consumers to shop smarter with greater confidence and convenience. Since 2005 more than 500,000 global retailers integrate Klarna’s technology and marketing solutions to drive growth and loyalty, including H&M, Saks, Sephora, Macy’s, Ikea, Expedia Group, Nike and Airbnb.

*Klarna Plus issued by WebBank and powered by Klarna for $7.99/month. Cancel any time in the Klarna App. Restrictions and exclusions apply to member benefits like double Rewards points, offers, & discounts. Klarna Plus member One Time Cards are issued by WebBank.

**Loyal Klarna users are characterized as those who engage with Klarna services multiple times each month, making a minimum of six One Time Card purchases monthly.

***Klarna Plus Members get five $6 monthly deals at five selected stores (max $30/month) one discount per store per monthly billing cycle. Use the Klarna App to pay with Klarna at the store’s checkout. Klarna Deals cannot be combined and can only be used once. Discounts can be modified based on availability, retailer participation, or due to technical issues. Discount will not be reflected in any receipt from the partner store, please refer to your Klarna receipt. Klarna may get a commission.

****Save $8 on your first Klarna Plus purchase for orders above $8, using the Klarna app and paying with Klarna at a partner stores’ checkout. Excludes purchases made with a One-time card and the Klarna Card. Valid for 30 days from the moment you sign up for Klarna Plus membership. If you return all or part of your order and the final amount is below $8, the discount will no longer apply. Klarna Deals cannot be combined and can only be used once. Klarna reserves the right to modify discounts offered based on availability, retailer participation, or due to technical issues. Discount will not be reflected in any receipt from the partner store, please refer to your Klarna receipt. Klarna may get a commission.

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: