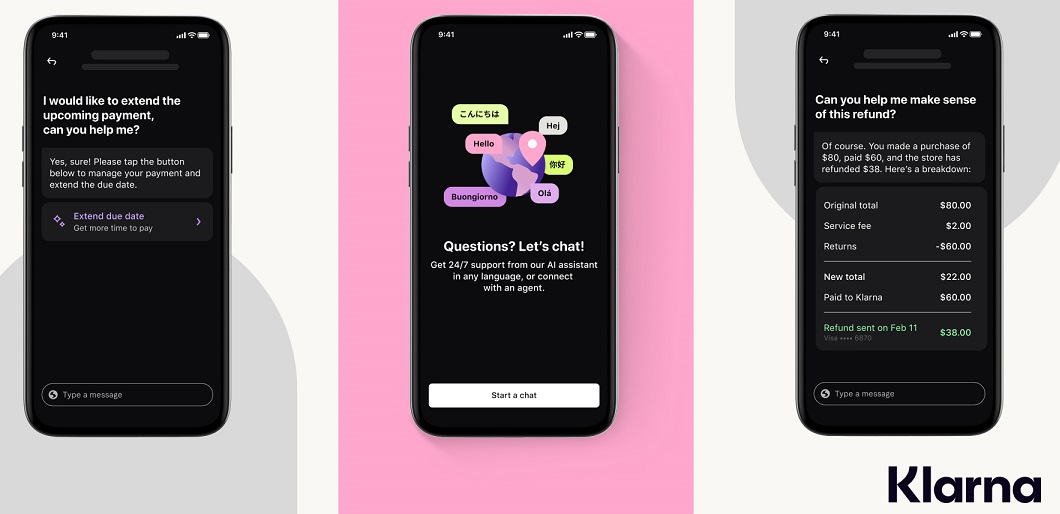

Available in the Klarna app, the assistant is designed to enhance the shopping and payments experience for Klarna’s 150 million consumers worldwide, capable of managing a range of tasks from multilingual customer service to managing refunds and returns, and fostering healthy financial habits. „Exciting new features are already in the pipeline and will be added to the AI assistant soon.” – the company says.

Klarna today announced its AI assistant powered by OpenAI. Now live globally for 1 month, the numbers speak for themselves:

.The AI assistant has had 2.3 million conversations, two-thirds of Klarna’s customer service chats

. It is doing the equivalent work of 700 full-time agents

. It is on par with human agents in regard to customer satisfaction score

. It is more accurate in errand resolution, leading to a 25% drop in repeat inquiries

. Customers now resolve their errands in less than 2 mins compared to 11 mins previously

. It’s available in 23 markets, 24/7 and communicates in more than 35 languages

. It’s estimated to drive a $40 million USD in profit improvement to Klarna in 2024

Klarna has also seen massive improvement in communication with local immigrant and expat communities across all our markets thanks to the language support.

„Klarna is at the very forefront among our partners in AI adoption and practical application.” said Brad Lightcap – COO of OpenAI. “Together we are unlocking the vast potential for AI to boost productivity and improve our day-to-day lives.„

“This AI breakthrough in customer interaction means superior experiences for our customers at better prices, more interesting challenges for our employees, and better returns for our investors.” said Sebastian Siemiatkowski – co-founder and CEO of Klarna. “We are incredibly excited about this launch, but it also underscores the profound impact on society that AI will have. We want to reemphasize and encourage society and politicians to consider this carefully and believe a considerate, informed and steady stewardship will be critical to navigate through this transformation of our societies.

The following key features are currently available to consumers worldwide:

. A 24/7 customer service expert: Klarna’s AI Assistant is a dependable, always-available resource for all customer service needs. It proficiently handles a wide array of queries, including refunds, returns, payment-related issues, cancellations, disputes, and invoice inaccuracies, ensuring swift and effective solutions.

. Your personal financial assistant: Klarna’s AI Assistant offers real-time updates on your outstanding balances and upcoming payment schedules, ensuring you never miss a Klarna payment. It also provides a clear understanding of your purchase power, explaining your spending limits and the reasons behind them, empowering you to make informed and confident shopping choices.

. Multilingual chat support: Do you speak Arabic? نعم بالطبع! And how about French? Oui bien sûr, comment puis-je vous aider? Wherever you’re from and whatever you speak, Klarna’s AI Assistant is always ready to chat in your mother tongue – adept at handling inquiries in over 35 languages.

__________

Launched in 2005, Klarna currently has a portfolio of over 150 million active users globally, generating 2 million transactions per day. More than 500,000 global retailers integrate Klarna’s solutions to drive growth and loyalty, including H&M, Saks, Sephora, Macy’s, Ikea, Expedia Group, Nike and Airbnb.

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: